Are We Heading for a Housing Supply Crunch?

As we enter the second half of 2025, Canada’s housing market presents a mixed but telling picture shaped by shifting population trends, evolving affordability, and a potential shortage in housing supply. While some regions are experiencing renewed growth, others face slowing momentum. For private lenders and investors, staying ahead of these trends is key to making informed, strategic decisions.

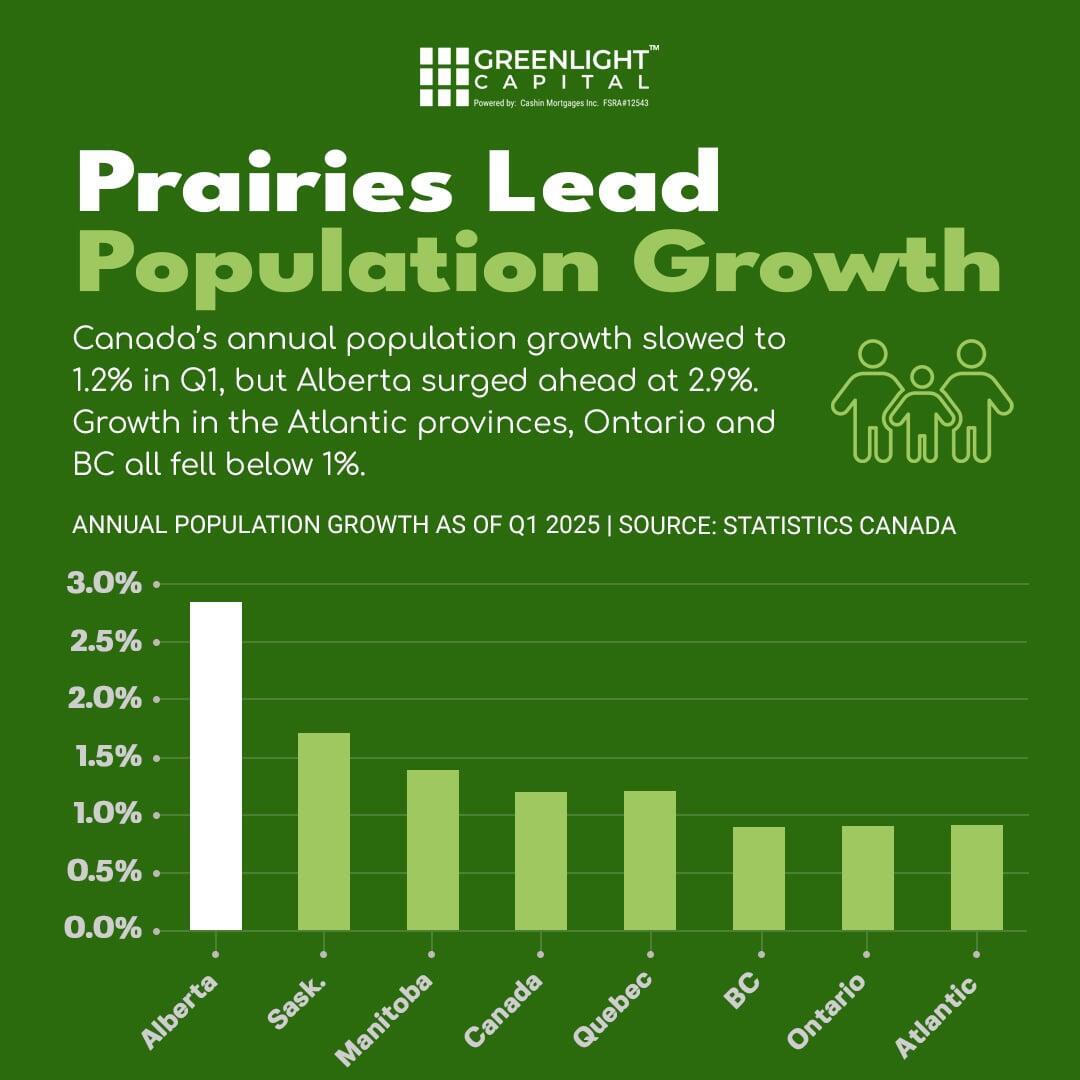

Prairies Lead the Pack in Population Growth

While Canada’s annual population growth slowed to 1.2% in the first quarter, Alberta surged ahead at 2.9%, leading the country. In contrast, growth in the Atlantic provinces, Ontario, and British Columbia remained below 1%. This shift toward the Prairies—driven by interprovincial migration and economic opportunity—may present emerging investment opportunities in areas with expanding demand but limited supply.

