The New Year is here, and with it comes a mix of challenges and opportunities in Canada’s housing and financial markets. As we move into 2026, Canadians are navigating a complex landscape: borrowing costs remain elevated, housing supply is uneven, and younger buyers are facing affordability hurdles unlike any previous generation.

At the same time, shifts in rental development, construction trends, and consumer spending patterns are creating opportunities for investors and homeowners alike. Staying informed and strategic will be essential for anyone looking to make smart financial decisions this year.

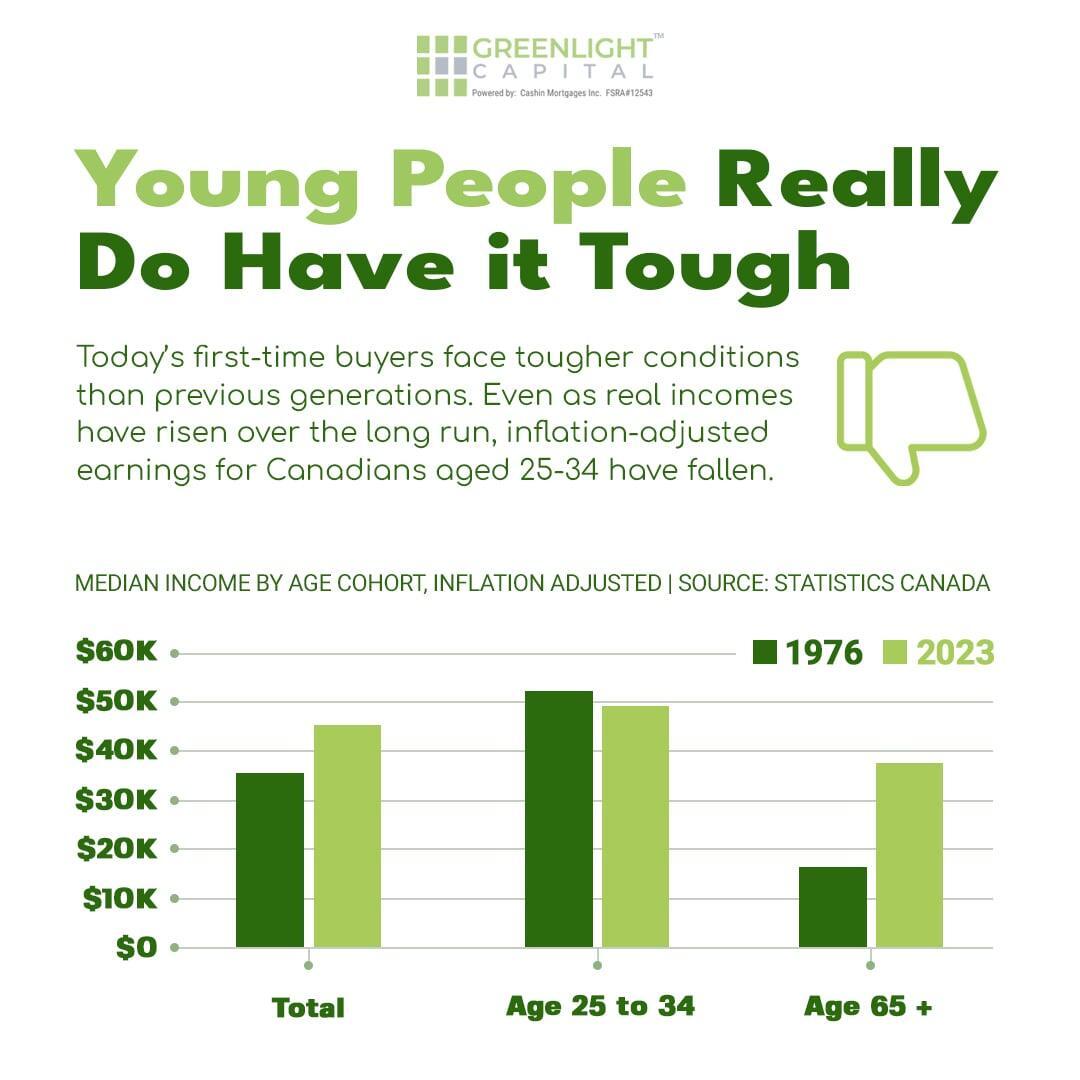

Young Canadians Are Facing Tougher Conditions

First-time buyers are feeling the squeeze more than ever. While long-term incomes have grown, inflation-adjusted earnings for Canadians aged 25–34 have actually declined. Rising home prices and higher borrowing costs make saving for a down payment increasingly difficult.

What this means for your client:

- First-time buyers may need flexible mortgage solutions or smaller down payment options to enter the market.

- Investors can explore opportunities in rental properties targeting younger demographics being priced out of ownership.

Housing Starts Continue to Decline

New home construction is slowing. Condo and single-family housing starts are now near levels last seen during the global financial crisis. Fewer new homes could mean tighter supply ahead especially in key markets where demand remains strong.

What this means for your client:

Buyers may face more competition for existing homes, driving prices higher.

