How the Bank of Canada's Rate Cut Impacts Business Owners

On June 5, 2024, the Bank of Canada (BoC) made a significant move by cutting its key interest rate from 5.0% to 4.75%. This decision marks the first rate cut since March 2020 and signals a shift in the country's monetary policy. The rate cut is expected to have far-reaching implications for business owners, consumers, and the overall economy. Furthermore, there are growing concerns about the potential for the Canadian dollar to drop to 70 cents amidst these rate cuts, a sentiment echoed by prominent private lenders like Greenlight Capital. In this blog, we will explore the impact of the rate cut on business owners and discuss the potential effects on the Canadian dollar.

The Rate Cut

The Bank of Canada's overnight lending rate, also known as the benchmark rate, serves as a reference point for financial institutions to set their prime rates. These prime rates, in turn, influence the interest rates charged on various financial products such as mortgages, loans, and home equity lines of credit. The recent rate cut of 25 basis points is a positive sign for borrowers, as it will lead to lower borrowing costs and potentially stimulate economic growth.

Impact on Business Owners

The rate cut by the BoC can have both direct and indirect effects on business owners. Here are some key implications:

Boost to Housing Market

The rate cut can also have a positive impact on the housing market. Lower mortgage rates can make it more affordable for people to purchase homes, which can lead to increased demand and higher property values. This can be beneficial for businesses involved in the real estate sector, such as construction mortgage companies and real estate agents.

Increased Investment

Lower interest rates can make borrowing cheaper, which can encourage businesses to invest in new projects, expand their operations, or upgrade their infrastructure. This increased investment can lead to job creation and economic growth.

Currency Fluctuations

The rate cut can also impact the value of the Canadian dollar. A lower interest rate can lead to a decrease in the value of the Canadian dollar, making exports cheaper and potentially boosting Canada's export sector. However, a weaker dollar can also lead to higher import costs and inflation.

Lower Borrowing Costs

The reduced interest rate will lead to lower borrowing costs for businesses. This is particularly significant for small and medium-sized enterprises (SMEs) that rely heavily on loans and credit to finance their operations. With lower borrowing costs, SMEs will have more flexibility to invest in growth initiatives, expand their operations, and create new jobs.

Increased Consumer Spending

The rate cut is also expected to boost consumer spending, which is a crucial driver of economic growth. As interest rates decrease, consumers will have more disposable income to spend on goods and services. This increased spending will benefit businesses across various sectors, from retail to hospitality.

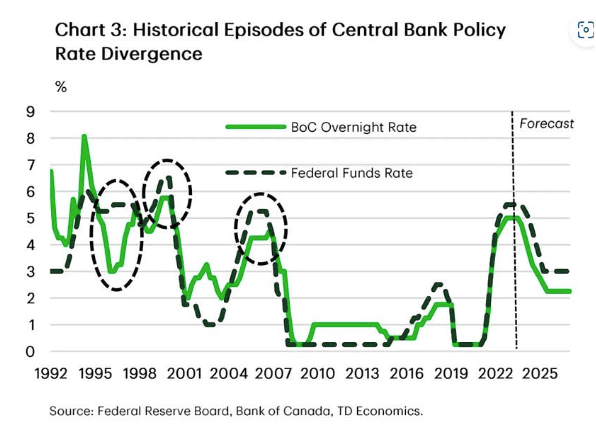

Canadian Dollar Could Drop to 70 Cents Amidst Rate Cuts

The Bank of Canada's rate cut can have significant implications for the value of the Canadian dollar. Historically, lower interest rates have led to a decrease in the value of a currency. This is because lower interest rates make a country's currency less attractive to foreign investors, leading to a decrease in demand and subsequently a decrease in value.

If the BoC continues to cut interest rates, the Canadian dollar could potentially drop to 70 cents against the US dollar. This would make Canadian exports cheaper and more competitive in the global market, which could boost Canada's export sector. However, a weaker dollar can also lead to higher import costs and inflation, which could negatively impact businesses that rely heavily on imports.

A Shift in Monetary Policy

The Bank of Canada's decision to cut interest rates marks a shift in its monetary policy. For nearly two years, the central bank had been raising interest rates to combat high inflation. However, with inflation easing and the economy slowing down, the Bank of Canada has decided to adopt a more accommodative stance.

What's Next for Business Owners?

The rate cut is a positive development for business owners, but it is not without its challenges. As the Canadian dollar potentially drops in value, businesses that rely heavily on imports may face increased costs. Additionally, the rate cut could lead to increased competition in certain sectors, making it more challenging for businesses to maintain their market share.

Economic Outlook and Future Rate Cuts

The BoC's rate cut signals that the central bank is willing to ease monetary policy to support the Canadian economy. The decision to cut rates reflects the bank's assessment that the economy is slowing down and that inflation is easing. This could lead to further rate cuts in the coming months, reducing borrowing costs for businesses and consumers.

The BoC has indicated that it is willing to continue cutting rates if inflation continues to ease. This could lead to a downward trend in interest rates, making it easier for businesses to borrow and invest. However, the bank also cautioned that lowering rates too quickly could jeopardize the progress made in reducing inflation.

Conclusion

The Bank of Canada's rate cut is a significant development that will have far-reaching implications for business owners across Canada. With lower borrowing costs, increased consumer spending, and a potentially weaker Canadian dollar, businesses will need to adapt to these changes to remain competitive. As the economy continues to evolve, business owners must stay informed about the latest developments in monetary policy and adjust their strategies accordingly. Insights from firms like Greenlight Capital underscore the importance of proactive financial planning and strategic adjustments to navigate these economic changes.

Sources: