Greenlight Capital’s Take on Canada’s Housing Trends

Greenlight Capital’s Take on Canada’s Housing Trends

As the Canadian housing market heads toward year-end, Greenlight Capital is tracking several important trends that will likely influence real estate activity into 2024 and beyond. From interest rate cuts and rising consumer confidence to population growth and a potential supply crunch, each of these factors has unique implications for lenders, developers, and investors. Here’s our in-depth look at the current market landscape.

As the Canadian housing market heads toward year-end, Greenlight Capital is tracking several important trends that will likely influence real estate activity into 2024 and beyond. From interest rate cuts and rising consumer confidence to population growth and a potential supply crunch, each of these factors has unique implications for lenders, developers, and investors. Here’s our in-depth look at the current market landscape.

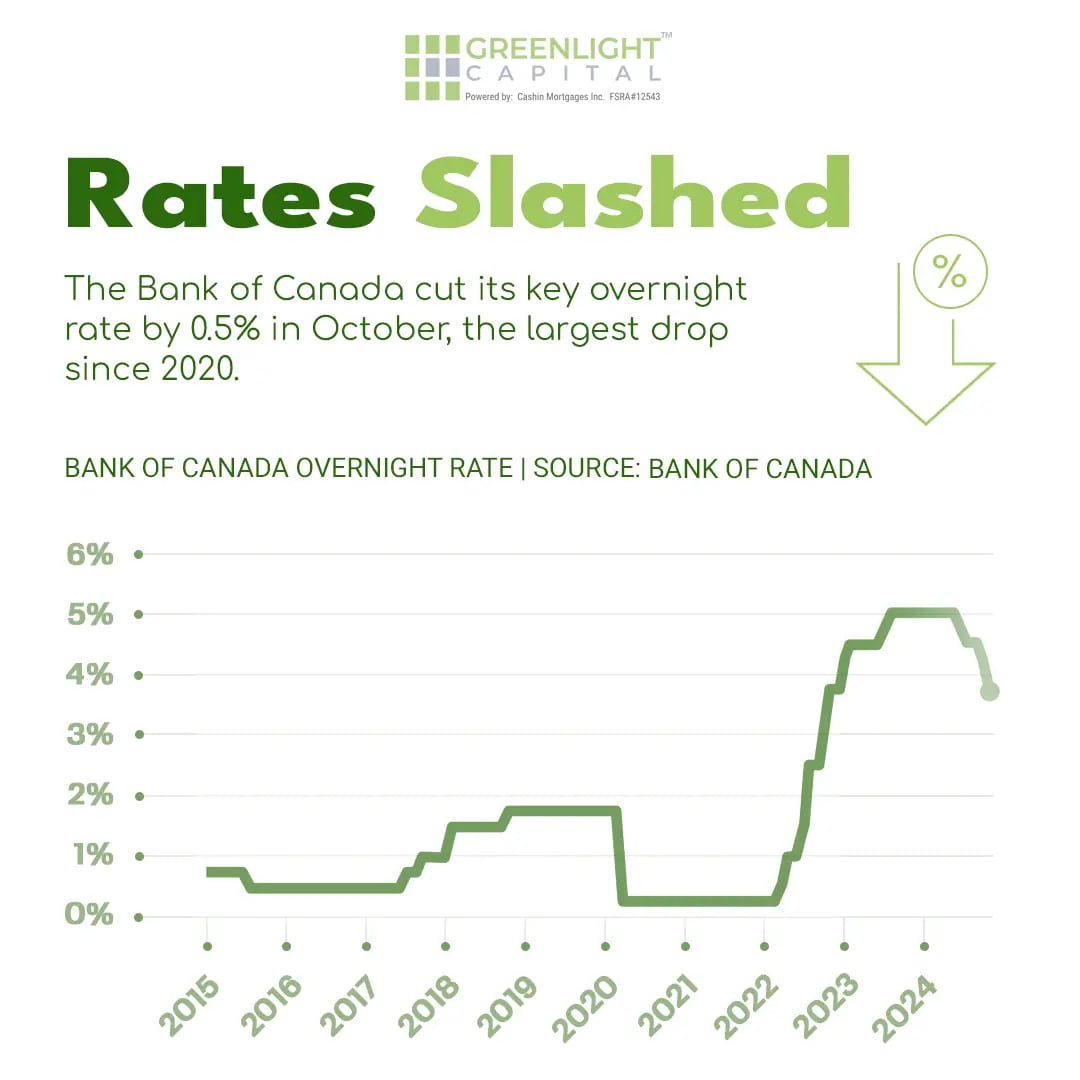

Bank of Canada’s Rate Cut: A Major Market Shift

Bank of Canada’s Rate Cut: A Major Market Shift

In October, the Bank of Canada lowered its overnight rate by 0.5%, marking the largest reduction since 2020. This cut not only brings relief to Canadian consumers but also opens up new possibilities in lending. With lower borrowing costs, we’re already seeing renewed interest in financing options as buyers, investors, and businesses leverage these lower rates to pursue their real estate and development goals.

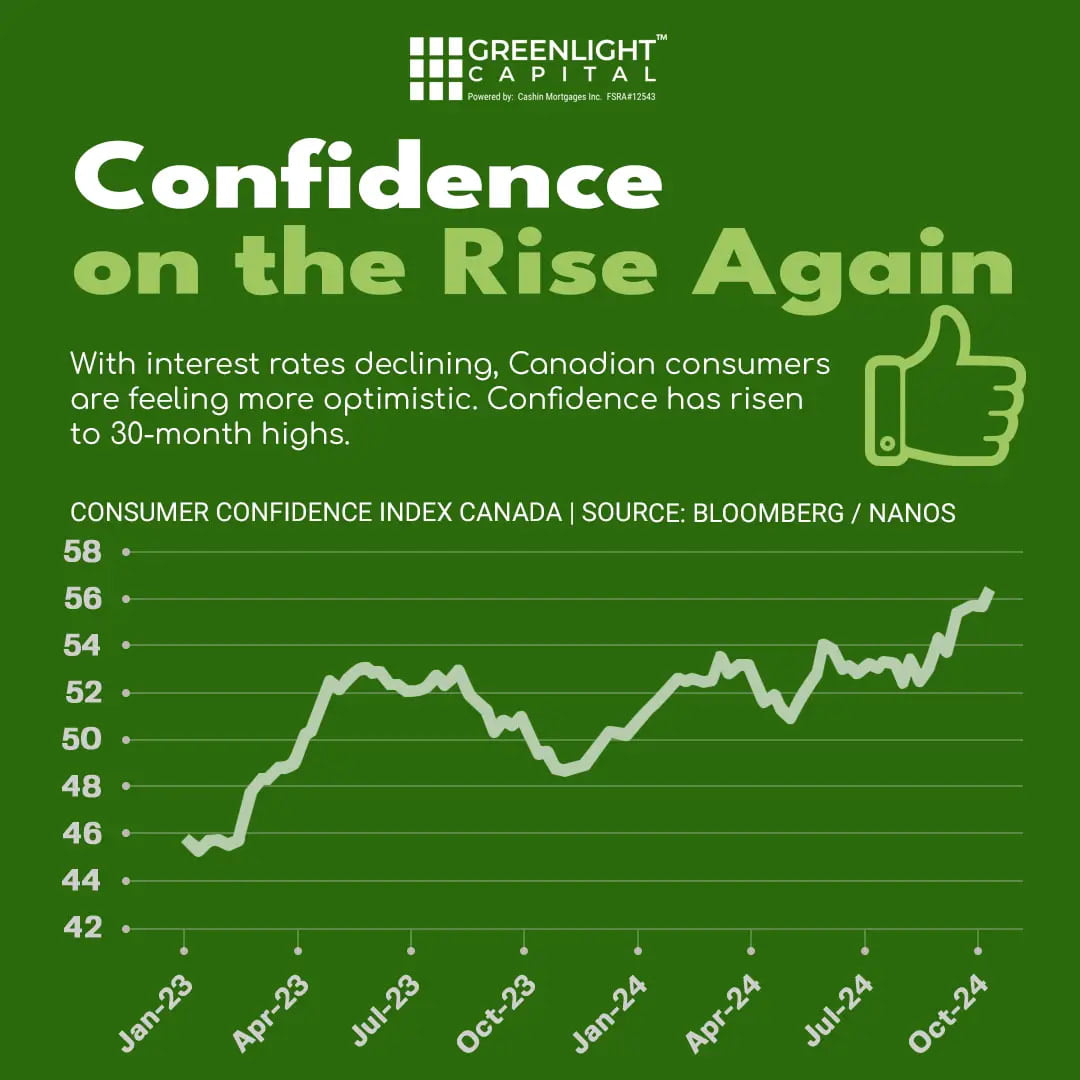

Rising Consumer Confidence at a 30-Month High

Rising Consumer Confidence at a 30-Month High

The rate cut has fueled an increase in consumer confidence, with sentiment now at a 30-month high. This optimism could lead to a more active market, as consumers feel financially secure and ready to invest in properties or renovations.

