What Investors and Homeowners Should Know This April

As Q2 kicks off, Canada’s economic landscape is evolving. From demographic shifts to inflationary pressures, here’s a breakdown of what’s happening and what it means for homeowners, investors, and developers.

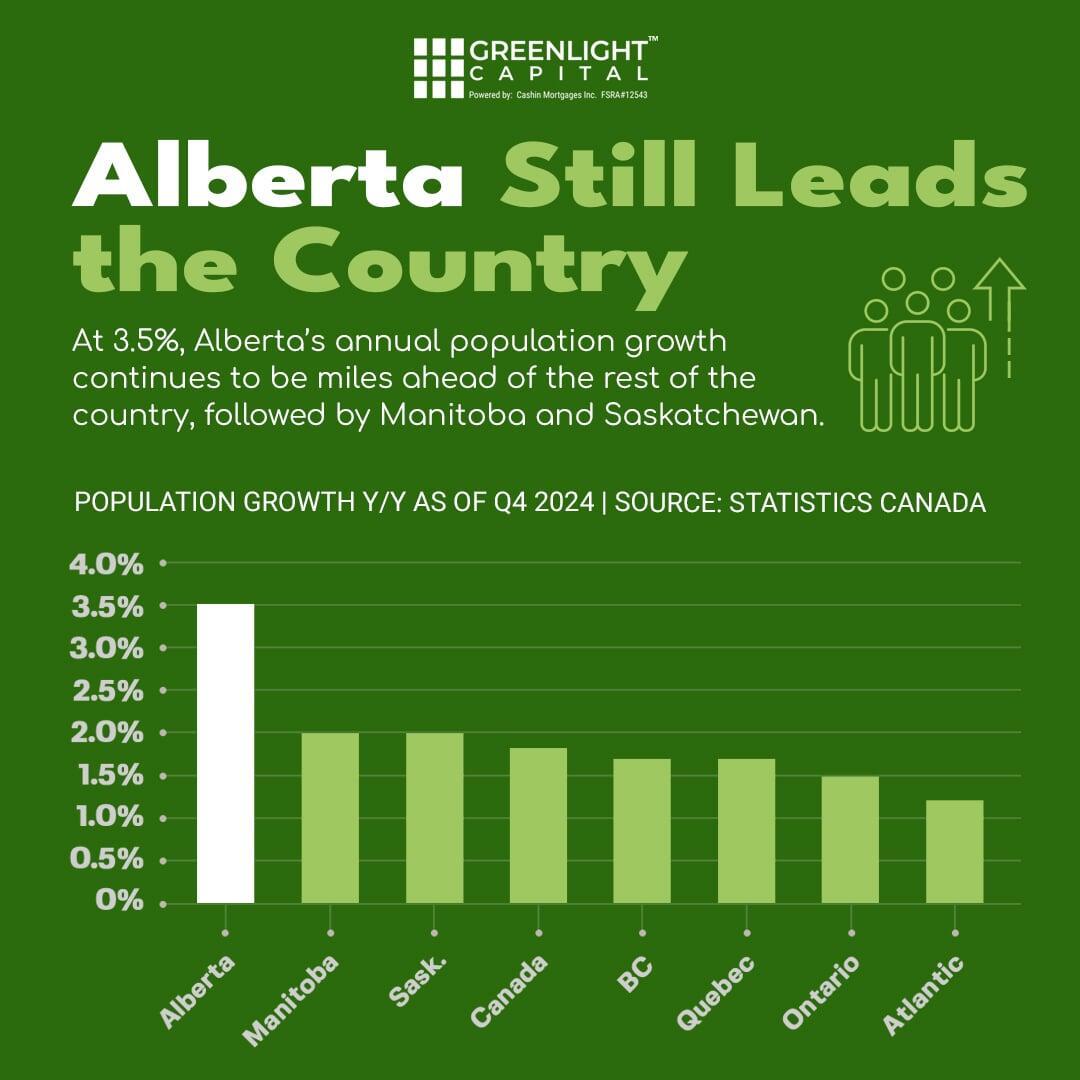

Alberta Continues to Lead

Alberta remains Canada’s fastest-growing province, with annual population growth holding strong at 3.5%. Economic momentum and affordable real estate are fueling migration to the region, creating new opportunities for development and investment.

