Housing and Mortgages

As we move through 2024, it's really important to understand how the economy affects where we live and how we buy homes. In this blog, we'll talk about some important things happening in the housing and mortgage markets to help you understand what's going on.

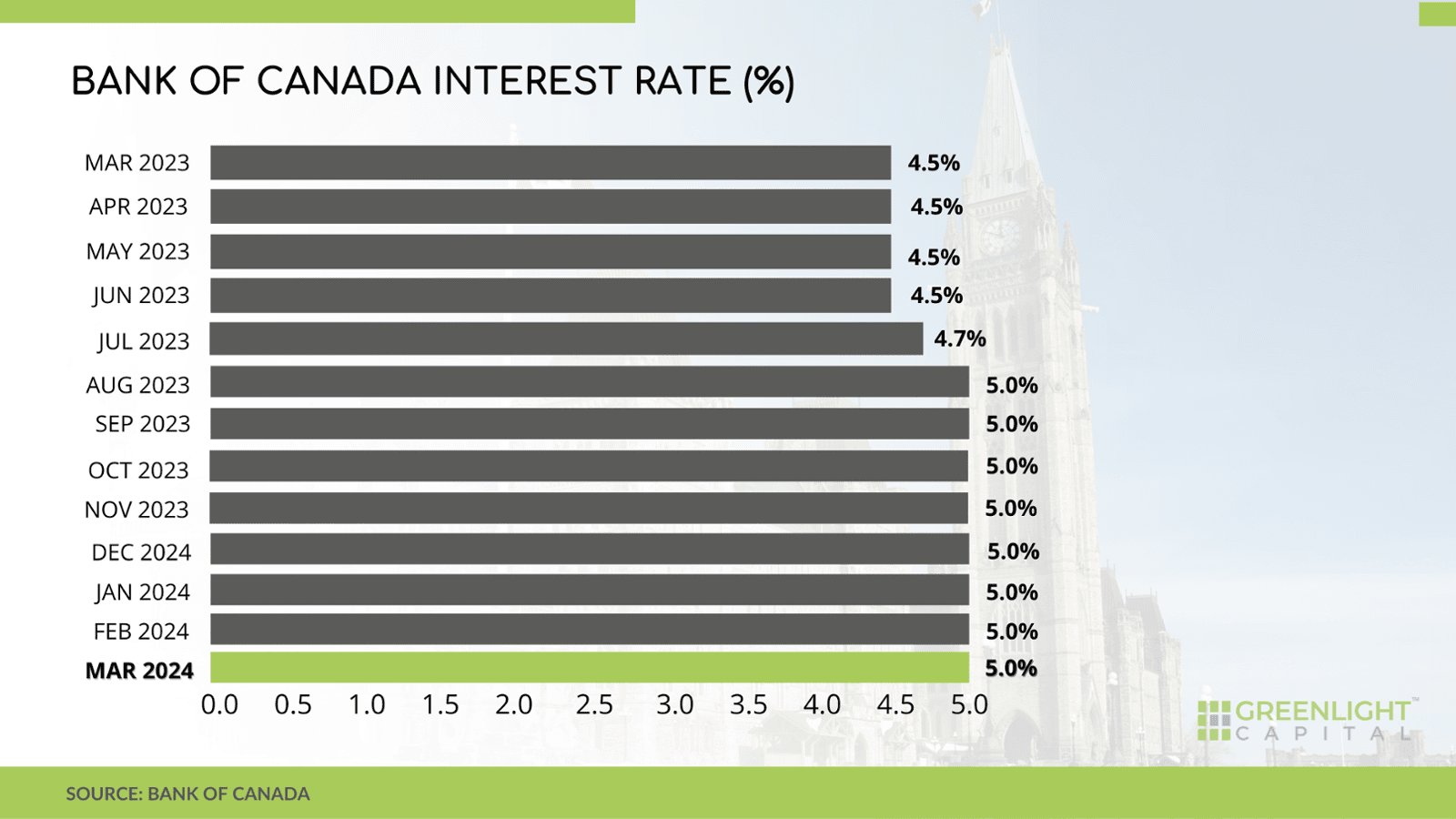

Recent Bank of Canada Decision: Last week, the Bank of Canada made a big decision about interest rates. Even though we're trying to recover from the effects of the pandemic and there are worries about prices going up, the Bank decided to keep the overnight rate at 5%. This choice shows they're trying to balance helping the economy grow while making sure prices don't rise too fast.

