What Canadian Homebuyers and Investors Need to Know

As we reach the halfway point of 2025, Canada’s housing market is showing signs of change and adaptation. From shifting mortgage preferences to improving consumer confidence, there’s a lot happening beneath the surface of the national headlines. At Greenlight Capital, we believe it’s important to look beyond averages and headlines to understand what’s really going on—and what it means for you.

Here’s our latest update on the key trends shaping Canadian real estate and lending today

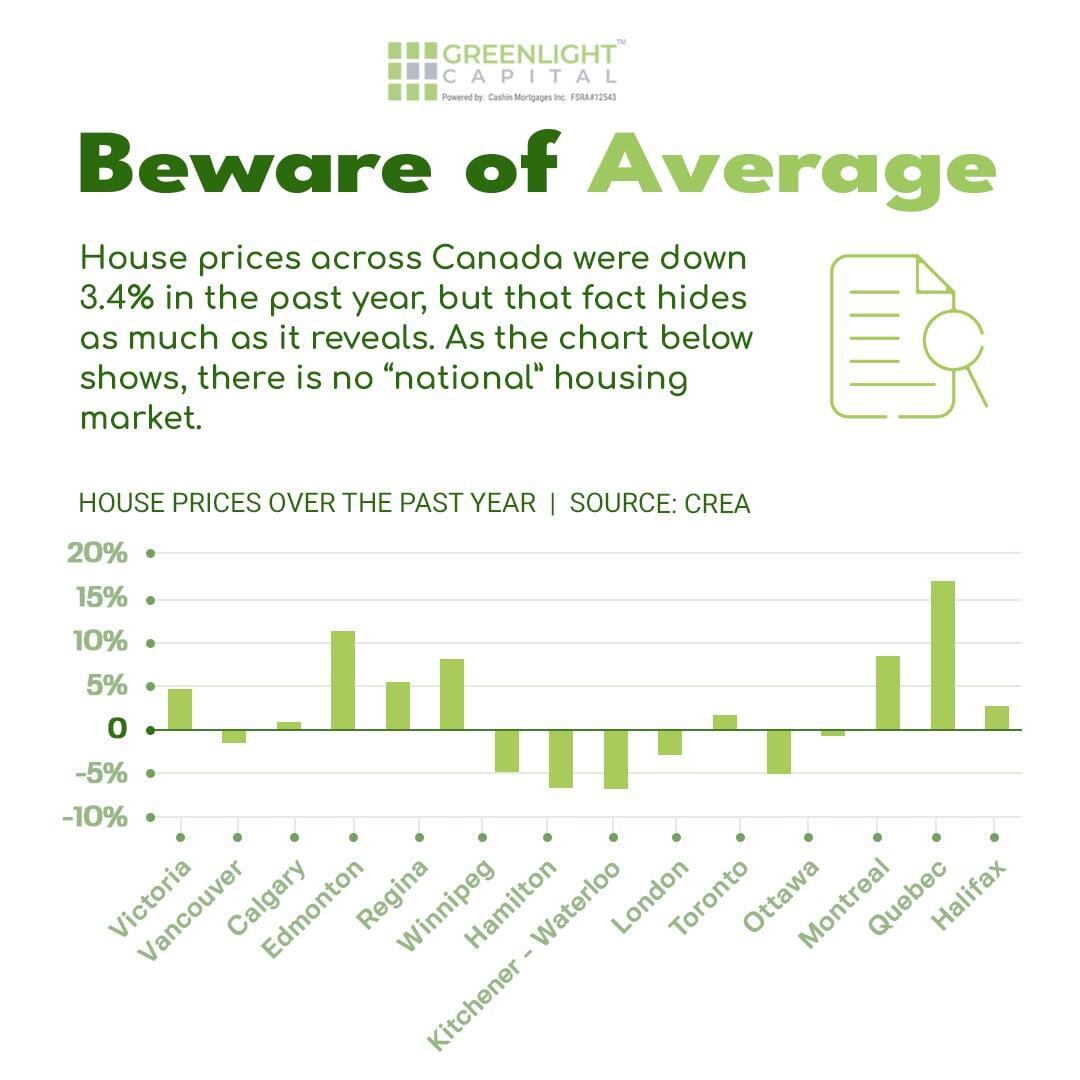

Beware of Averages: The Canadian Housing Market is Many Markets

You’ve likely heard that national home prices have dropped by about 3.4% year-over-year. While that statistic captures attention, it hides a more nuanced reality. Canada’s housing market is not a single, uniform market—it's a mosaic of diverse regions each experiencing different conditions.

Some cities and provinces are seeing home prices cool off significantly, while others remain stable or even continue to grow. For example, markets in some smaller urban centers or resource-driven regions may be thriving, while major metropolitan areas could be experiencing a slowdown.

What this means for you: Whether you’re buying or selling, it’s critical to understand the local market dynamics where you live or plan to invest. Don’t rely solely on national averages—work with experts who can provide insights tailored to your area.