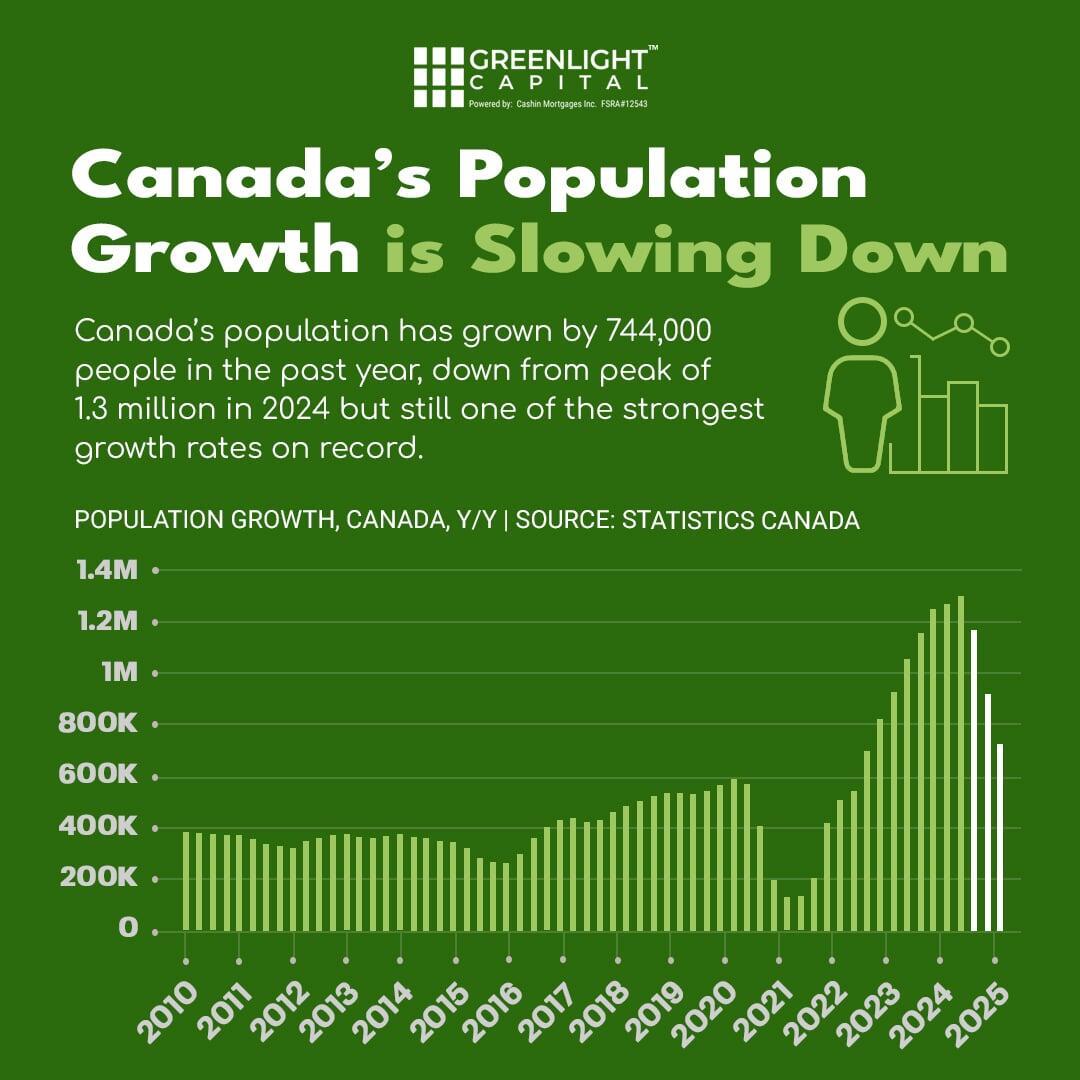

Slower—but Still Strong—Population Growth

Canada added 744,000 new residents in the past year—a slowdown compared to the 1.3 million seen in 2024. Despite the dip, this remains one of the strongest growth periods in Canadian history. For investors, this sustained demand means housing and infrastructure needs aren’t going anywhere.

