February marks an important transition point in the Canadian housing market. As we move closer to the spring season, shifting population patterns, changing supply conditions, and regional price movements are beginning to reshape opportunities across the country.

At Greenlight Capital Canada, staying ahead of these trends helps investors, borrowers, and business owners make informed, strategic decisions in an evolving market.

Below is a snapshot of what’s happening now and what it means for you.

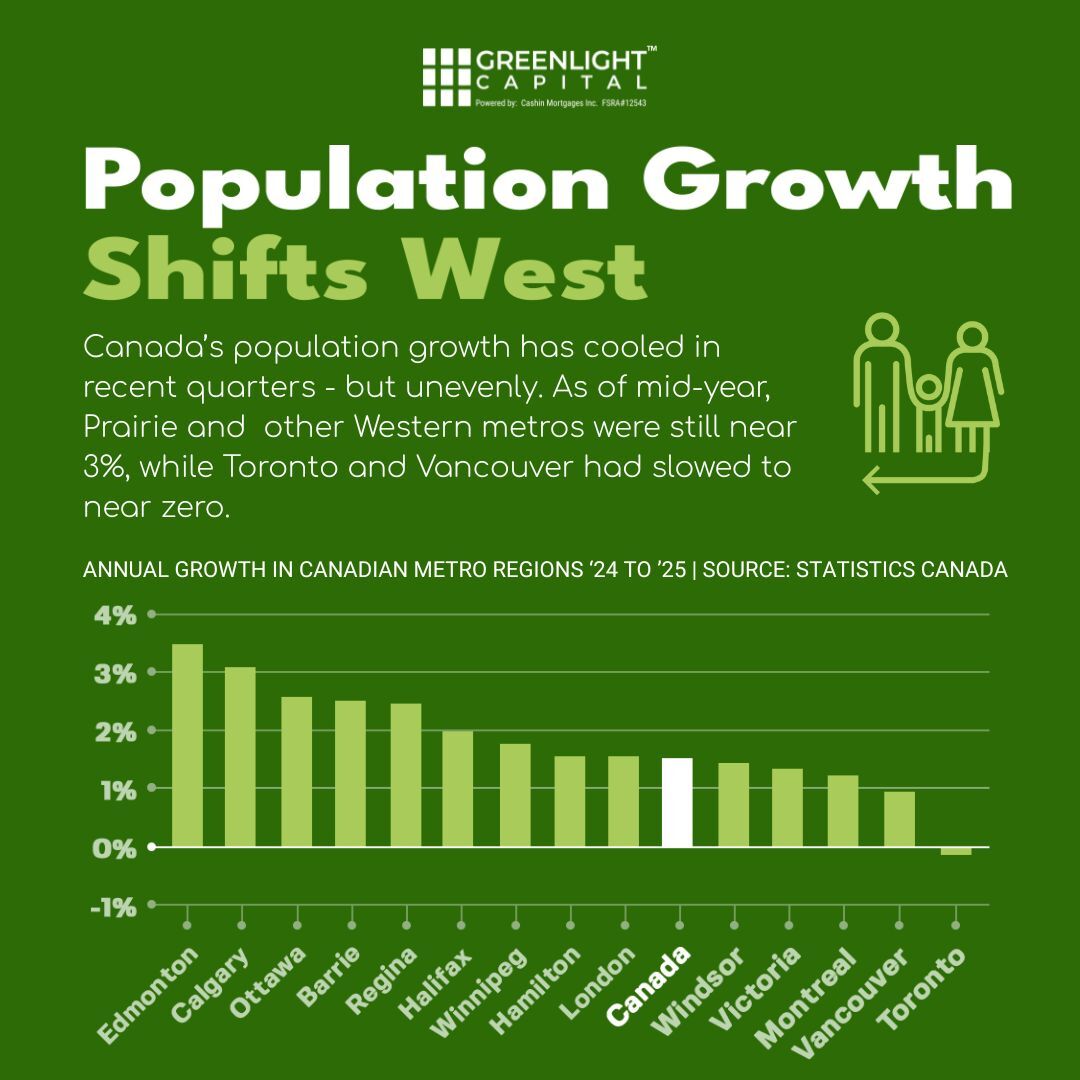

Population Growth Is Shifting West

Canada’s population growth has cooled overall, but the slowdown hasn’t been evenly distributed. Prairie provinces and western metros continue to see population growth near 3%, while Toronto and Vancouver have slowed to close to zero.

