As we move through October, Canada’s housing market is showing notable shifts in affordability, buyer sentiment, and household wealth. Here’s what you need to know this month:

House Price Expectations:

Regional Differences

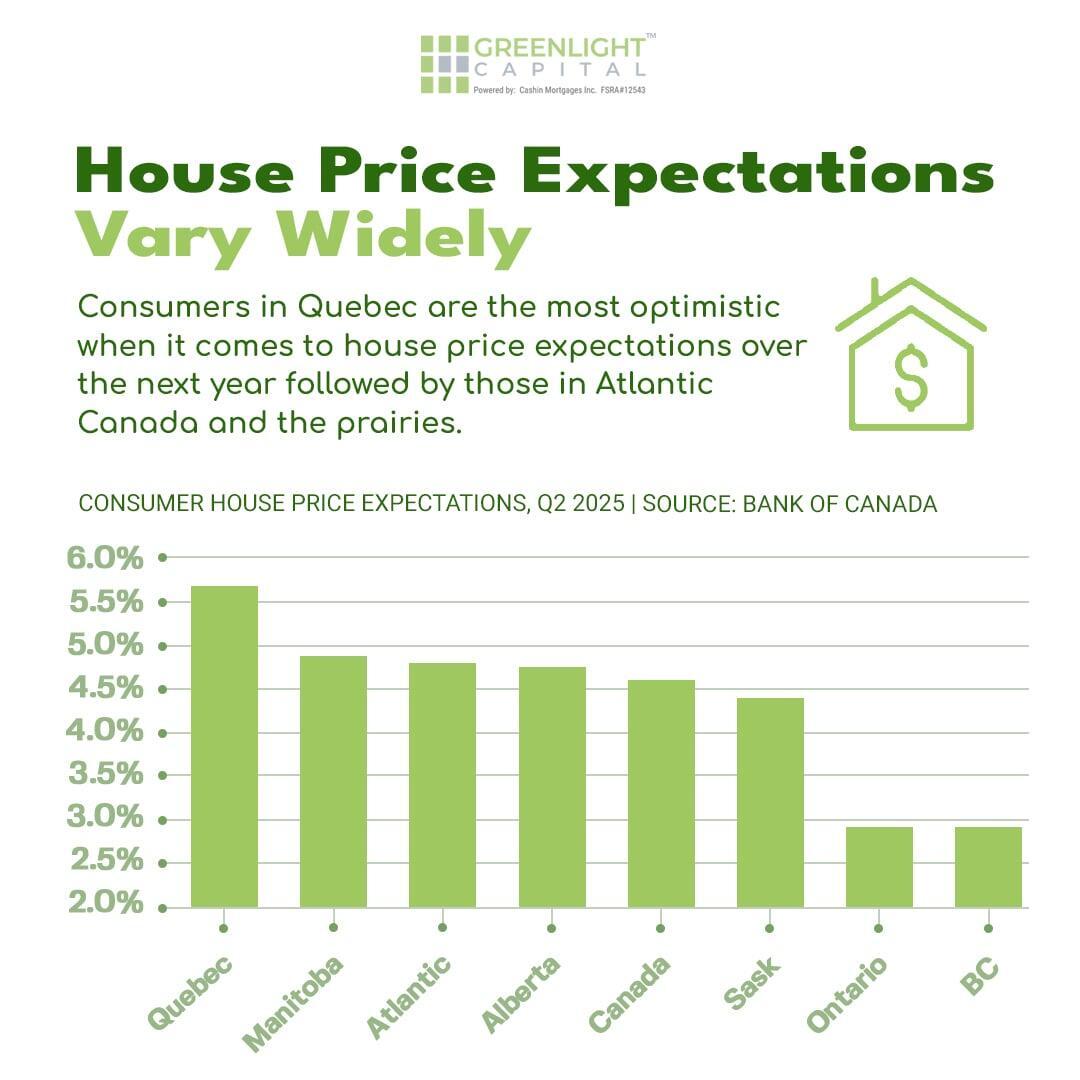

Consumer expectations for home prices vary across the country. Buyers in Quebec are the most optimistic, anticipating stronger price growth over the next year, followed by Atlantic Canada and the Prairies. Meanwhile, Ontario and British Columbia show more cautious sentiment. Understanding these regional differences can help borrowers plan their next steps and make informed decisions.

