As we wrap up the final month of 2025, Canada’s real estate and lending landscape continues to show steady shifts some expected, others surprising. Here’s what stood out as we head into a new year of opportunities and planning.

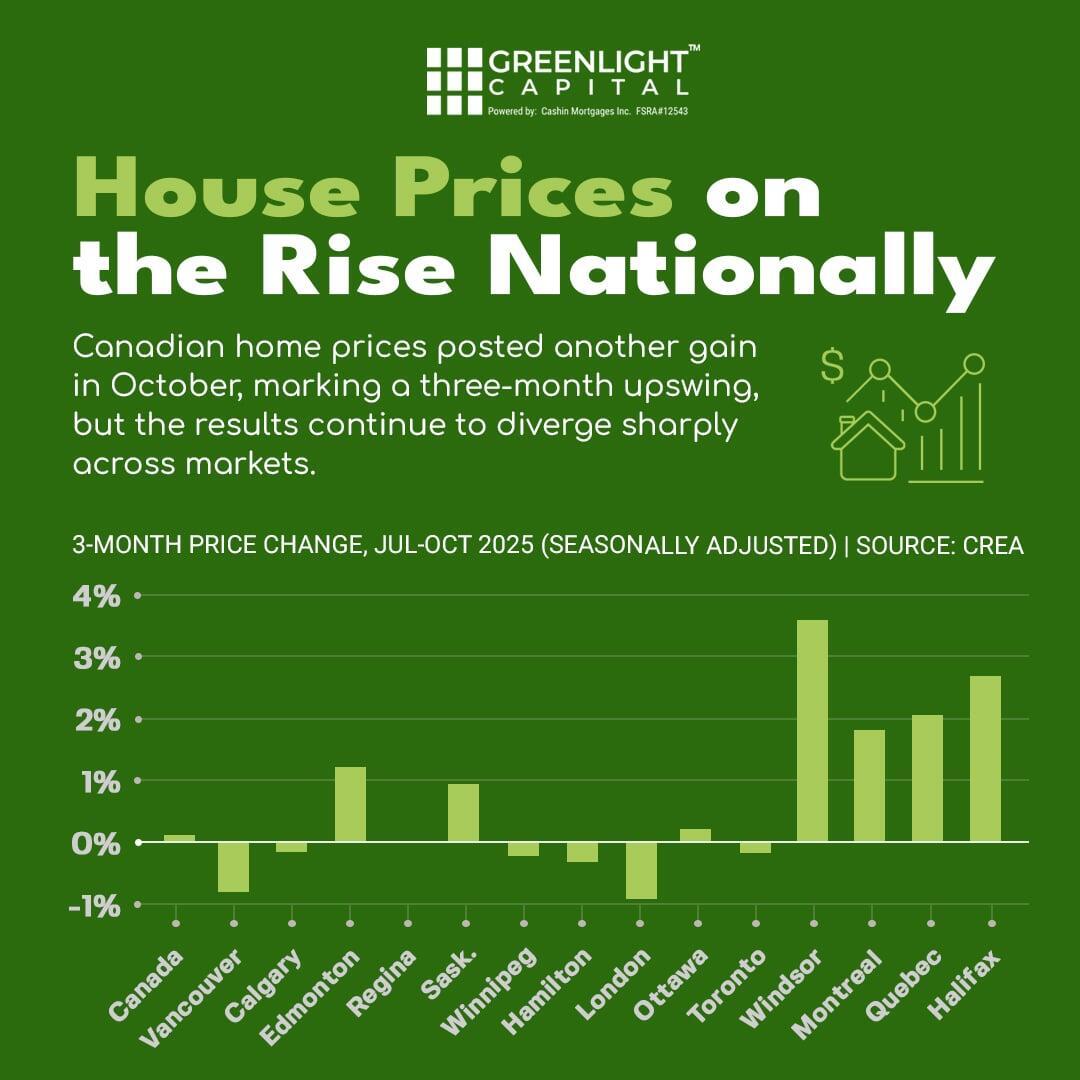

National Home Prices Continue to Rise

While the national picture looks positive, performance remains. Some markets continue to cool, while others are experiencing renewed competition and price pressure.

What Your Clients Need to Know:

- Conditions vary significantly by region.

- Strategic buying and selling decisions should be based on trends, not national averages.

While the national picture looks positive, performance remains. Some markets continue to cool, while others are experiencing renewed competition and price pressure.

What Your Clients Need to Know:

- Conditions vary significantly by region.