Click here to view the Bank of Canada Rate Hikes timeline.

Now, let’s dive into the other key developments:

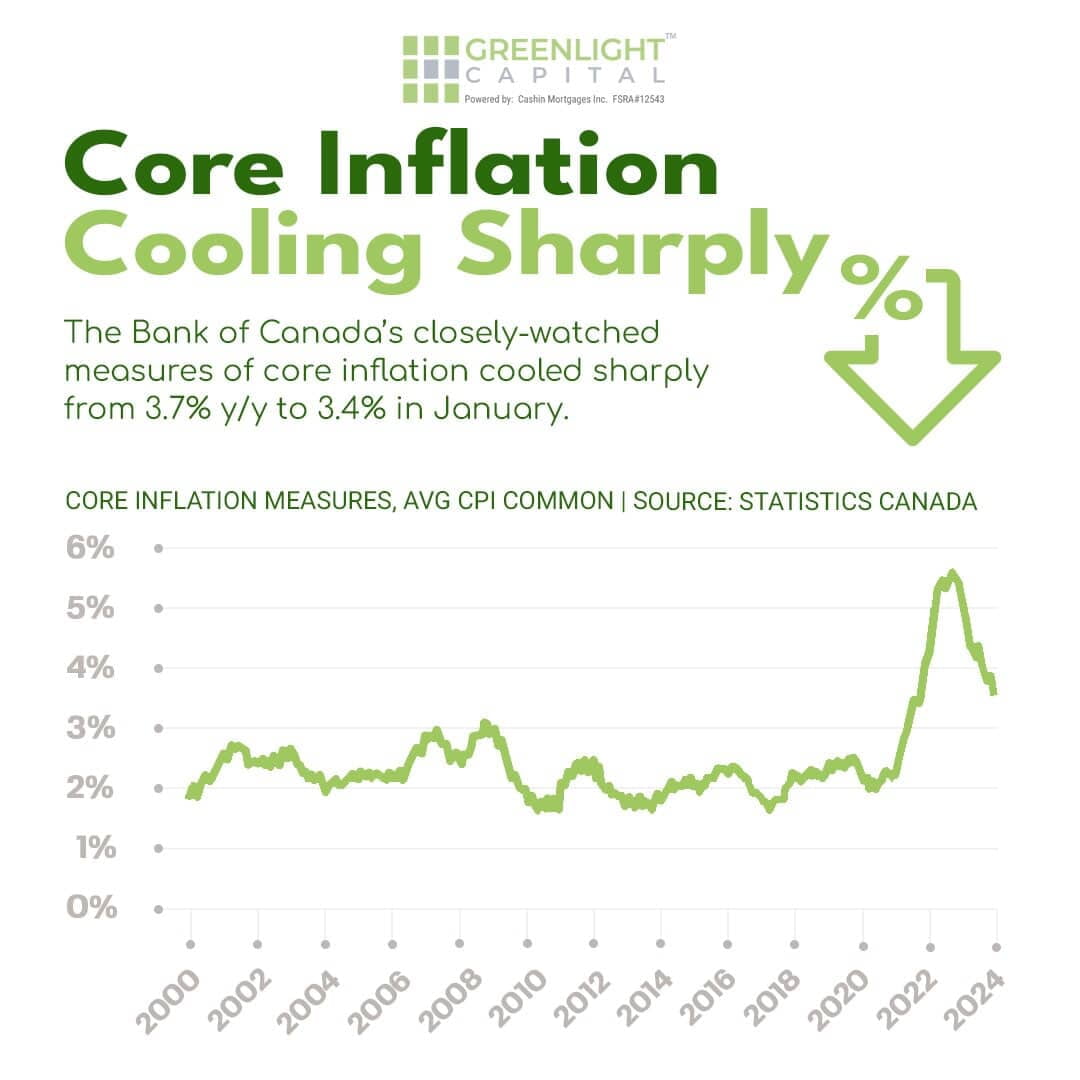

Core Inflation Cooling Sharply: The latest data from the Bank of Canada reveals a significant decline in core inflation, dropping from 3.7% to 3.4% in January. While this suggests a potential easing of price pressures, it's crucial to stay alert as inflation fluctuations could greatly influence monetary policy choices.