Strong Resale Supply… For Now

Inventory in the resale market is relatively healthy at the moment, but that could change. Construction activity for condos and single-family homes has slowed considerably, suggesting that new supply may not keep up with future demand—especially in high-growth provinces like Alberta.

For lenders and developers, this is a critical indicator of a potential future supply crunch.

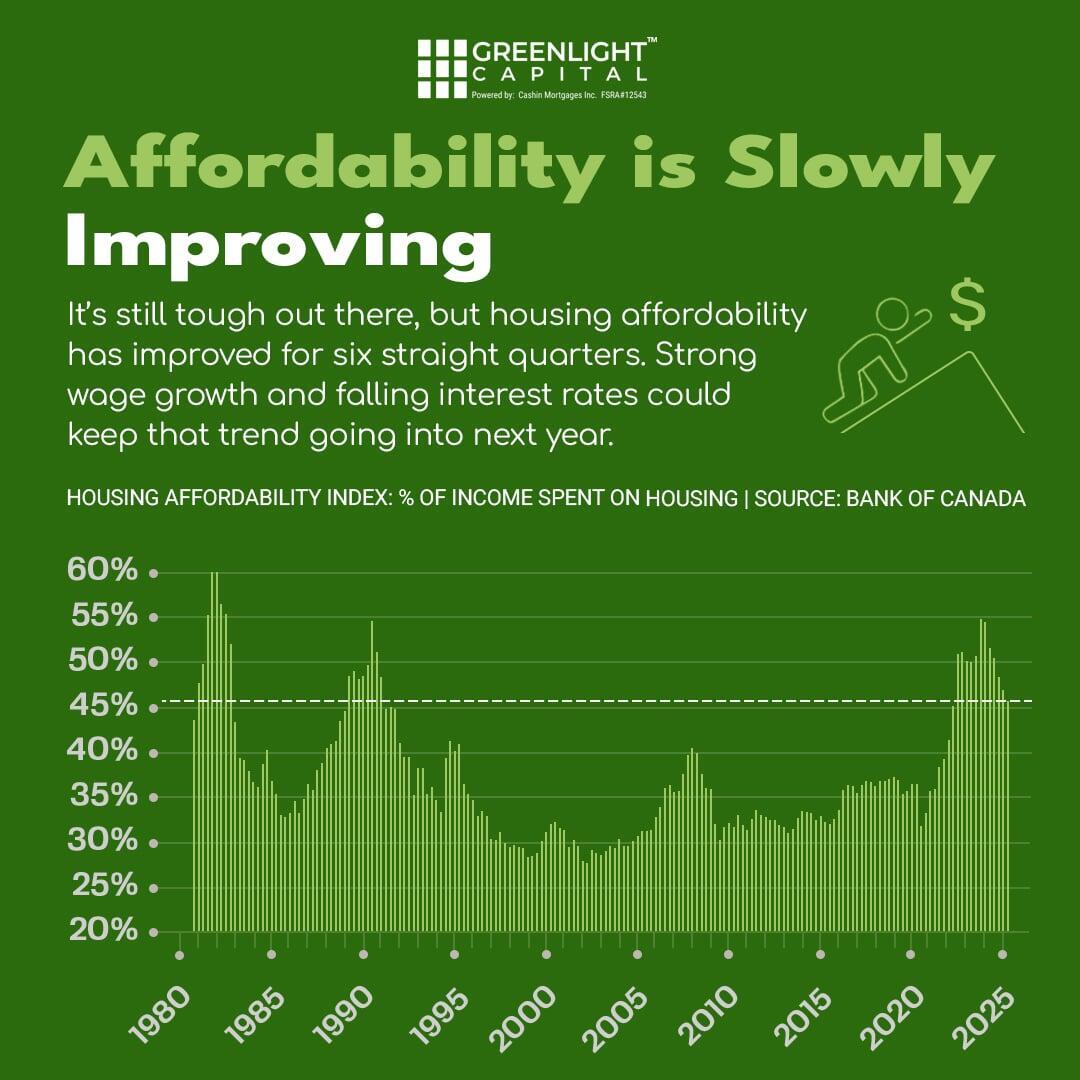

Affordability Is Slowly Improving

Although affordability remains a concern for many Canadians, the trend is cautiously positive. Housing affordability has improved for six consecutive quarters, thanks to steady wage growth and easing interest rates.

Should this trend continue, we may see more buyers return to the market through the remainder of 2025, increasing demand for financing solutions.

