Understanding the Economic Balancing Act

Understanding the Economic Balancing Act

Balancing GDP growth and inflation is a critical task for any economy, and Canada is no exception. This balancing act involves ensuring that the economy grows at a healthy rate without triggering excessive inflation. This blog delves into the intricate balance between GDP growth and inflation in Canada, highlighting the role of Greenlight Capital Canada in navigating this economic terrain.

Balancing GDP growth and inflation is a critical task for any economy, and Canada is no exception. This balancing act involves ensuring that the economy grows at a healthy rate without triggering excessive inflation. This blog delves into the intricate balance between GDP growth and inflation in Canada, highlighting the role of Greenlight Capital Canada in navigating this economic terrain.

GDP and Inflation

Gross Domestic Product (GDP) is the total value of all goods and services produced within a country over a specific period. It is a key indicator of economic health. Higher GDP growth typically signifies a robust economy with increased production and consumption.

Inflation, on the other hand, refers to the rate at which the general level of prices for goods and services rises, eroding purchasing power. Moderate inflation is a sign of a growing economy, but high inflation can be detrimental, leading to uncertainty and reduced consumer spending.

Gross Domestic Product (GDP) is the total value of all goods and services produced within a country over a specific period. It is a key indicator of economic health. Higher GDP growth typically signifies a robust economy with increased production and consumption.

Inflation, on the other hand, refers to the rate at which the general level of prices for goods and services rises, eroding purchasing power. Moderate inflation is a sign of a growing economy, but high inflation can be detrimental, leading to uncertainty and reduced consumer spending.

The Relationship Between GDP Growth and Inflation

The relationship between GDP growth and inflation is complex. Generally, as GDP grows, inflation tends to increase due to higher demand for goods and services. However, this relationship is not always linear. Various factors, including supply chain disruptions, labour market conditions, and monetary policies, can influence both GDP growth and inflation.

ut. Nationally, sales increased by 3.8%, with Ontario seeing an even more impressive 6.0% rise. This surge has injected fresh energy into the real estate market, bringing renewed optimism to both buyers and sellers. The rate cut has effectively lowered borrowing costs, making homeownership more accessible and stimulating market activity. For those looking to enter the market or make a move, this uptick in sales presents a window of opportunity.

The relationship between GDP growth and inflation is complex. Generally, as GDP grows, inflation tends to increase due to higher demand for goods and services. However, this relationship is not always linear. Various factors, including supply chain disruptions, labour market conditions, and monetary policies, can influence both GDP growth and inflation.

Canada's Economic Outlook Solid Growth and Easing Inflation

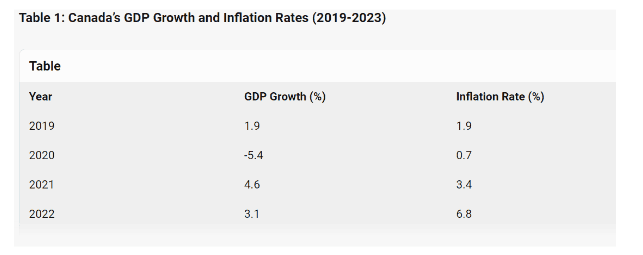

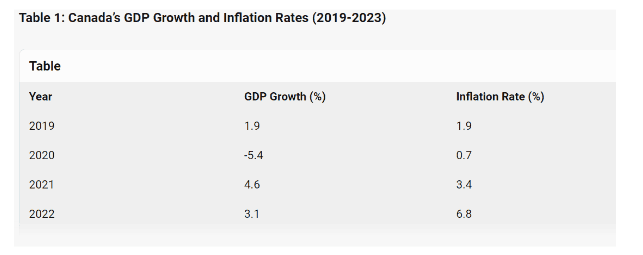

The Canadian economy is outperforming expectations despite higher interest rates. Real GDP grew at an annualised pace of 7.4% in January and 4.9% in February 2024, putting first quarter growth on track for around 3.5%. The labour market remains strong, with over 1.1 million more Canadians employed compared to pre-pandemic levels. Private sector forecasters expect growth to pick up further in the year ahead as interest rates decline and inflation falls to around 2%. Both the IMF and OECD project Canada will lead the G7 in economic growth in 2025.