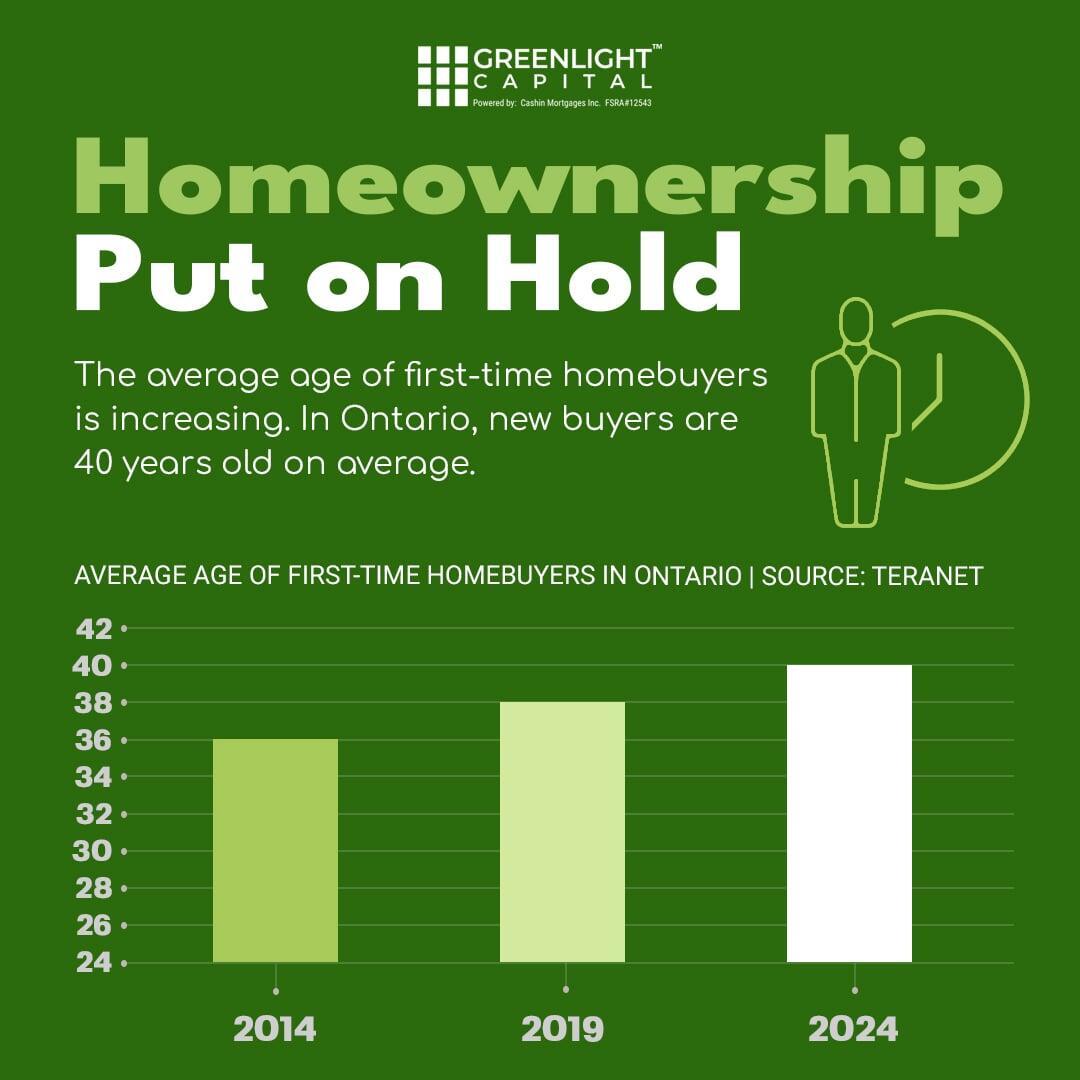

Homeownership Delayed, But Not Denied

Another important trend is the rising average age of first-time homebuyers. In Ontario, that average has now reached 40 years old. This shift reflects the ongoing affordability challenges and financial pressures facing many Canadians, including rising living costs, down payment hurdles, and tighter mortgage qualification rules.

However, delayed homeownership doesn’t mean it’s out of reach. With thoughtful planning, strategic mortgage choices, and expert guidance, homeownership remains an achievable goal.

Our advice: Don’t be discouraged if you’re not ready to buy right now. Focus on building your financial foundation and exploring mortgage options that fit your unique situation. We’re here to help you navigate every step toward your dream home.