What this means for your client:

- Western markets may continue to benefit from stronger housing demand and more resilient pricing.

Slower growth in Toronto and Vancouver could create opportunities for buyers, investors, and borrowers seeking more negotiating leverage or refinancing flexibility.

Regional divergence reinforces the importance of location-specific strategies rather than relying on national averages

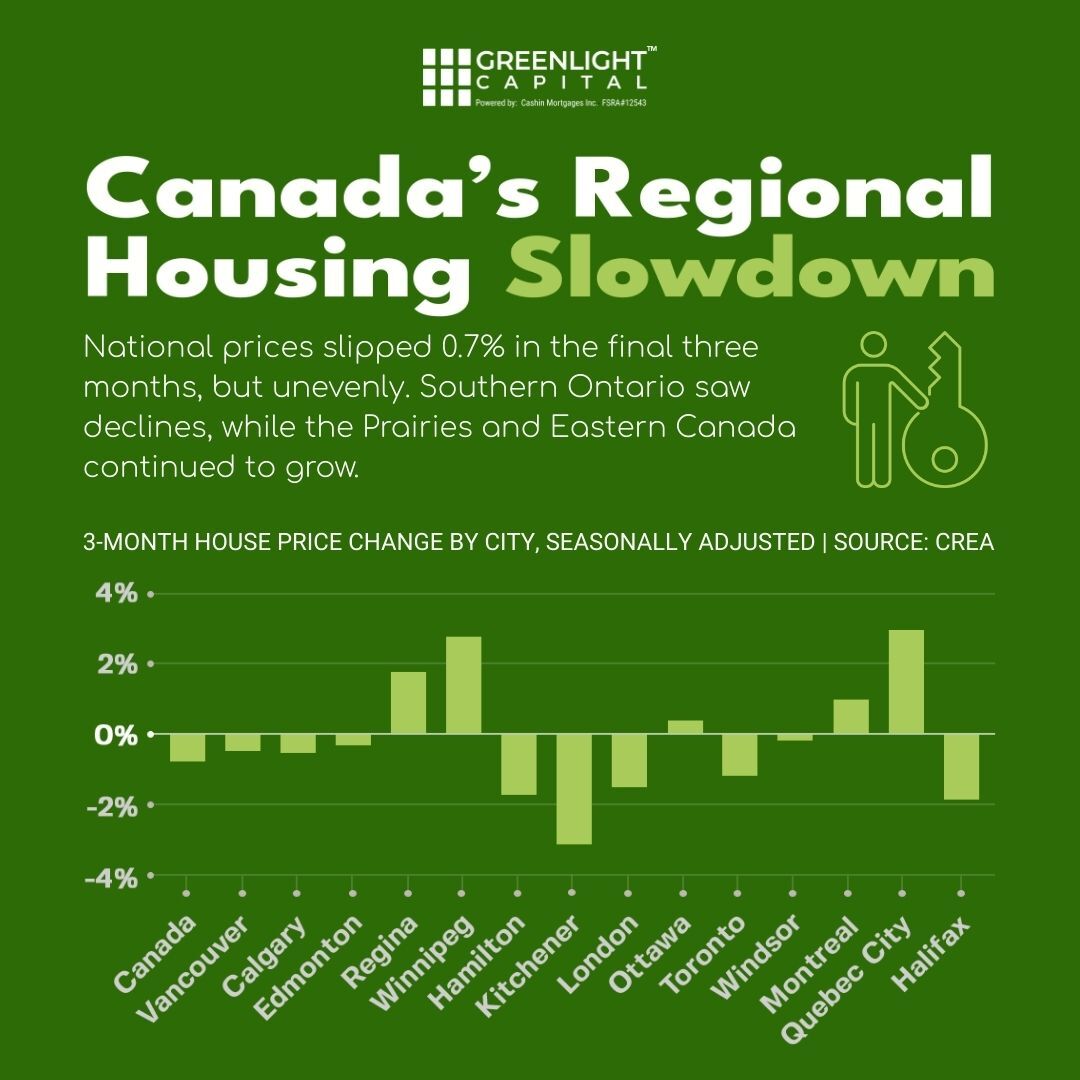

Canada’s Housing Slowdown Is Regional

National home prices declined by approximately 0.7% in the final quarter of 2025 but the impact varies significantly by region. Southern Ontario experienced price softness, while the Prairies and Eastern Canada continued to show growth.