However, the economic outlook remains clouded by uncertainties around inflation, interest rates, and geopolitical risks. A downside scenario developed by the Department of Finance Canada sees a shallow recession in 2024 if inflation and rates stay elevated for longer than expected, with the U.S. also experiencing slower growth. In contrast, an upside scenario envisions moderately faster growth if the U.S. economy proves more resilient and benefits Canada through higher exports and commodity prices.

Source: Statistics Canada

The Canadian economy is outperforming expectations despite higher interest rates. Real GDP grew at an annualised pace of 7.4% in January and 4.9% in February 2024, putting first quarter growth on track for around 3.5%. The labour market remains strong, with over 1.1 million more Canadians employed compared to pre-pandemic levels. Private sector forecasters expect growth to pick up further in the year ahead as interest rates decline and inflation falls to around 2%. Both the IMF and OECD project Canada will lead the G7 in economic growth in 2025.

However, the economic outlook remains clouded by uncertainties around inflation, interest rates, and geopolitical risks. A downside scenario developed by the Department of Finance Canada sees a shallow recession in 2024 if inflation and rates stay elevated for longer than expected, with the U.S. also experiencing slower growth. In contrast, an upside scenario envisions moderately faster growth if the U.S. economy proves more resilient and benefits Canada through higher exports and commodity prices.

Source: Statistics Canada

The Balancing Act Maintaining Growth While Taming Inflation

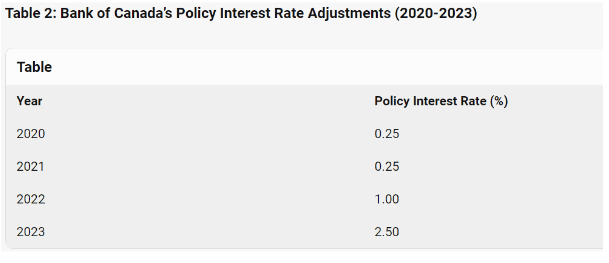

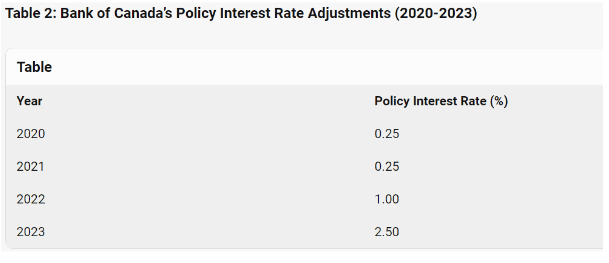

While Canada's economic performance is positive, the government faces challenges in balancing growth and inflation. Some of the biggest cost-of-living factors, such as groceries and housing, remain elevated. The Bank of Canada has raised interest rates by 4.75 percentage points since March 2022 to curb inflation, slowing economic activity.

Upside risks to inflation persist due to global tensions that could disrupt supply chains and increase energy prices. Downside risks to GDP growth have also increased slightly. As of October 2023, a scenario where inflation is within the Bank's 1-3% target range and growth is between 0-2% seems most likely in 12 months.

While Canada's economic performance is positive, the government faces challenges in balancing growth and inflation. Some of the biggest cost-of-living factors, such as groceries and housing, remain elevated. The Bank of Canada has raised interest rates by 4.75 percentage points since March 2022 to curb inflation, slowing economic activity.

Upside risks to inflation persist due to global tensions that could disrupt supply chains and increase energy prices. Downside risks to GDP growth have also increased slightly. As of October 2023, a scenario where inflation is within the Bank's 1-3% target range and growth is between 0-2% seems most likely in 12 months.

Policy Responses Promoting Inclusive Growth

To maintain a balance between growth and inflation, the Canadian government has implemented various policies:

Structural reforms to enhance productivity, such as reducing trade barriers, promoting infrastructure investment, improving innovation, investing in education and training, and encouraging workforce participation.

A fairer tax system, lowering middle-class taxes while raising taxes on the top 1% to reduce income inequality and provide more opportunities for success.

Increased child care benefits under the Canada Child Benefit plan, reducing child poverty by 40%.

Tying future increases in the Canada Child Benefit to inflation to keep pace with the costs of raising a family.