Household Wealth Hits Record High

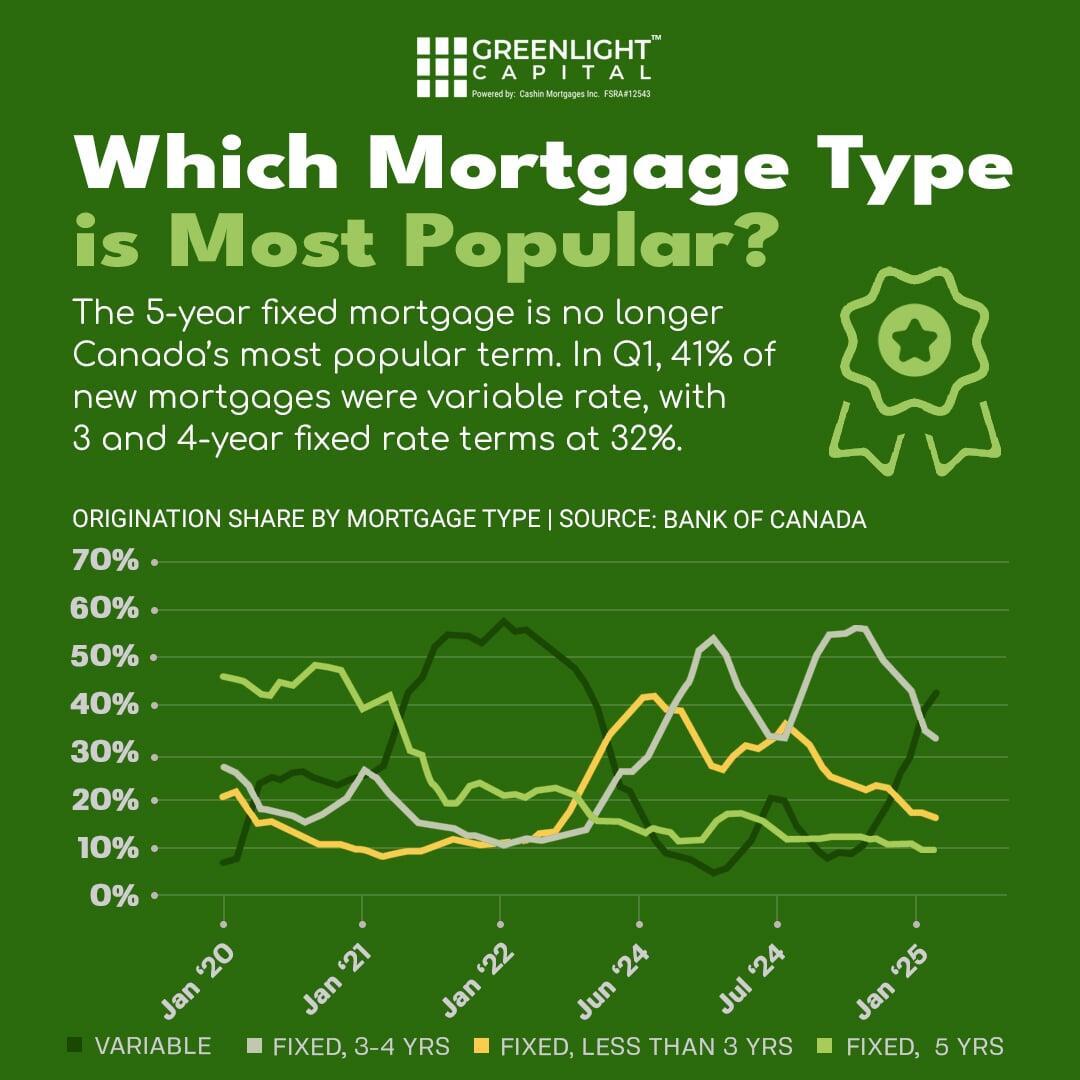

The mortgage market itself is adapting to current economic realities. For the first time in decades, the traditional 5-year fixed mortgage is no longer the most popular term among Canadian borrowers.

In the first quarter of 2025:

This shift shows borrowers seeking greater flexibility and shorter commitments to better manage interest rate risk and market uncertainty.

Tip: Understanding which mortgage types suit your risk tolerance and financial goals is crucial. Whether you prefer the predictability of fixed rates or the potential savings of variable rates, there’s no one-size-fits-all answer.

