Bank of Canada Cuts Interest Rates

On December 11, 2024, the Bank of Canada announced a 50 basis points reduction in its key policy rate, bringing it down to 3.25%. This marks the second consecutive rate cut as the central bank aims to support an economy grappling with weaker-than-expected performance and a softening labour market. According to Governor Tiff Macklem, the move signals a shift toward a more measured approach to rate adjustments, acknowledging uncertainties such as potential trade challenges with the United (Source: Reuters.com)

While this rate cut is designed to stimulate economic growth, its impact on borrowing costs and consumer confidence could have significant implications for the housing market. Lower rates may make mortgages more accessible, potentially driving demand for housing—an essential factor to consider in light of Canada’s ambitious housing goals.

Trudeau’s Housing Plan: 2 Million New Homes

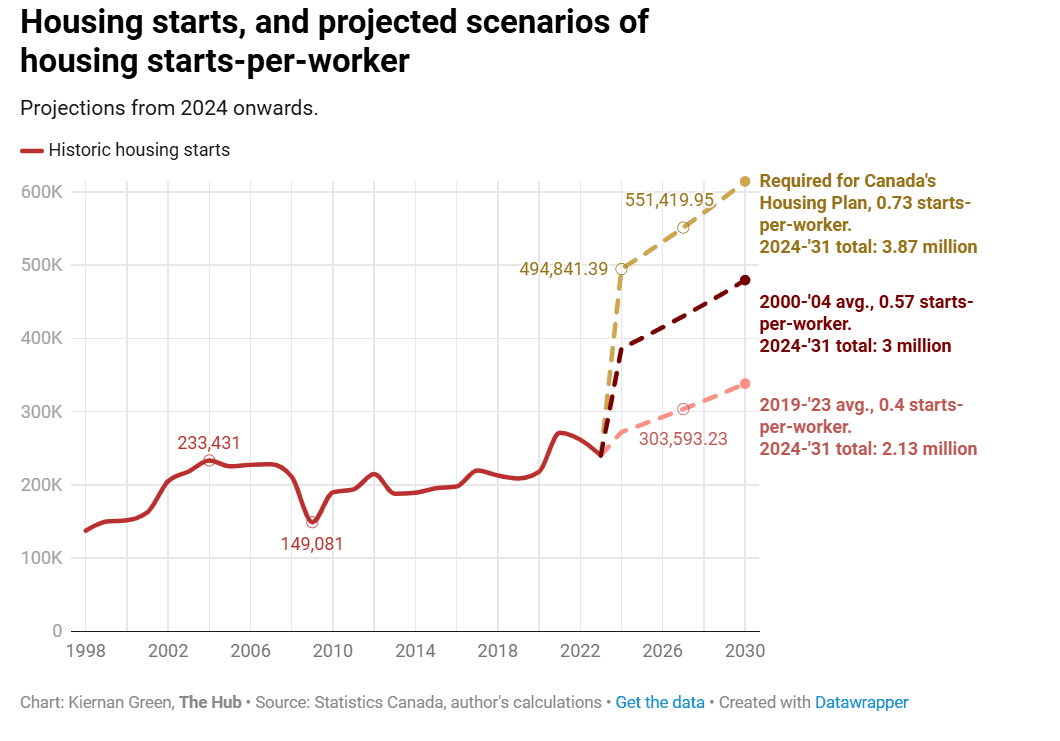

Earlier this year, Prime Minister Justin Trudeau announced a bold plan to build nearly 3.9 million new homes by 2031, including 2 million net new homes beyond the Canada Mortgage and Housing Corporation’s (CMHC) forecast. The plan aims to address Canada’s housing crisis by increasing the availability of affordable housing through initiatives like the Public Lands for Homes Plan. (Source: PMO)

While the initiative is ambitious, critics have raised questions about its feasibility. Achieving this target would require unprecedented acceleration in housing construction. Current analyses suggest Canada would need to construct over one house per minute to meet the goal—a pace that has not been seen in decades.

What This Means for Real Estate Investors

Lower Interest Rates: The Bank of Canada’s rate cut could make financing more accessible, creating opportunities for new investments in the housing sector.

Housing Supply Goals: If Trudeau’s plan gains traction, it could open avenues for developers and investors to participate in large-scale housing projects.

Market Uncertainty: Despite these opportunities, the feasibility of constructing 2 million new homes remains uncertain. Investors should monitor market trends and government actions closely.

For investors, these developments present both opportunities and challenges:

Greenlight Capital’s Perspective

At Greenlight Capital, we understand the complexities of navigating Canada’s evolving real estate market. Whether you’re looking to invest in development projects or seeking financing for your next venture, we’re here to help. Stay informed about market trends and explore tailored lending solutions that align with your goals.

Final Thoughts

The combination of lower interest rates and an ambitious housing agenda sets the stage for potential shifts in Canada’s real estate market. As we move into 2025, staying informed and prepared will be key for both investors and homeowners.

The combination of lower interest rates and an ambitious housing agenda sets the stage for potential shifts in Canada’s real estate market. As we move into 2025, staying informed and prepared will be key for both investors and homeowners.