Canada’s Housing and Economic Trends

November is here, offering a fresh look at Canada’s housing market and the economic trends shaping borrowing and homeownership decisions as we move toward the end of 2025.

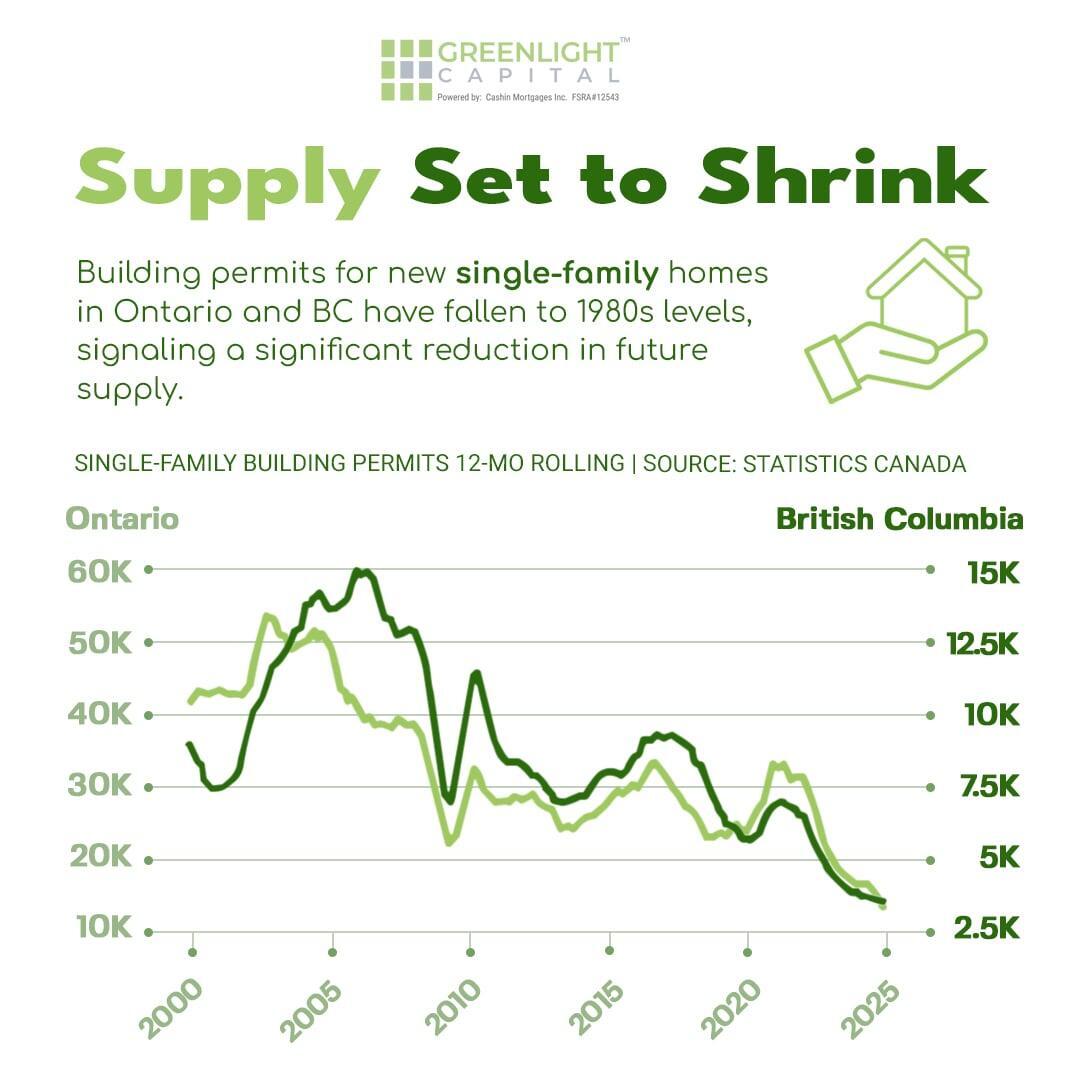

Supply Set to Shrink

Building permits for new single-family homes in Ontario and British Columbia have fallen to levels not seen since the 1980s. This sharp reduction in future supply could put upward pressure on home prices in key markets, highlighting opportunities for strategic investments.

What Your Clients Need to Know:

With fewer new homes entering the market, existing housing inventory will become more valuable. Investors should anticipate tighter supply conditions that could lead to higher resale prices and stronger long-term equity growth.

.

Building permits for new single-family homes in Ontario and British Columbia have fallen to levels not seen since the 1980s. This sharp reduction in future supply could put upward pressure on home prices in key markets, highlighting opportunities for strategic investments.

What Your Clients Need to Know:

With fewer new homes entering the market, existing housing inventory will become more valuable. Investors should anticipate tighter supply conditions that could lead to higher resale prices and stronger long-term equity growth.