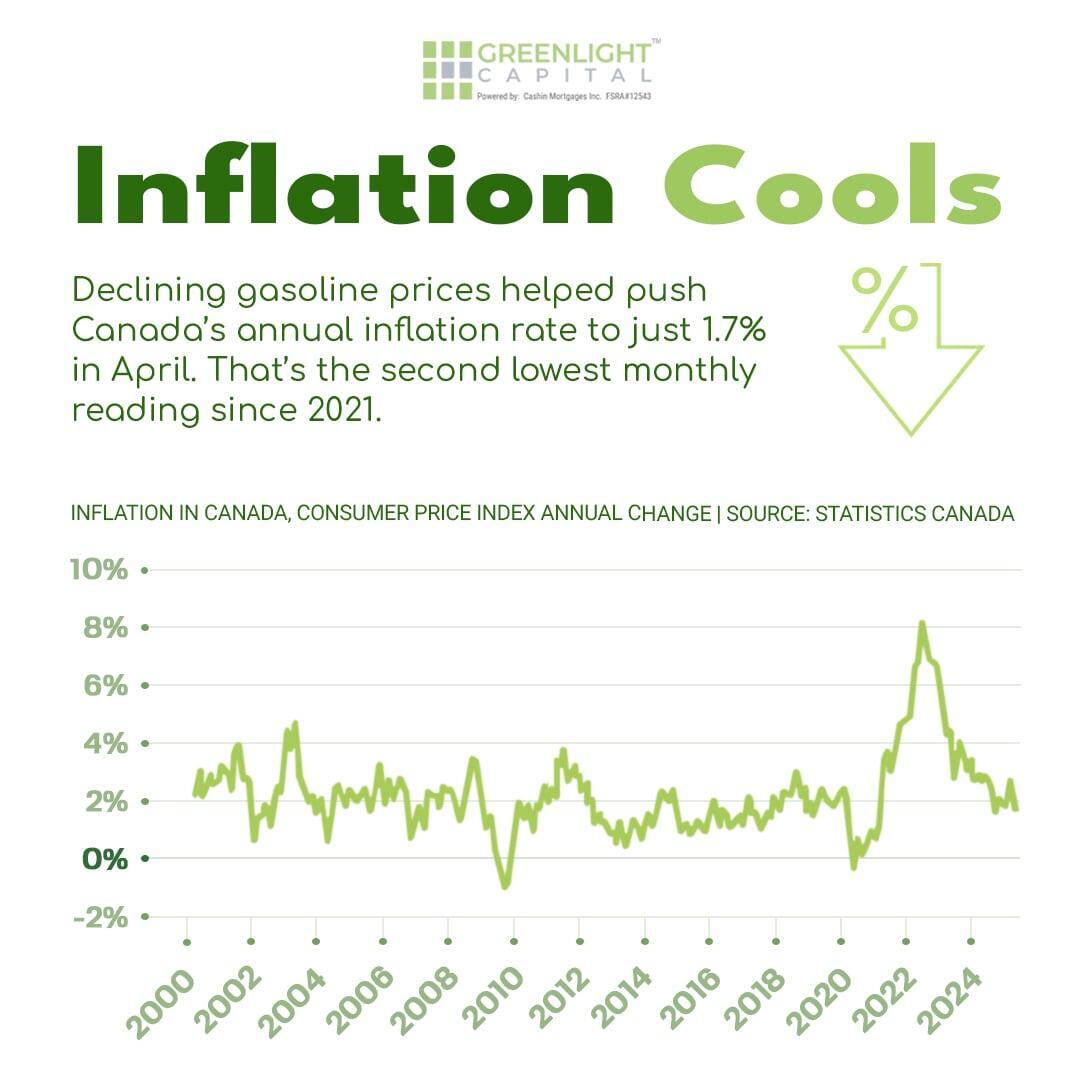

Inflation Cools to 1.7%

Good news for borrowers: Canada’s annual inflation rate cooled down to 1.7% in April 2025, the second-lowest monthly reading since 2021. Falling gasoline prices played a significant role in easing inflationary pressure, offering some financial relief to Canadians.

Lower inflation can influence the Bank of Canada’s interest rate decisions, potentially easing borrowing costs in the months ahead.

What to watch: Keep an eye on inflation trends as they can impact mortgage rates and your borrowing power. Staying informed helps you make timely and smart financial decisions.