Investors could benefit from limited supply supporting stronger rental demand and property value

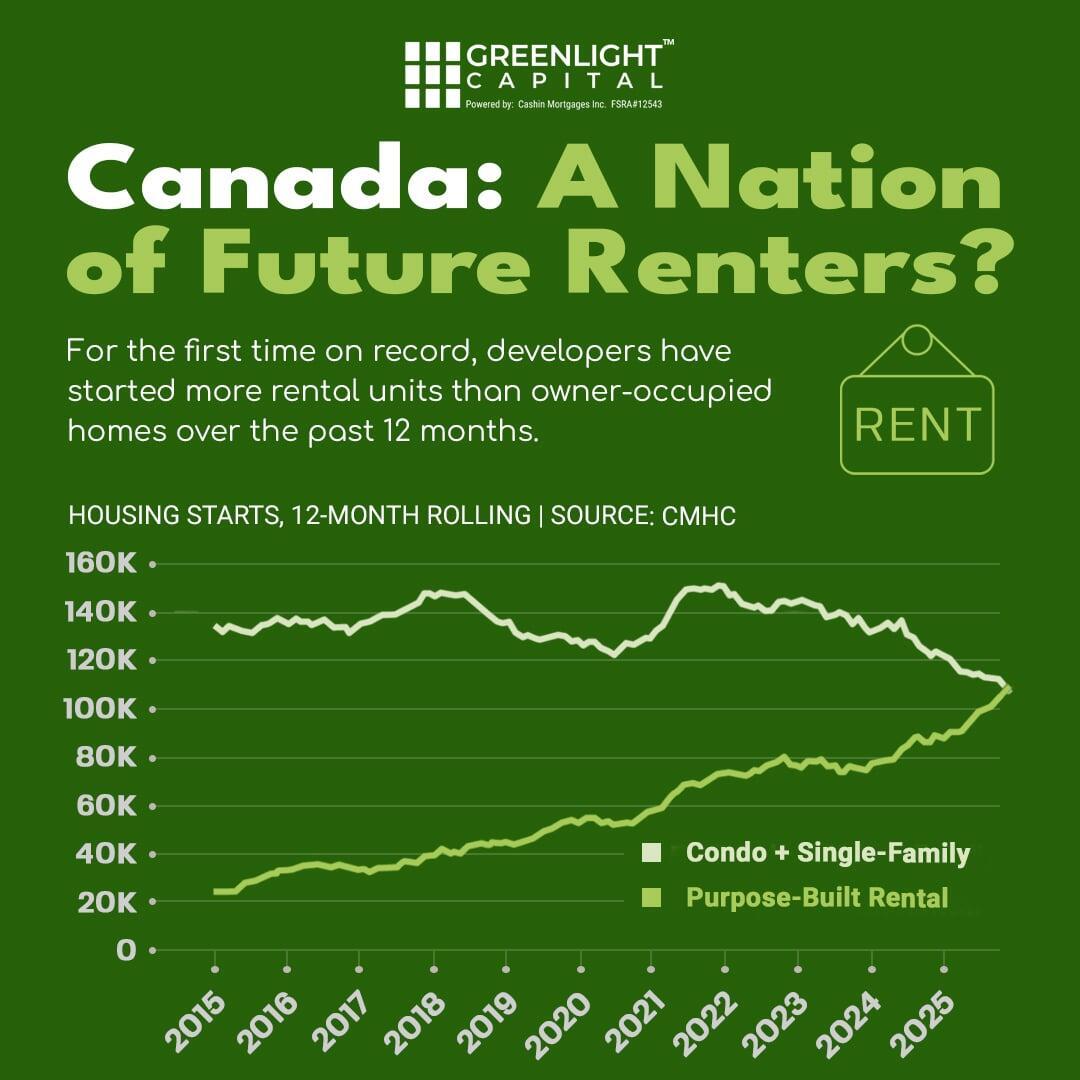

Canada Is Becoming a Nation of Renters

For the first time on record, developers have started more rental units than owner-occupied homes over the past 12 months. This shift reflects affordability challenges for buyers and a growing demand for rental housing a trend investors should watch closely.

What this means for your client:

Prospective homeowners may need to rent longer-term or explore shared ownership programs.

Investors can capitalize on rising rental demand by targeting well-located or new rental developments.

Housing Supply Varies Across the Country

Not all housing markets are equal. Inventory remains elevated in major metros across Ontario and British Columbia, but many other regions have listings near decade lows. Limited supply in these areas can keep competition and prices high for buyers.

What this means for your client:

Buyers in low-inventory regions need to act strategically with pre-approvals and strong offers.

Investors may find the best opportunities where supply constraints are driving higher returns.

Rising Grocery Costs Are Adding Pressure

While overall inflation has eased, food prices are rising faster than any time since 2023. Rising grocery costs are putting extra pressure on household budgets, highlighting the need for careful financial planning.

What this means for your client:

Homeowners should review cash flow and consider lines of credit or HELOCs to manage short-term expenses.

Investors can focus on rental properties that appeal to tenants seeking affordability, as higher living costs may increase rental demand.

Looking Ahead

2026 is shaping up to be a year of contrasts opportunities for investors in rental properties and well-positioned markets, but continued challenges for first-time buyers. Staying informed and strategic will be key to making smart financial decisions.

Greenlight Capital Canada is here to guide your clients through the evolving market. Reach out today to discuss mortgages, investment strategies, or tailored solutions.