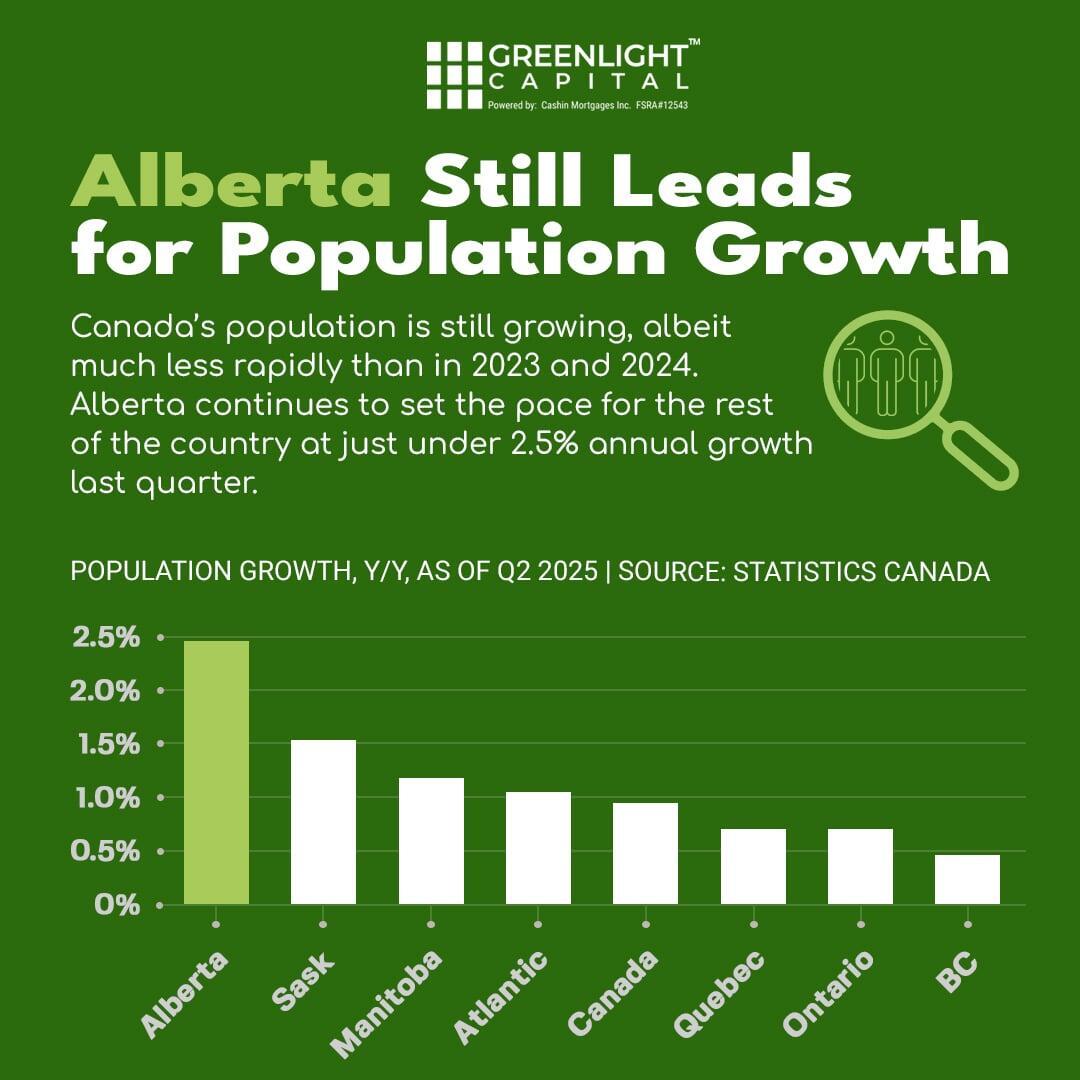

Alberta Leads in Population Growth

Canada’s population continues to grow, though at a slower pace than in 2023 and 2024. Alberta is leading the way with 2.5% annual growth last quarter, driving strong housing demand and creating potential opportunities for investors in the region.

What Your Clients Need to Know:

Rising population in Alberta means ongoing rental and ownership demand. Investors may find strong opportunities in residential development or income-generating properties as migration trends favor this province

Canada’s population continues to grow, though at a slower pace than in 2023 and 2024. Alberta is leading the way with 2.5% annual growth last quarter, driving strong housing demand and creating potential opportunities for investors in the region.

What Your Clients Need to Know:

Rising population in Alberta means ongoing rental and ownership demand. Investors may find strong opportunities in residential development or income-generating properties as migration trends favor this province

Unemployment on the Rise

The national unemployment rate has surpassed 7% for the first time since the pandemic. Regional differences remain significant, making local market knowledge essential for investors assessing rental demand and housing trends.