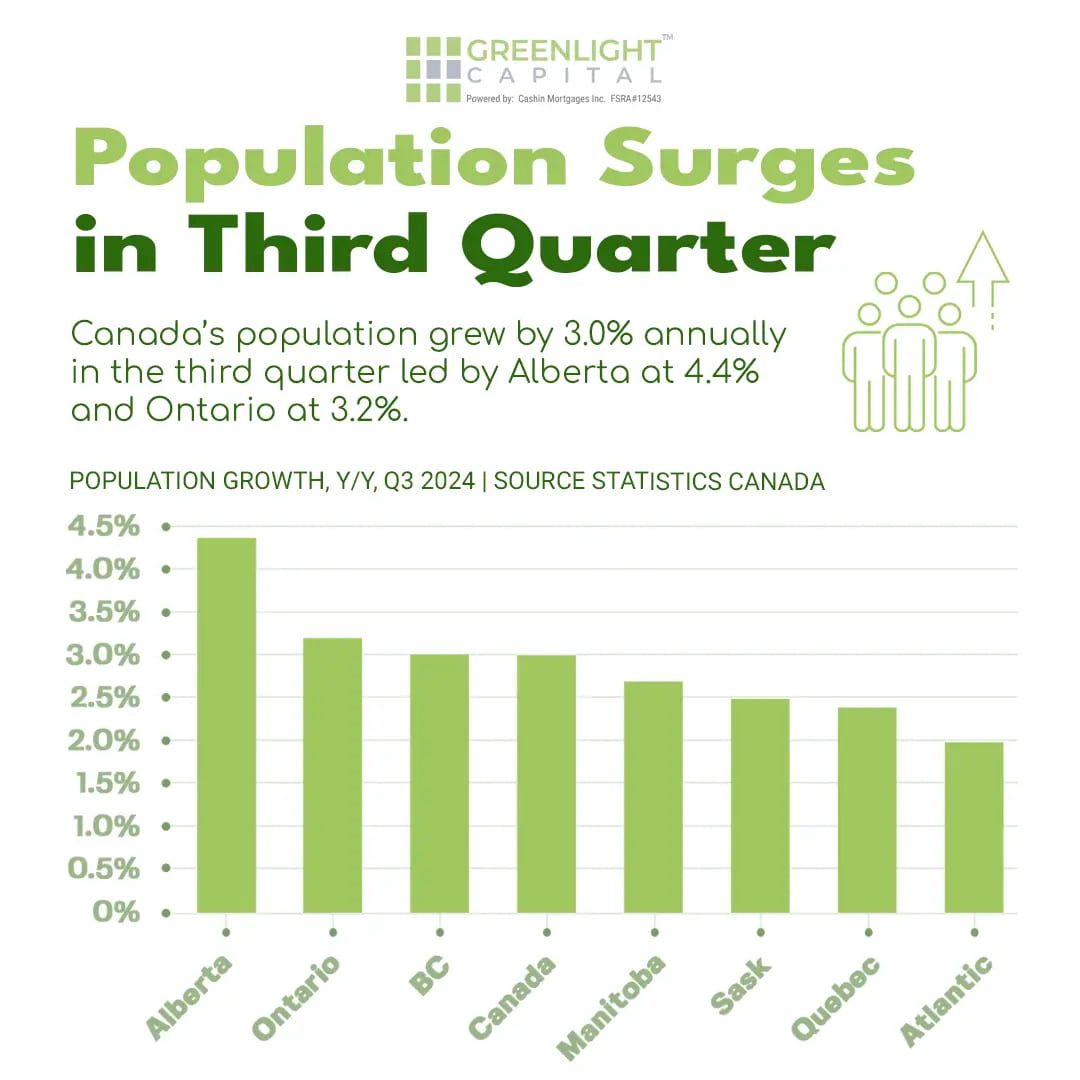

Population Growth Accelerates in Q3

Population Growth Accelerates in Q3

Canada’s population grew by an impressive 3.0% in the third quarter, with Alberta and Ontario leading the surge at 4.4% and 3.2%, respectively. This rapid growth signals a sustained demand for housing, especially in provinces experiencing the highest influx of new residents.

Implications for Developers and InfrastructureDevelopers and investors should pay attention to high-growth areas, as demand for housing and infrastructure will likely increase. Alberta and Ontario, in particular, may see heightened demand for both residential and commercial real estate, presenting strategic opportunities for those involved in land acquisition and development.

Canada’s population grew by an impressive 3.0% in the third quarter, with Alberta and Ontario leading the surge at 4.4% and 3.2%, respectively. This rapid growth signals a sustained demand for housing, especially in provinces experiencing the highest influx of new residents.