These policies aim to distribute the benefits of growth more broadly and ensure that hard work pays off for Canadians.

To maintain a balance between growth and inflation, the Canadian government has implemented various policies:

Structural reforms to enhance productivity, such as reducing trade barriers, promoting infrastructure investment, improving innovation, investing in education and training, and encouraging workforce participation.

A fairer tax system, lowering middle-class taxes while raising taxes on the top 1% to reduce income inequality and provide more opportunities for success.

Increased child care benefits under the Canada Child Benefit plan, reducing child poverty by 40%.

Tying future increases in the Canada Child Benefit to inflation to keep pace with the costs of raising a family.

These policies aim to distribute the benefits of growth more broadly and ensure that hard work pays off for Canadians.

Challenges and Uncertainties

Despite the progress made, several challenges and uncertainties remain:

Elevated global tensions and the risk of supply chain disruptions

Persistent shelter price inflation

Uncertainty around when central banks will begin cutting policy rates

Potential spillovers from geopolitical tensions and their impact on confidence and investment decisions

In the face of these challenges, the Department of Finance Canada has developed scenarios that incorporate uncertainties and consider faster or slower growth tracks. A downside scenario sees a shallow recession in Canada due to structural imbalances in housing markets and spillovers from geopolitical tensions, while an upside scenario envisions moderately faster growth.

Despite the progress made, several challenges and uncertainties remain:

Elevated global tensions and the risk of supply chain disruptions

Persistent shelter price inflation

Uncertainty around when central banks will begin cutting policy rates

Potential spillovers from geopolitical tensions and their impact on confidence and investment decisions

In the face of these challenges, the Department of Finance Canada has developed scenarios that incorporate uncertainties and consider faster or slower growth tracks. A downside scenario sees a shallow recession in Canada due to structural imbalances in housing markets and spillovers from geopolitical tensions, while an upside scenario envisions moderately faster growth.

Strategies for Balancing GDP Growth and Inflation

Monetary Policy: The BoC adjusts the policy interest rate to influence economic activity. Lower rates stimulate growth, while higher rates help

control inflation

Fiscal Policy: Government spending and taxation policies also play a role. Increased government spending can boost GDP growth, while higher taxes can help control inflation.

Supply-Side Measures: Improving productivity and supply chain efficiency can help balance GDP growth and inflation. Investments in infrastructure and technology are crucial in this regard.

Labor Market Policies: Ensuring a stable labour market with adequate wage growth can support GDP growth without triggering excessive inflation.

The Role of Greenlight Capital Canada

In this complex economic environment, financial institutions like Greenlight Capital Canada play a vital role. Greenlight Capital Canada is a private lender that provides financial solutions for individuals and businesses who may not qualify for traditional institutional mortgages. By offering alternative financing options, Greenlight Capital Canada helps stimulate economic activity and supports growth in various sectors.

In this complex economic environment, financial institutions like Greenlight Capital Canada play a vital role. Greenlight Capital Canada is a private lender that provides financial solutions for individuals and businesses who may not qualify for traditional institutional mortgages. By offering alternative financing options, Greenlight Capital Canada helps stimulate economic activity and supports growth in various sectors.

For instance, Greenlight Capital Canada’s mortgage products enable homebuyers and investors to access the real estate market, contributing to housing sector growth. Additionally, their commercial financing solutions support businesses in expanding operations, creating jobs, and driving economic development.

Challenges and Uncertainties

Despite the progress made, several challenges and uncertainties remain:

Elevated global tensions and the risk of supply chain disruptions

Persistent shelter price inflation

Uncertainty around when central banks will begin cutting policy rates

Potential spillovers from geopolitical tensions and their impact on confidence and investment decisions

In the face of these challenges, the Department of Finance Canada has developed scenarios that incorporate uncertainties and consider faster or slower growth tracks. A downside scenario sees a shallow recession in Canada due to structural imbalances in housing markets and spillovers from geopolitical tensions, while an upside scenario envisions moderately faster growth.

Elevated global tensions and the risk of supply chain disruptions

Persistent shelter price inflation

Uncertainty around when central banks will begin cutting policy rates

Potential spillovers from geopolitical tensions and their impact on confidence and investment decisions