What this means for your client:

In slower markets, careful timing and capital structure are critical for acquisitions, refinancing, or renewals.

In growth regions, strong fundamentals may continue to support long-term value and rental demand.

Market dispersion creates opportunities for investors focused on regional fundamentals rather than headline trends.

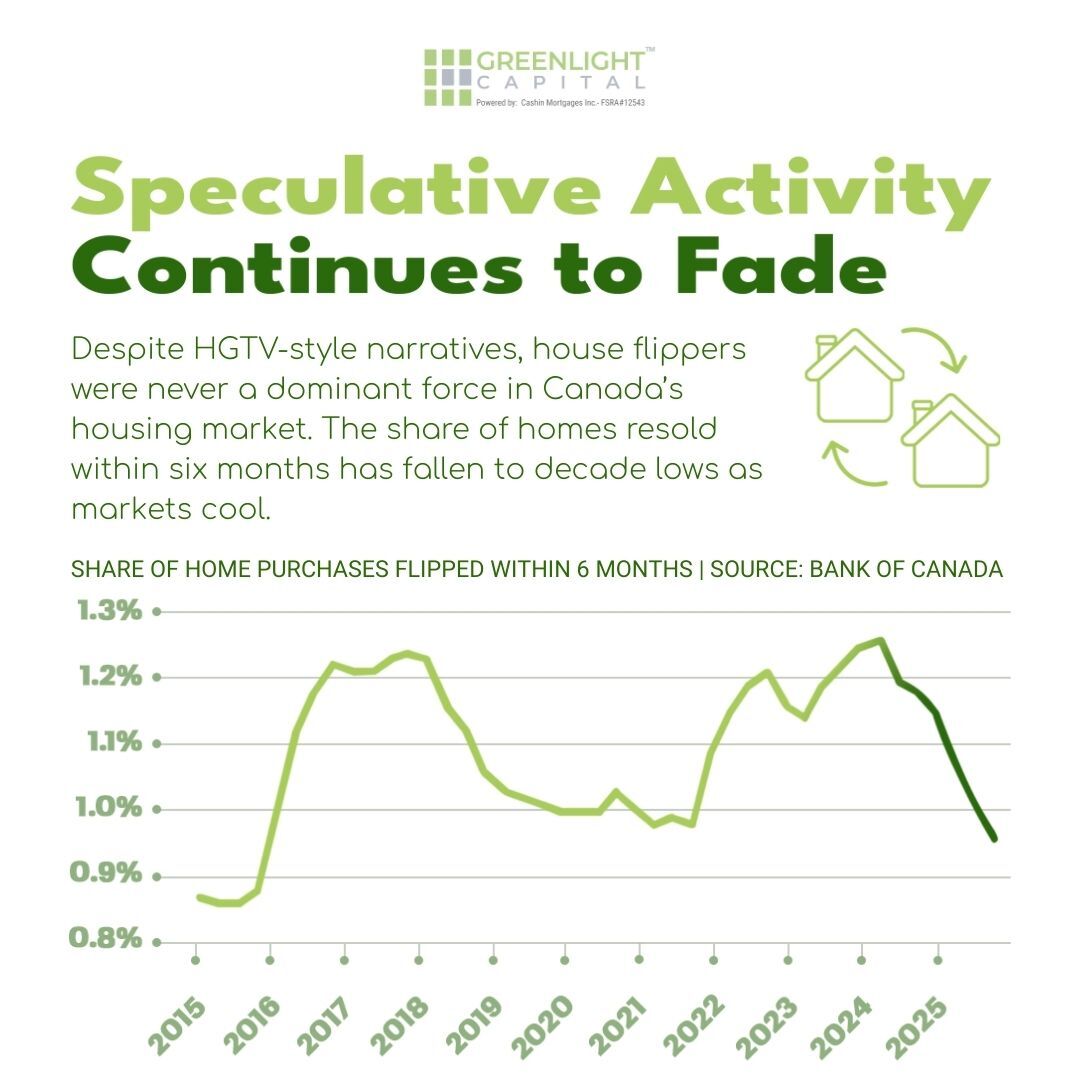

Speculative Activity Continues to Cool

The share of homes resold within six months has dropped to decade lows, confirming that short-term speculation is no longer a major market driver.

What this means for your client:

Today’s market is increasingly shaped by end users and long-term investors.

Reduced speculative pressure contributes to more stable pricing and healthier market conditions.

Private lending solutions remain focused on real assets and real demand, not short-term hype.