- Strategic buying and selling decisions should be based on trends, not national averages.

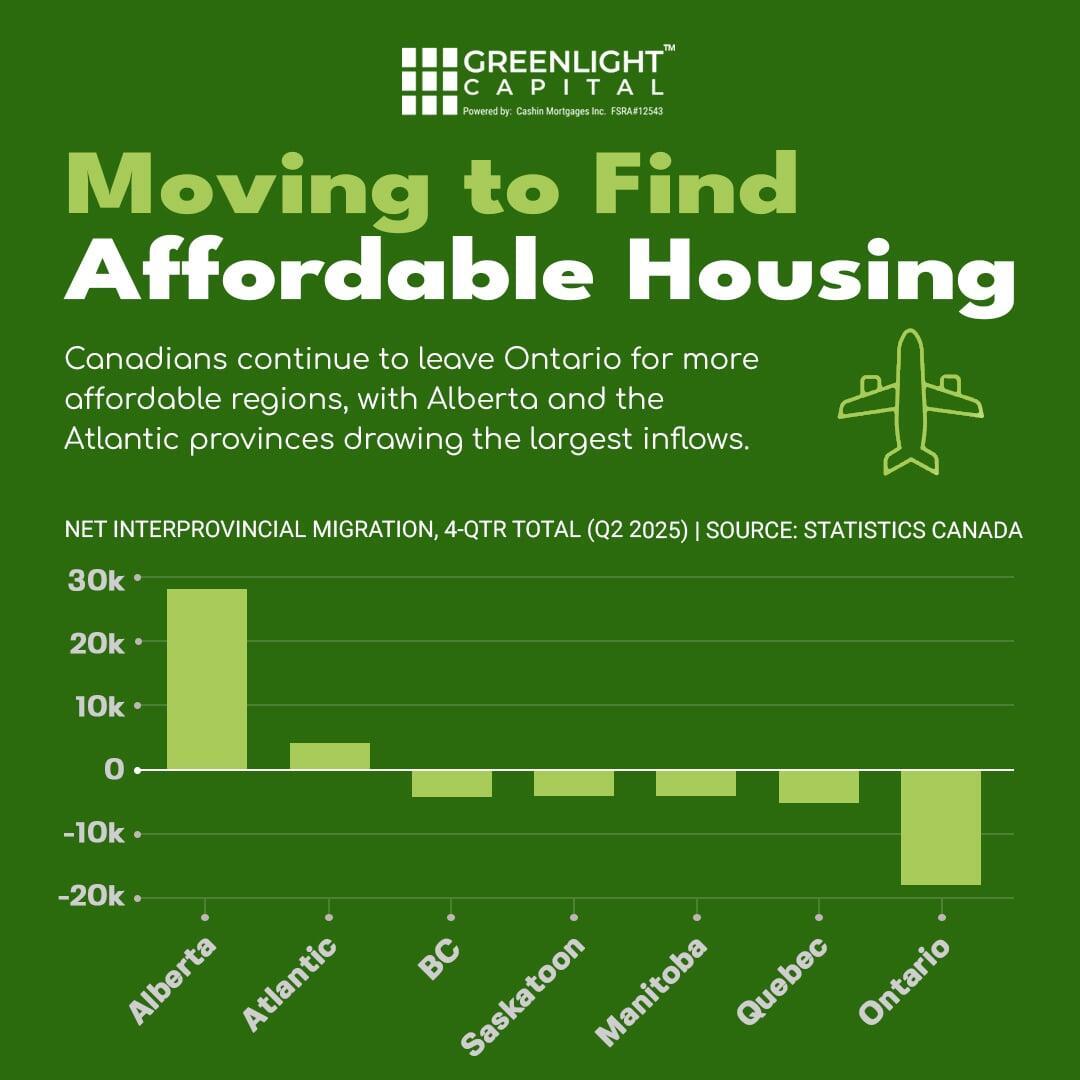

Canadians Are Moving for Affordability

More Canadians are leaving Ontario in search of affordable living. continue to attract the largest inflows of new residents.Alberta and the Atlantic provinces.

What Your Clients Need to Know:

- - Demand is strengthening in lower-cost regions.

- - These markets offer promising opportunities for investors and borrowers seeking better value.

Alberta and the Atlantic provinces.

What Your Clients Need to Know:

- - Demand is strengthening in lower-cost regions.

- - These markets offer promising opportunities for investors and borrowers seeking better value.

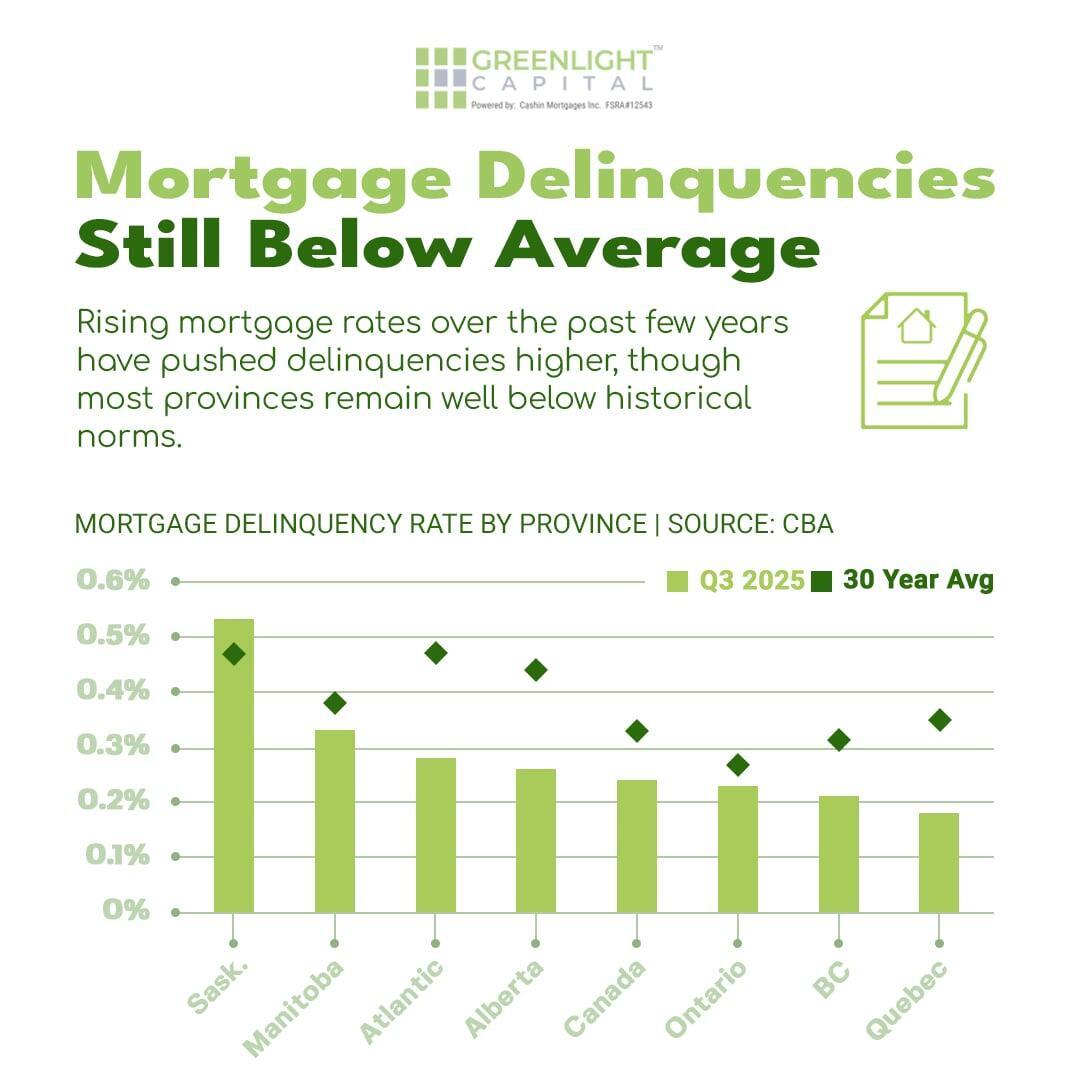

Mortgage Delinquencies Remain Lower Than Expected

While delinquencies have edged up due to rate pressures, most provinces still sit below historical norms.

- What Your Clients Need to Know:

- Borrowers remain financially resilient.

- Private lending solutions continue to help Canadians stay on track during tighter lending conditions.

While delinquencies have edged up due to rate pressures, most provinces still sit below historical norms.

- What Your Clients Need to Know:

- Borrowers remain financially resilient.

- Private lending solutions continue to help Canadians stay on track during tighter lending conditions.

