What Investors Need to Know

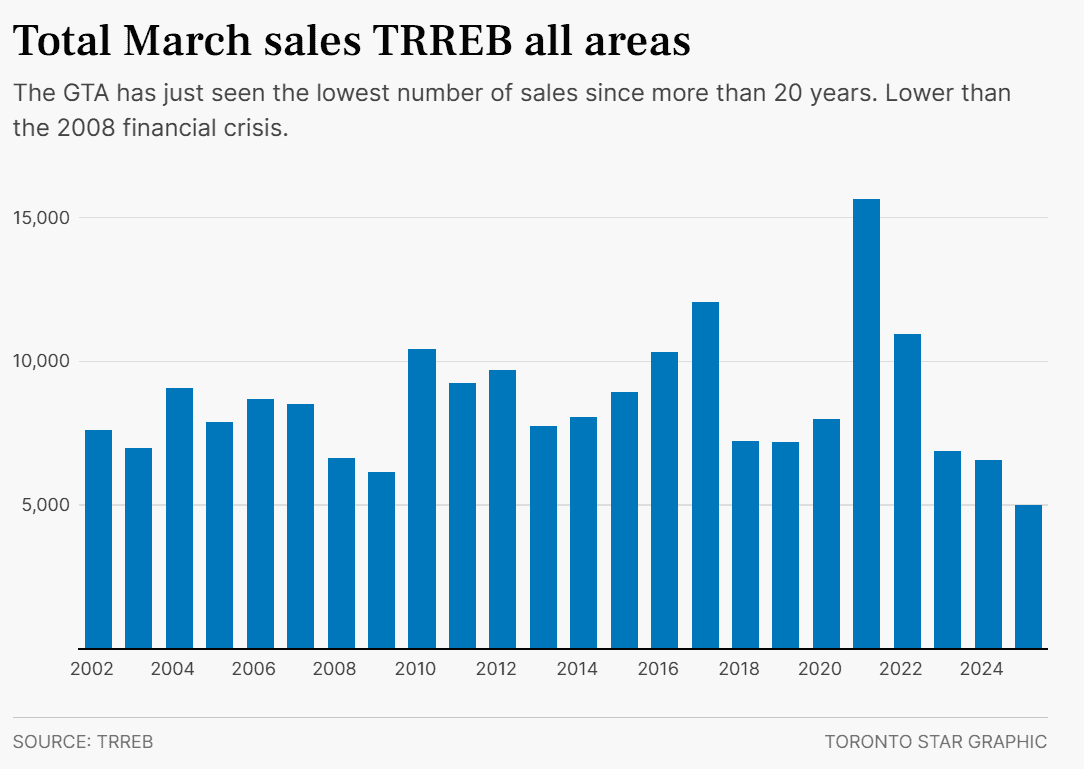

The Greater Toronto Area (GTA) real estate market saw a major pullback in March 2025, with only 5,011 homes sold—marking the slowest March in over two decades.

Sales were down 23% year-over-year, while new listings surged by 29%, climbing above 17,000. The resulting sales-to-new-listings ratio of 29% signals a definitive buyer’s market—and a shift in how investors should approach the months ahead.

What’s Driving the Market?

Uncertainty is the dominant theme:

Federal election timing is causing hesitation among end-users and developers alike.

Tariff concerns are raising flags around future construction costs and project feasibility.

These variables are pushing many buyers to the sidelines, resulting in slower absorption and a growing inventory—conditions that can create new openings for strategic investors.

Prices Are Coming Down?

The market is adjusting. Prices declined across all major home types in March:

Detached homes: ↓ 1.8%

Semi-detached homes: ↓ 0.9%

Townhomes: ↓ 3.5%

Condos: ↓ 2.6%

As price pressure builds and listings rise, sellers have less leverage—opening up room for investors to step in.

Key Implications for Investors

At Greenlight Capital, we work closely with real estate investors, developers, and mortgage professionals who need to move quickly and strategically in changing conditions.

Here’s what this shift could mean for you:

Buy-and-Hold Opportunities

Falling prices and rising inventory may present attractive entry points—especially for investors focused on long-term appreciation and rental yield.

Caution for Builders

Tariff uncertainty is introducing new risk layers to construction timelines and budgets. Pre-construction and redevelopment planning should account for potential volatility in material costs and permitting delays.

Leverage in Private Lending

As traditional financing becomes more conservative, private lenders and investors can fill the gap with flexible solutions—while being more selective about the deals they fund.

Our Take

The current slowdown is less about fundamentals and more about timing, uncertainty, and sentiment. Markets like this often create windows of opportunity—for those who are ready.

If you're looking to acquire, refinance, or fund your next project, Greenlight Capital offers custom-tailored lending solutions designed for today’s market.

Let’s connect and explore your next move.