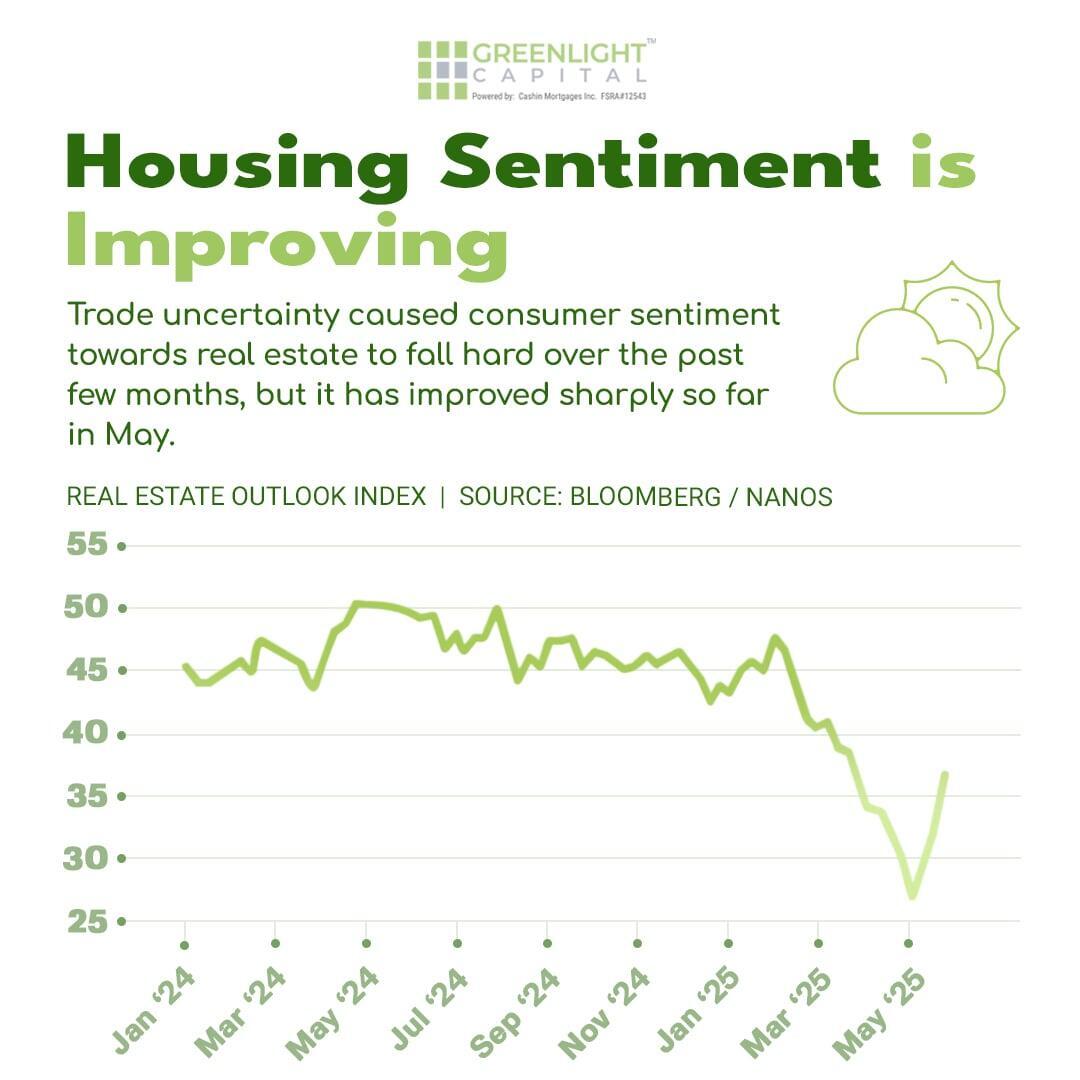

Housing Sentiment is Rising

After months of uncertainty driven by trade tensions and economic worries, consumer confidence in real estate took a sharp upward turn in May 2025. Canadians are feeling more optimistic about buying, selling, and investing in homes.

This renewed confidence is a positive sign for the market’s health and signals growing opportunities for those ready to act.

Our message: Whether you’re planning to buy, sell, or invest—or simply watching the market—it pays to stay informed and work with knowledgeable partners who can help you seize the right opportunities.

Bank of Canada Rate Update and What It Means for Borrowers

In its most recent announcement, the Bank of Canada decided to hold its key interest rate steady. This decision reflects the bank’s assessment of easing inflation pressures alongside ongoing global economic uncertainties.

What this means for you:

Holding the rate steady can provide some short-term predictability for mortgage rates, especially for fixed-rate borrowers.

Variable-rate borrowers should still watch for market fluctuations, but stable rates may ease some upward pressure.

For those considering new mortgages or refinancing, it’s a good time to review your options and consult with experts to lock in favourable terms before any future changes.

The Bank of Canada’s cautious stance signals a “wait and see” approach—meaning changes could come later depending on inflation and economic data.

At Greenlight Capital, we monitor these updates closely to help you understand how macroeconomic moves impact your personal borrowing costs and homeownership goals.

Final Thoughts

The Canadian housing market is evolving, with varied regional trends, changing mortgage preferences, easing inflation, and improving consumer sentiment all playing a role. At Greenlight Capital, we’re committed to keeping you informed and empowered to make the best lending and investment decisions possible.

Have questions or want to explore your mortgage options? Visit Greenlight Capital or reach out to our team today. Your path to smarter real estate decisions starts here.