What Your Clients Need to Know:

Increased unemployment may impact affordability and rental stability in certain regions. Investors should focus on markets with diverse employment bases and resilient industries to mitigate potential risks.

The national unemployment rate has surpassed 7% for the first time since the pandemic. Regional differences remain significant, making local market knowledge essential for investors assessing rental demand and housing trends.

What Your Clients Need to Know:

Increased unemployment may impact affordability and rental stability in certain regions. Investors should focus on markets with diverse employment bases and resilient industries to mitigate potential risks.

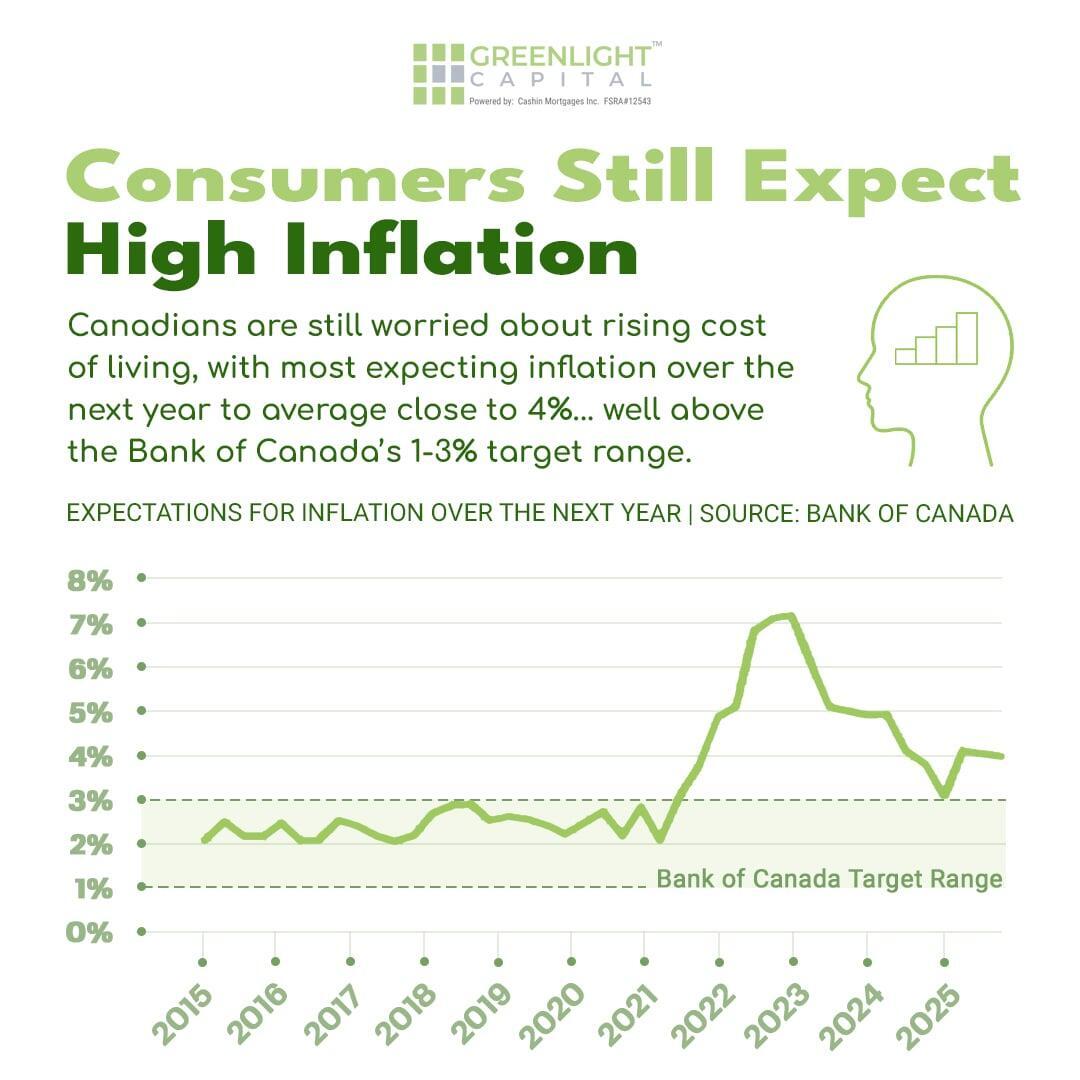

Consumers Expect High Inflation

Canadians remain concerned about the cost of living, with most expecting inflation near 4% over the next year well above the Bank of Canada’s 1.3% target. This could affect mortgage affordability and consumer spending, influencing housing markets across the country.