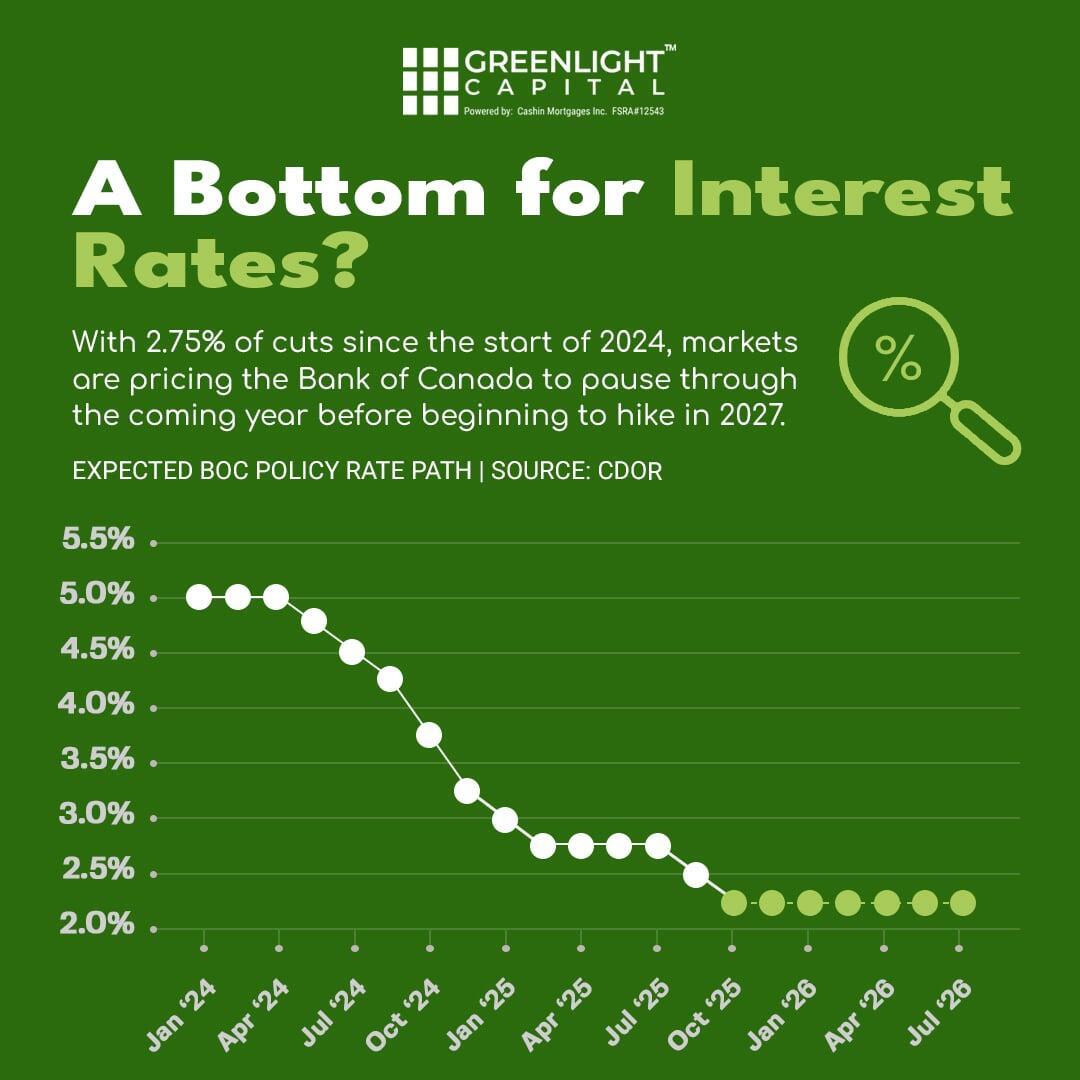

Are We Close to the Bottom for Interest Rates?

Since early 2024, the Bank of Canada has delivered 2.75% in cumulative cuts. Markets now expect the Bank to pause for most of 2026, with potential hikes not resuming until 2027.

What Your Clients Need to Know:

- We are likely near the bottom of the rate cycle.

- This creates a stable planning environment for refinancing, investing, and business capital needs.