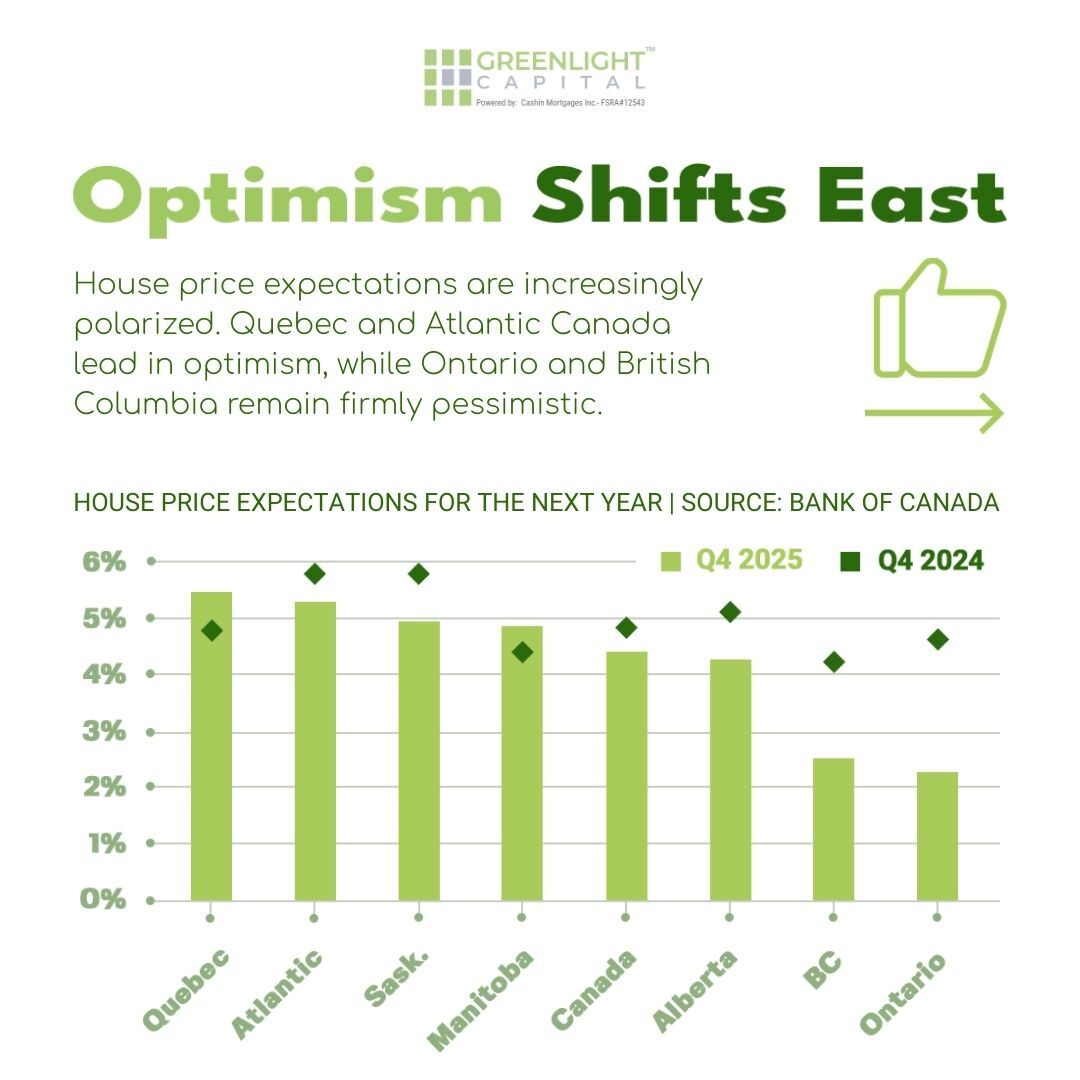

Optimism Is Shifting East

Buyer sentiment across Canada is becoming more polarized. Quebec and Atlantic Canada are leading in optimism, while Ontario and British Columbia remain more cautious.

What this means for your client:

Regional sentiment can influence transaction volumes, pricing expectations, and negotiation dynamics.

Understanding where confidence is strengthening can help identify emerging opportunities earlier.

Strategic capital deployment benefits from aligning financing with both market data and sentiment trends.