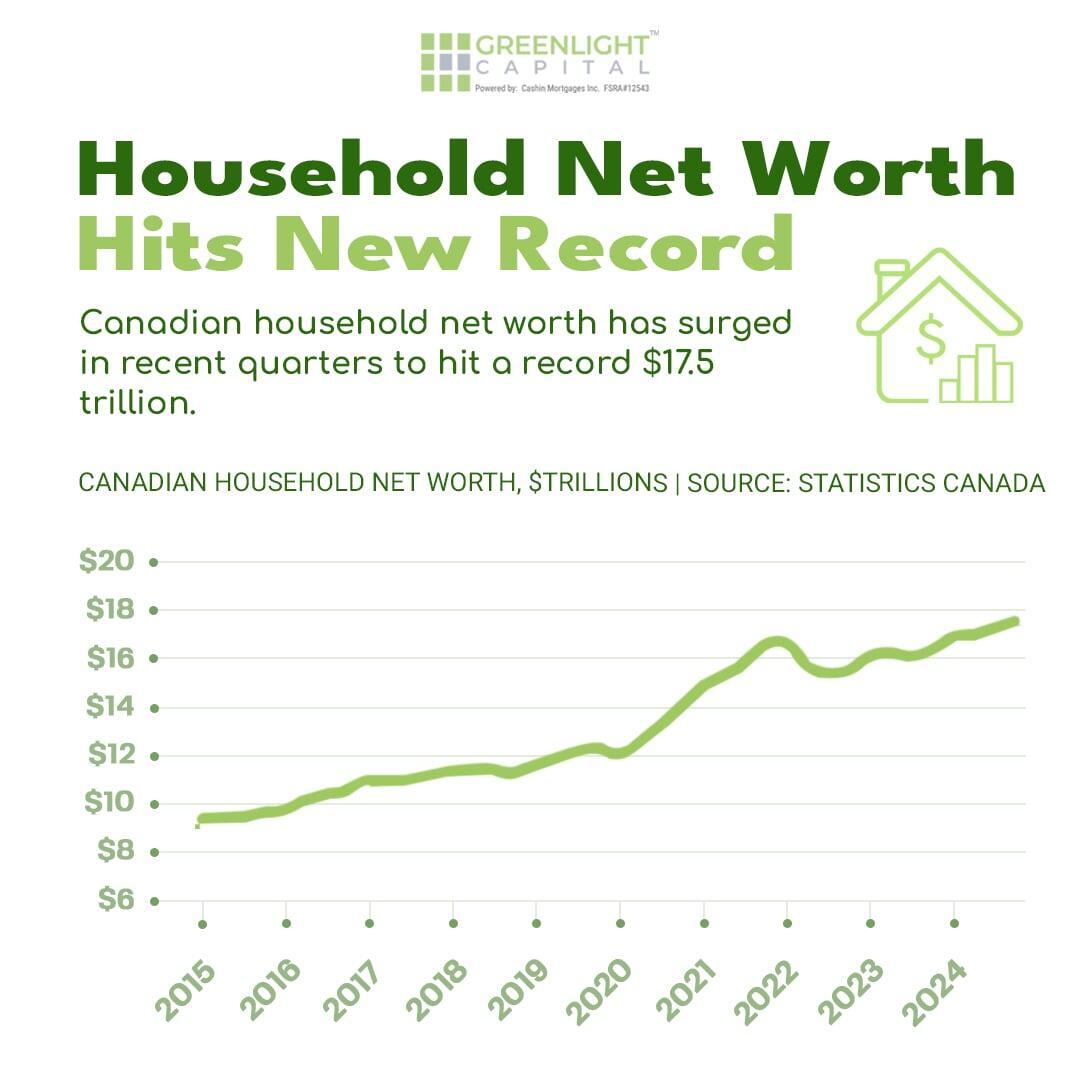

Household Wealth Hits Record High

Canadian households now hold a collective net worth of $17.5 trillion. Much of this growth is tied to strong real estate valuations and investment returns. For developers and lenders, this wealth provides a solid foundation for credit and borrowing capacity.