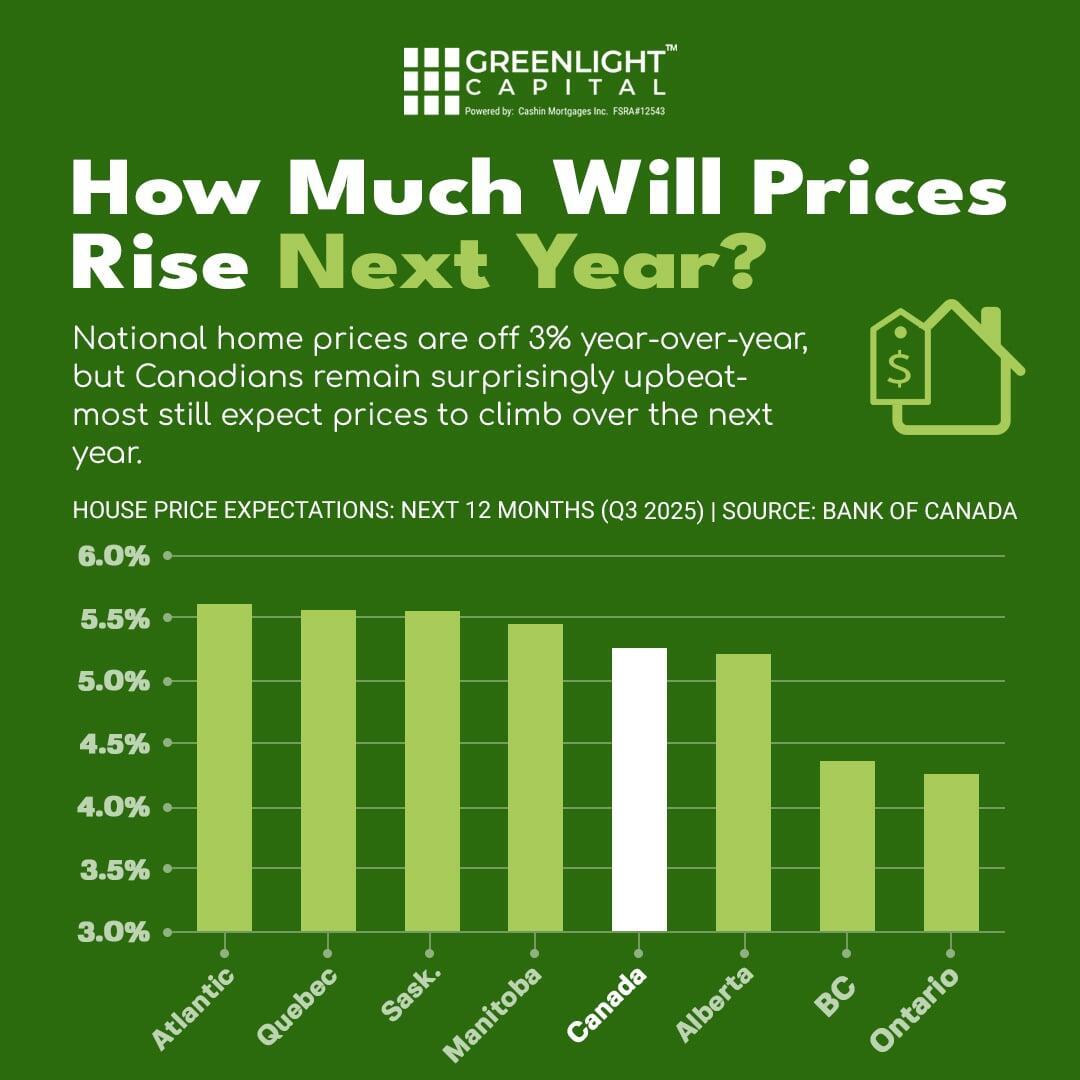

What to Expect for Home Prices in 2026

Despite national prices sitting 3% below last year, Canadians remain surprisingly optimistic. Most still believe prices will rise over

the next 12 months.

What Your Clients Need to Know:

- Positive buyer sentiment could drive early-year activity.

- Many clients may choose to move now before anticipated price increases in 2026.