What Your Clients Need to Know:

Inflation expectations suggest interest rate relief may remain gradual. Investors should plan financing strategies carefully, focusing on flexible lending options and strong cash flow properties.

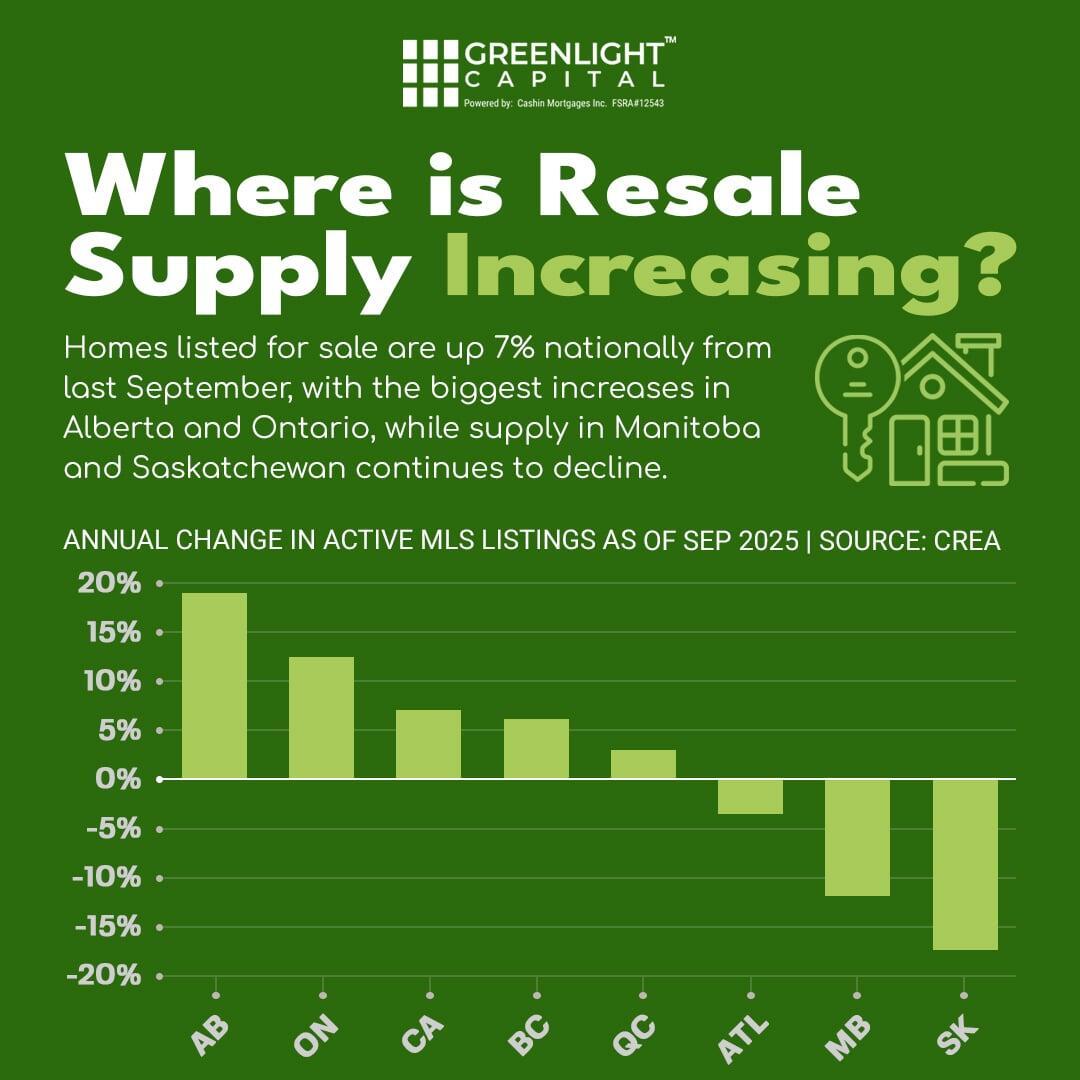

Where Is Rebate Supply Increasing?

Homes listed for sale are up 7% nationally from last September, with the largest increases in Alberta and Ontario. Meanwhile, supply in Manitoba and Saskatchewan continues to decline, highlighting regional variations and opportunities for investors to explore.

What Your Clients Need to Know:

More listings mean greater selection for investors in certain regions, particularly in Alberta and Ontario. Those seeking undervalued opportunities may want to explore these markets before prices adjust upward.

Final Thoughts

Whether you’re buying, selling, refinancing, or investing, Greenlight Capital Canada is here to provide the guidance and financing solutions that fit your needs and your clients.

Greenlight Capital Canada is here to support you with fast, flexible lending solutions and a deep understanding of where the market is headed.

📩 Have a deal or a client looking for financing?

Contact us today to see how we can help.