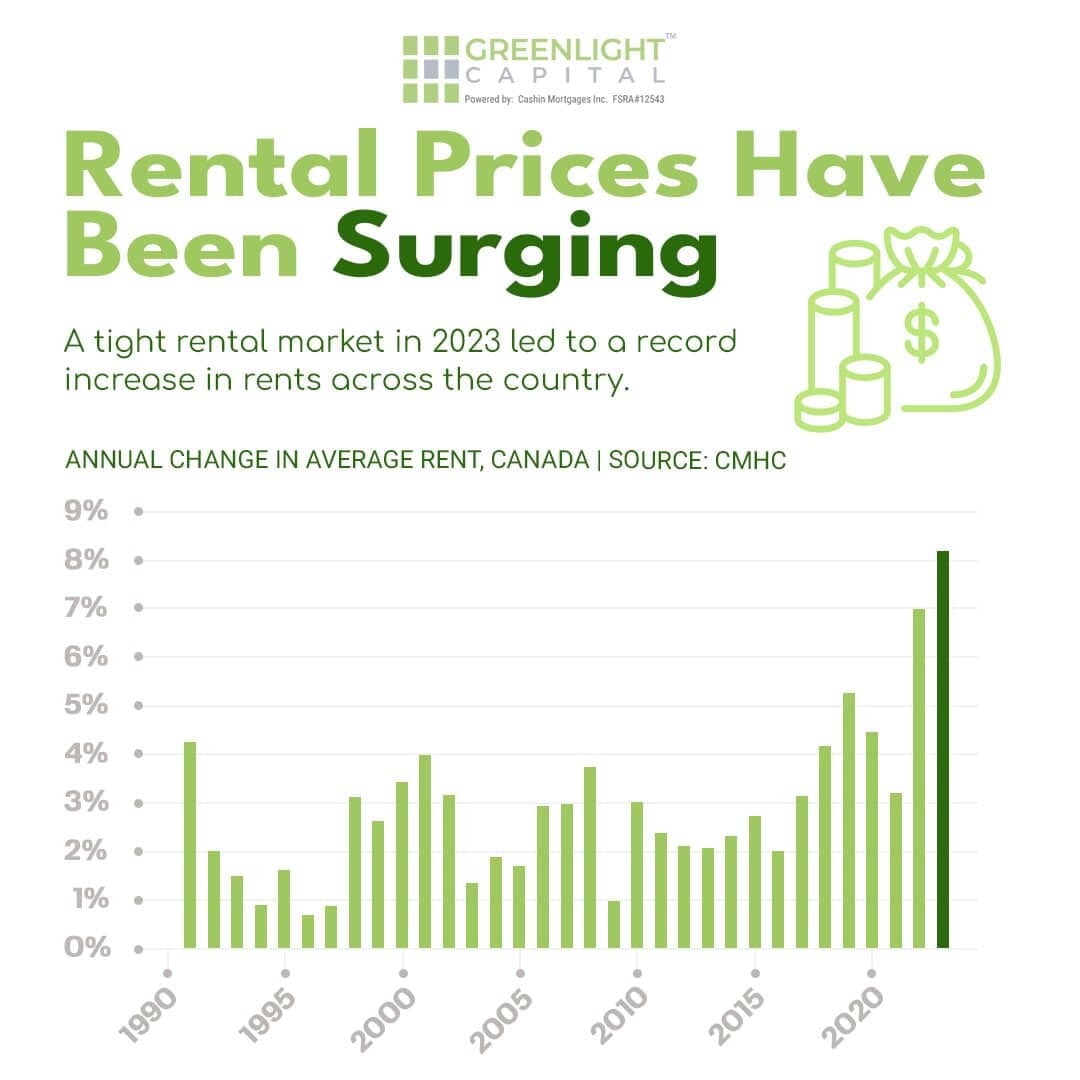

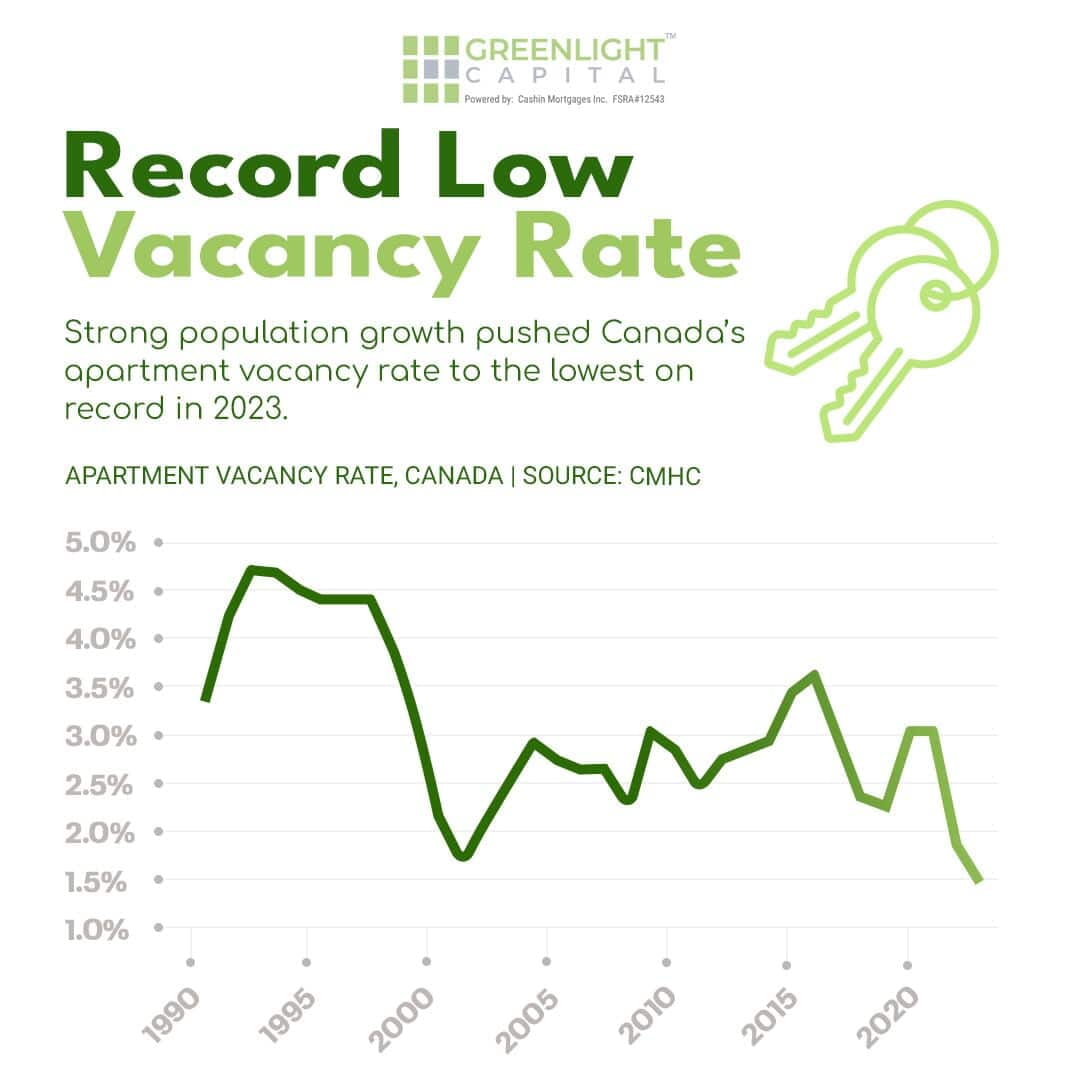

Surging Rental Prices: In 2023, we observed an unparalleled tightening in the rental market, resulting in record-high rents nationwide. This surge highlights the difficulties renters encounter due to restricted housing supply and strong demand.