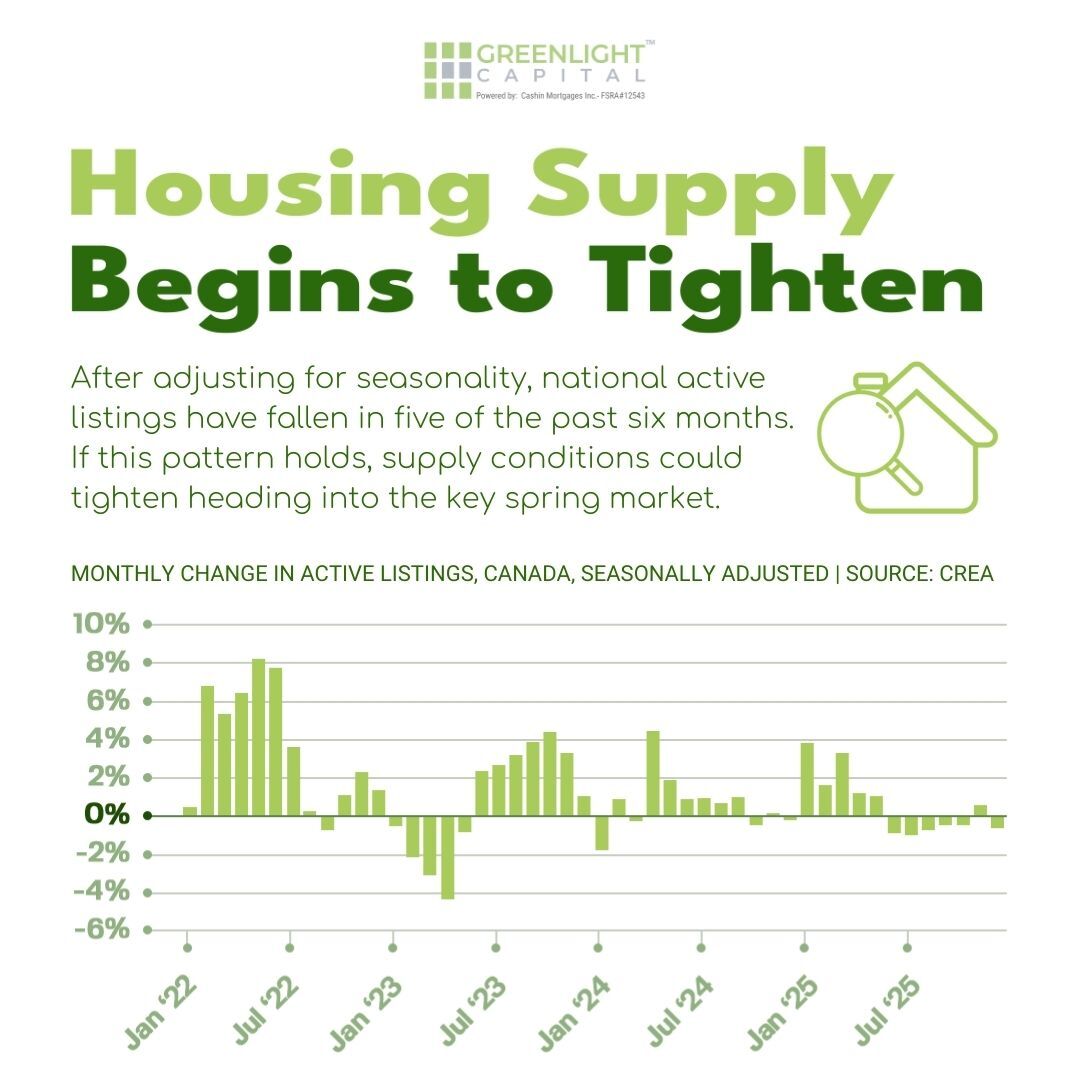

Housing Supply Is Beginning to Tighten

After adjusting for seasonal trends, national active listings have declined in five of the past six months. If this pattern continues, supply conditions could tighten just as the spring market approaches.

What this means for your client:

Reduced inventory may increase competition in certain markets, particularly in regions with steady population growth.

Well-positioned properties may move faster, supporting pricing stability.

Flexible financing solutions can be a competitive advantage when timing matters.

Final Thoughts

2026 is shaping up to be a year of contrasts opportunities for investors in rental properties and well-positioned markets, but continued challenges for first-time buyers. Staying informed and strategic will be key to making smart financial decisions.

Greenlight Capital Canada is here to guide your clients through the evolving market. Reach out today to discuss mortgages, investment strategies, or tailored solutions.