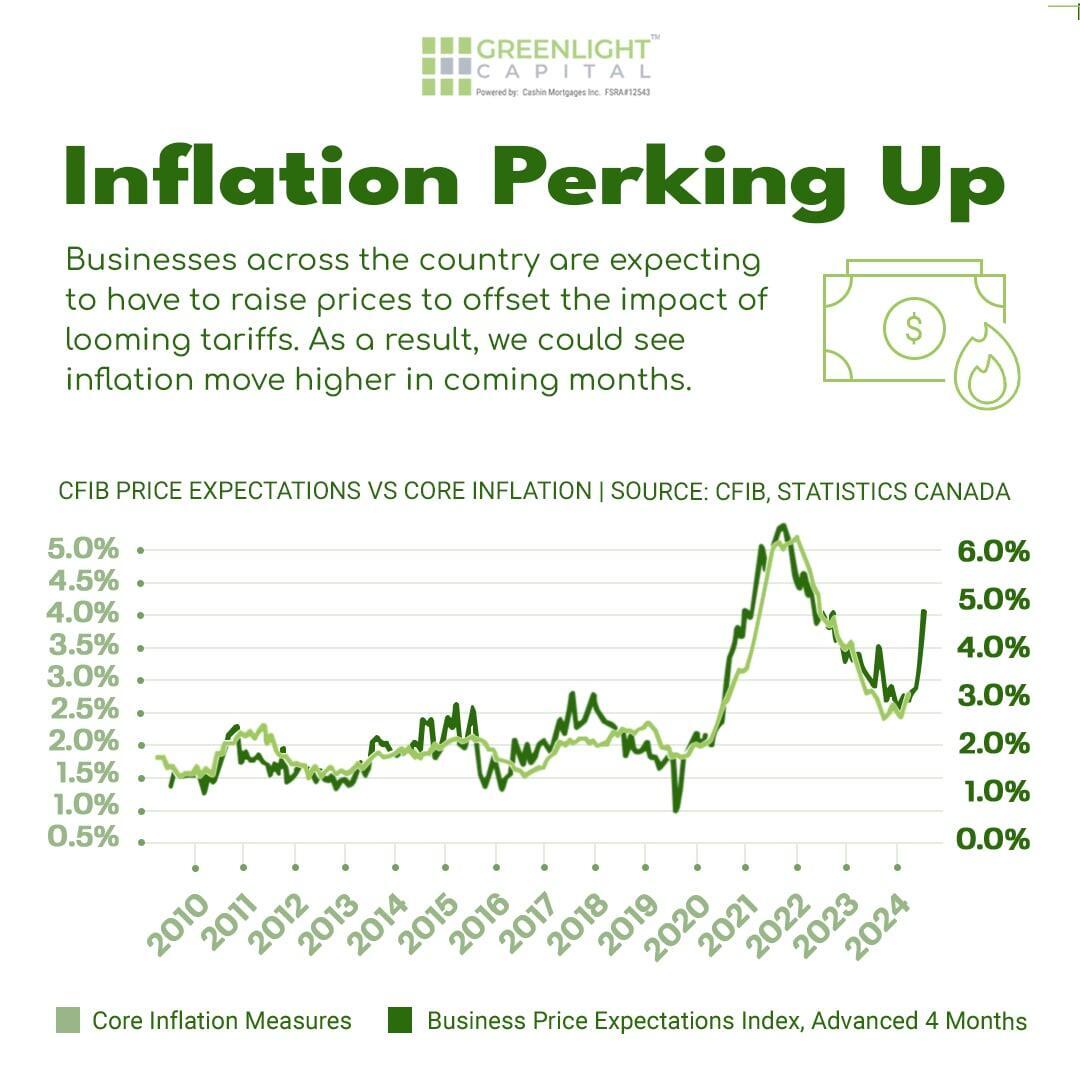

Tariffs and Inflation: What’s Next?

With new tariffs on the horizon, businesses are bracing for rising costs, which could push inflation higher. For the housing market, this means increased construction costs and potentially tighter margins.

Wages Rising Fast

Wages are growing at nearly 6% annually—among the highest rates in 20 years. This could support higher borrowing power, though it may also sustain inflationary pressures and affect rate decisions down the line.

Using a HELOC as a Financial Tool

With prices creeping up, a Home Equity Line of Credit (HELOC) remains one of the most flexible ways for homeowners to manage cash flow or fund renovations. It’s especially useful for navigating volatile pricing on construction materials or project delays.

In Summary:

Population growth, wage gains, and record household net worth point to a strong foundation, but inflation and rising costs must be watched closely. At Greenlight Capital, we’re here to help investors and homeowners make strategic decisions in this shifting landscape.

With prices creeping up, a Home Equity Line of Credit (HELOC) remains one of the most flexible ways for homeowners to manage cash flow or fund renovations. It’s especially useful for navigating volatile pricing on construction materials or project delays.

In Summary:

Population growth, wage gains, and record household net worth point to a strong foundation, but inflation and rising costs must be watched closely. At Greenlight Capital, we’re here to help investors and homeowners make strategic decisions in this shifting landscape.