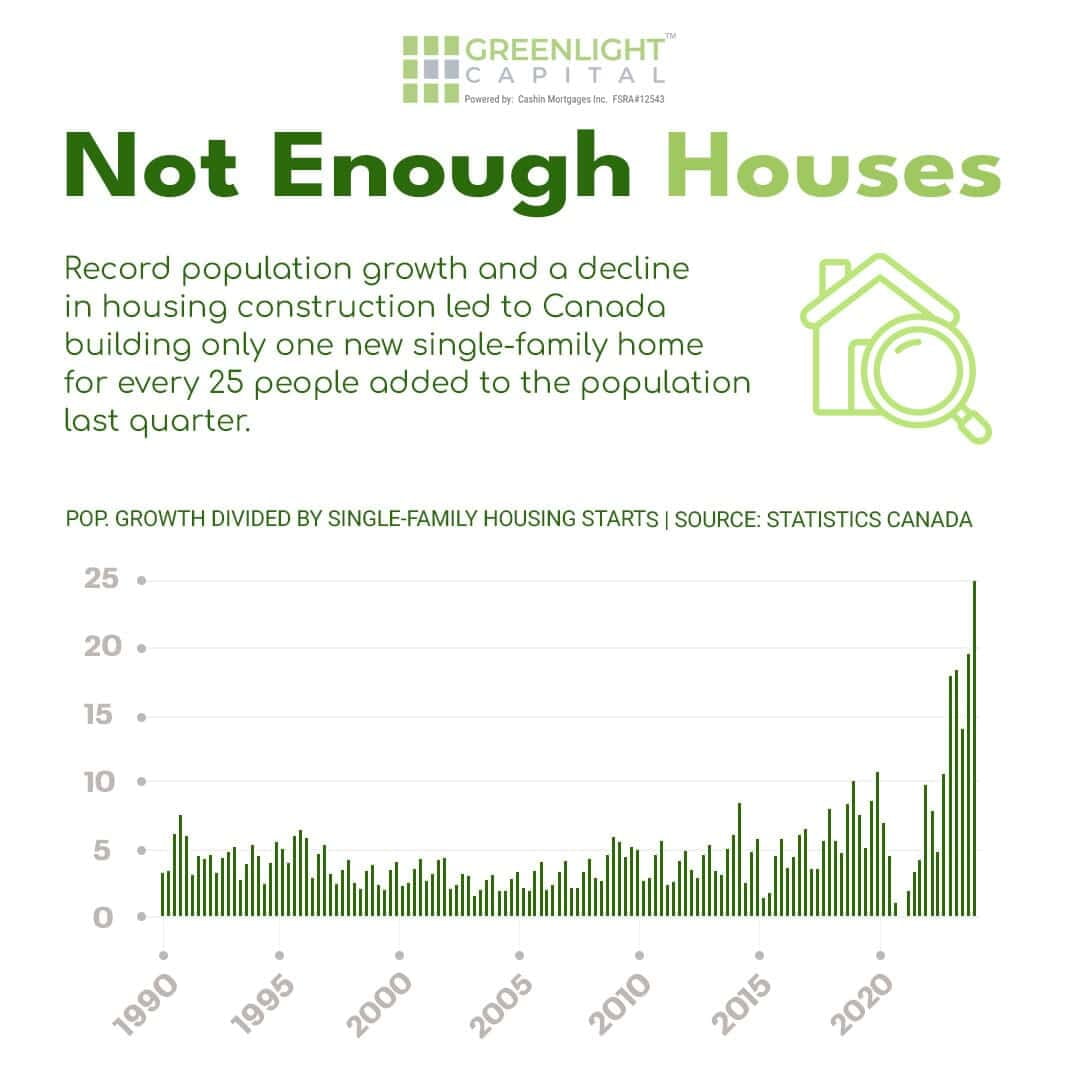

Housing Construction Shortfall: Canada is facing a critical housing shortage worsened by rapid population growth and a decrease in housing construction. Alarmingly, only one new single-family home was built for every 25 people added to the population last quarter. This highlights the immediate requirement for a boost in housing supply to match the growing demand.

Record Low Vacancy Rate: Canada's robust population growth has driven the apartment vacancy rate to its lowest level ever recorded in 2023. This trend underscores the scarcity within the rental market and the difficulties individuals face in securing affordable housing options.