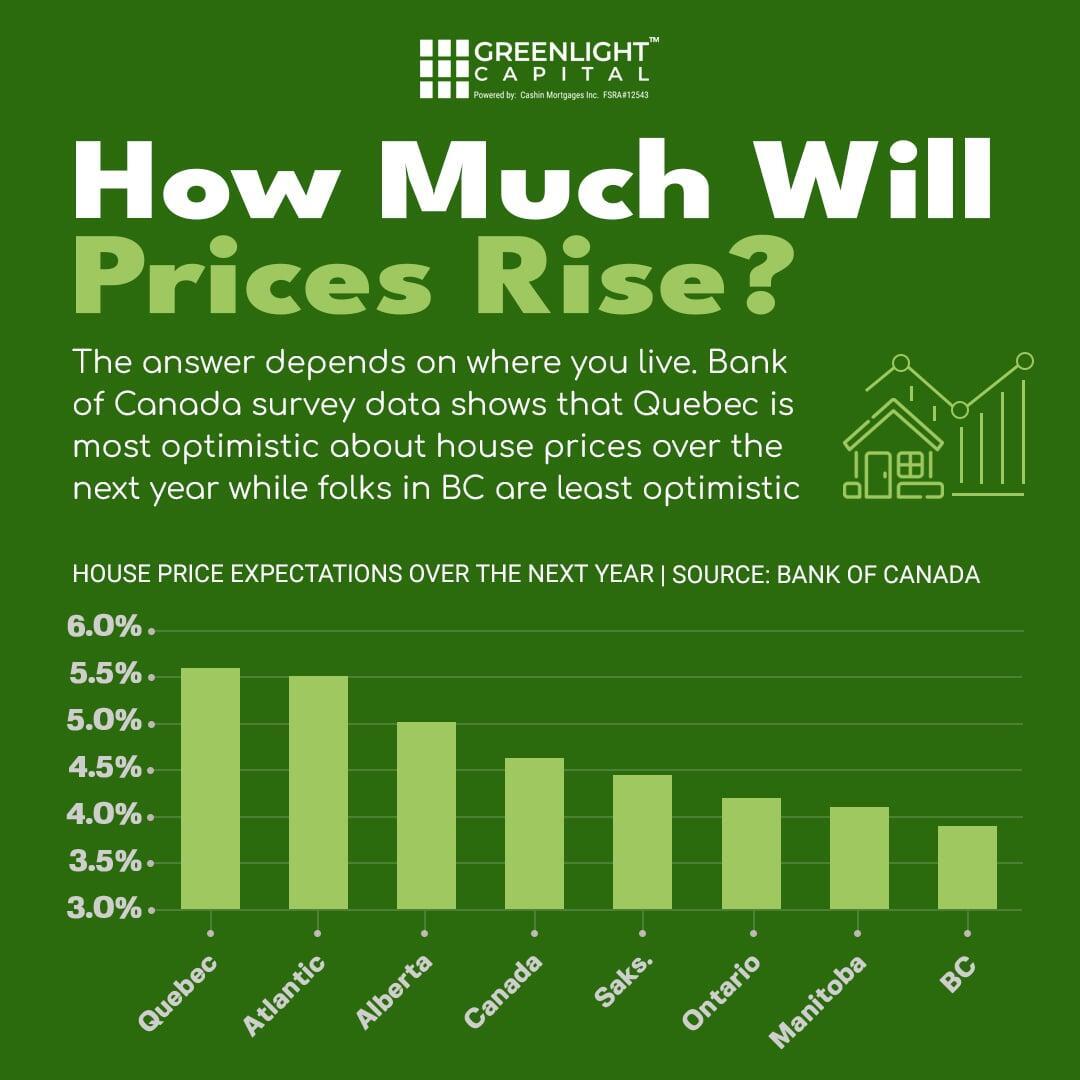

Price Expectations Vary by Province

According to recent Bank of Canada survey data, price growth expectations vary significantly across regions. Homeowners in Quebec are the most optimistic, while those in British Columbia remain the most cautious.

Understanding regional sentiment is essential when evaluating investment risk and return.

Home Sales on the Rise

There’s more encouraging news: Canadian home sales rose by 3.6% in May (seasonally adjusted), marking the strongest performance since October 2023.

Ontario led the growth with a 9.6% increase, reflecting a rebound in buyer confidence and activity in key urban markets.

Greenlight Insight

For investors and private lenders, today’s market presents both challenges and opportunities. As supply tightens and affordability improves, the demand for creative financing and alternative lending solutions is likely to rise—particularly in high-growth regions like Alberta.

If you’re working with borrowers or exploring new investment avenues, now’s the time to position yourself strategically.

Greenlight Capital Canada is here to support you with fast, flexible lending solutions and a deep understanding of where the market is headed.

📩 Have a deal or a client looking for financing?

Contact us today to see how we can help.