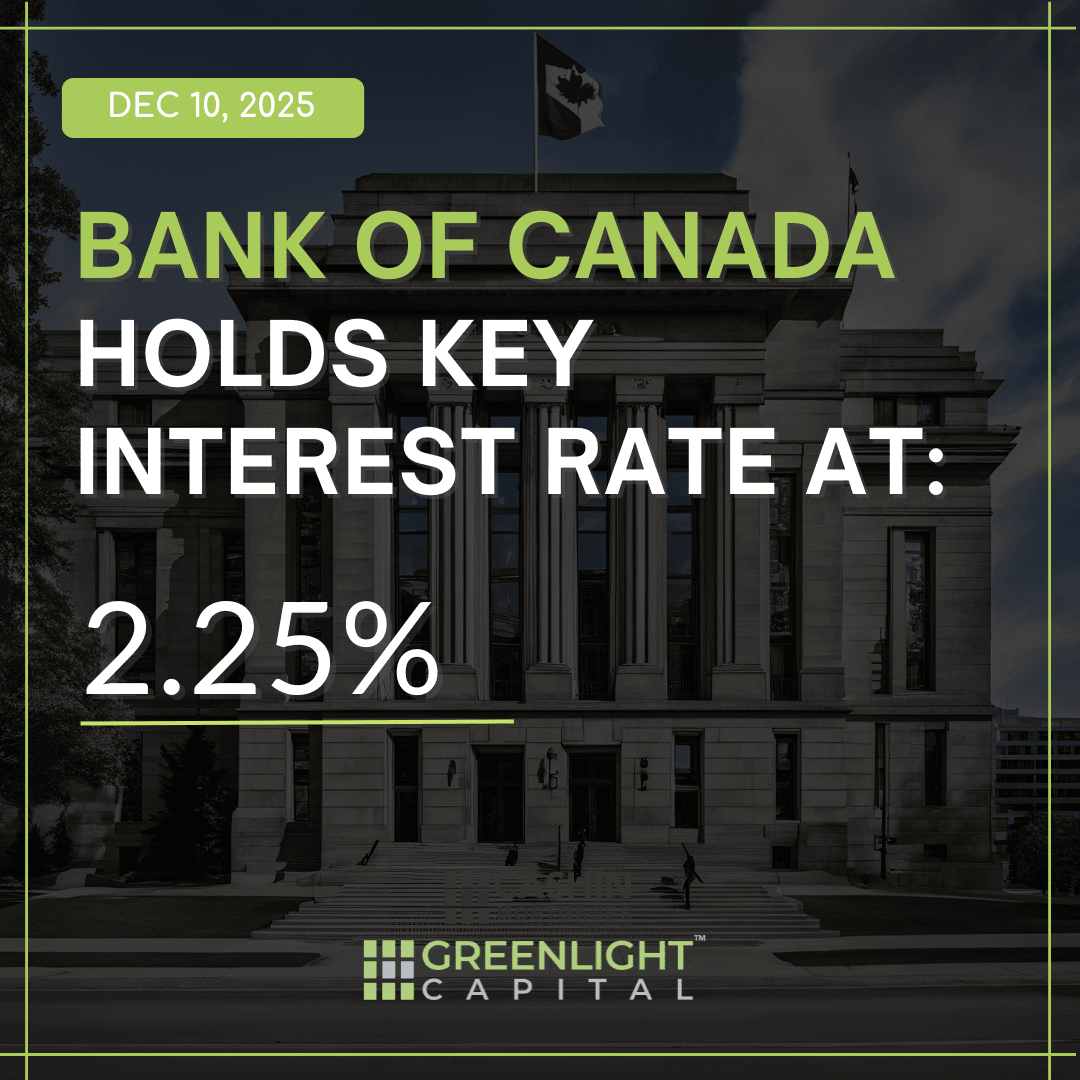

Bank of Canada: Current Interest Rate Update

As of the BoC’s December 10, 2025 decision, the policy interest rate remains fixed at 2.25%.

That rate hold follows two rate cuts earlier this year.

- The Bank Rate stands at 2.50% and the deposit rate at 2.20%.

- Many economists now expect the BoC to remain on hold throughout 2026, with the next possible move upward (rather than downward) likely sometime in 2026 or 2027, if conditions change.

What your clients need to know:

- The current rate environment provides stability for borrowers and investors.

- Variable-rate mortgages and HELOCs should remain relatively steady for now.

- It may be an ideal time for clients to lock in financing or plan strategic investments before potential future rate hikes.

Final Thoughts

Shifting migration patterns, rising prices, and stable rates all point to a where private lending plays an increasingly essential role.

At Greenlight Capital, we continue to support brokers, borrowers, and investors with private lending solutions that are designed for today’s evolving . We understand that traditional financing doesn’t always fit every scenario, that’s why we offer fast, flexible, and common-sense lending, tailored to your unique goals.

📩 Have a deal or a client looking for financing?

Submit Deal Now

| |

|

📩 Have a deal or a client looking for financing?

Submit Deal Now