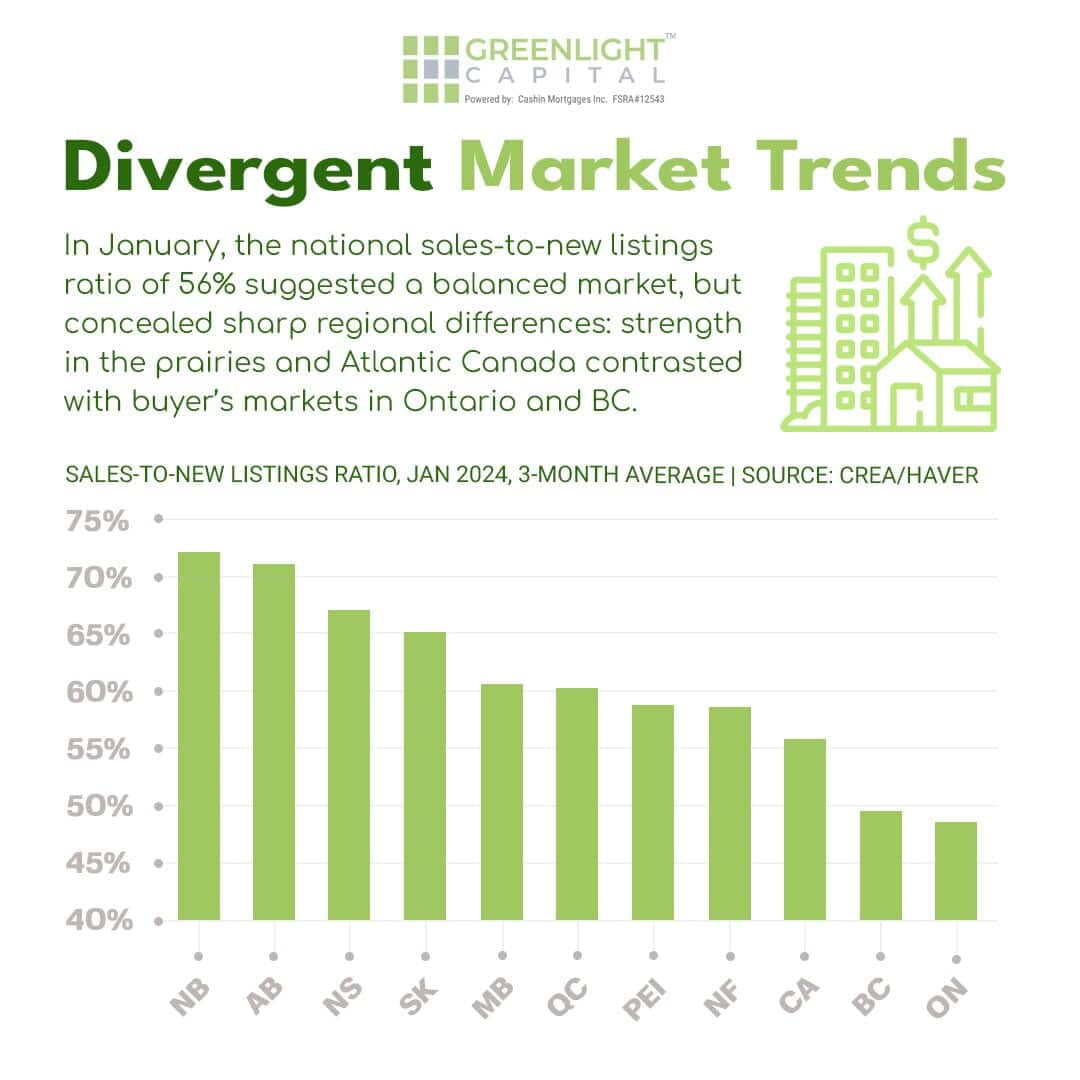

Divergent Market Trends: Although a national sales-to-new listings ratio of 56% suggests a balanced market in January, there were notable regional variations. The Prairies and Atlantic Canada showed resilience, whereas Ontario and BC experienced buyer's markets, highlighting divergent trends across the country.

Conclusion

Private lenders like Greenlight Capital can play a crucial role in accelerating your real estate investment goals. Whether you're looking to finance a new property purchase or leverage your existing home equity, Greenlight Capital offers flexible financing solutions designed to meet your needs. With competitive rates, customizable repayment options, and a focus on customer service, Greenlight Capital is the ideal partner for your real estate investment journey. Contact Us today for more information.