Bank of Canada Outlook

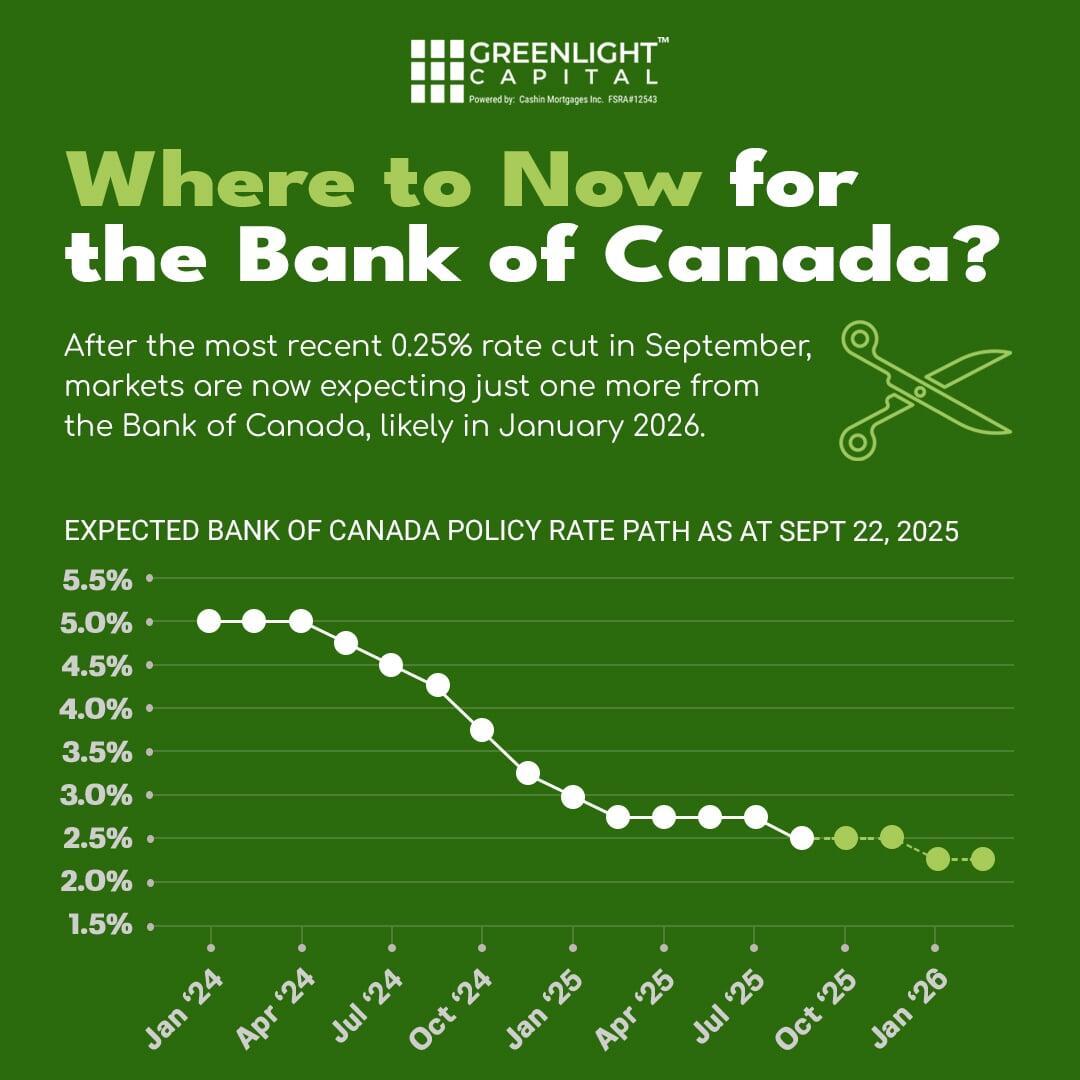

Following September’s 0.25% rate cut, markets now expect only one more cut, likely in January 2026. The central bank’s cautious approach balances inflation management with growing concerns about housing affordability, signaling relative stability in borrowing costs for the coming months.

Market Balance in Major Metros

Sales-to-new-listings ratios have tightened in Ontario and B.C., reflecting stronger demand and competitive conditions. Alberta, on the other hand, has seen markets cool slightly, offering a more balanced environment. Borrowers in tighter markets may need faster approvals or flexible lending solutions to secure their goals.

Sales-to-new-listings ratios have tightened in Ontario and B.C., reflecting stronger demand and competitive conditions. Alberta, on the other hand, has seen markets cool slightly, offering a more balanced environment. Borrowers in tighter markets may need faster approvals or flexible lending solutions to secure their goals.

What this means for our clients:

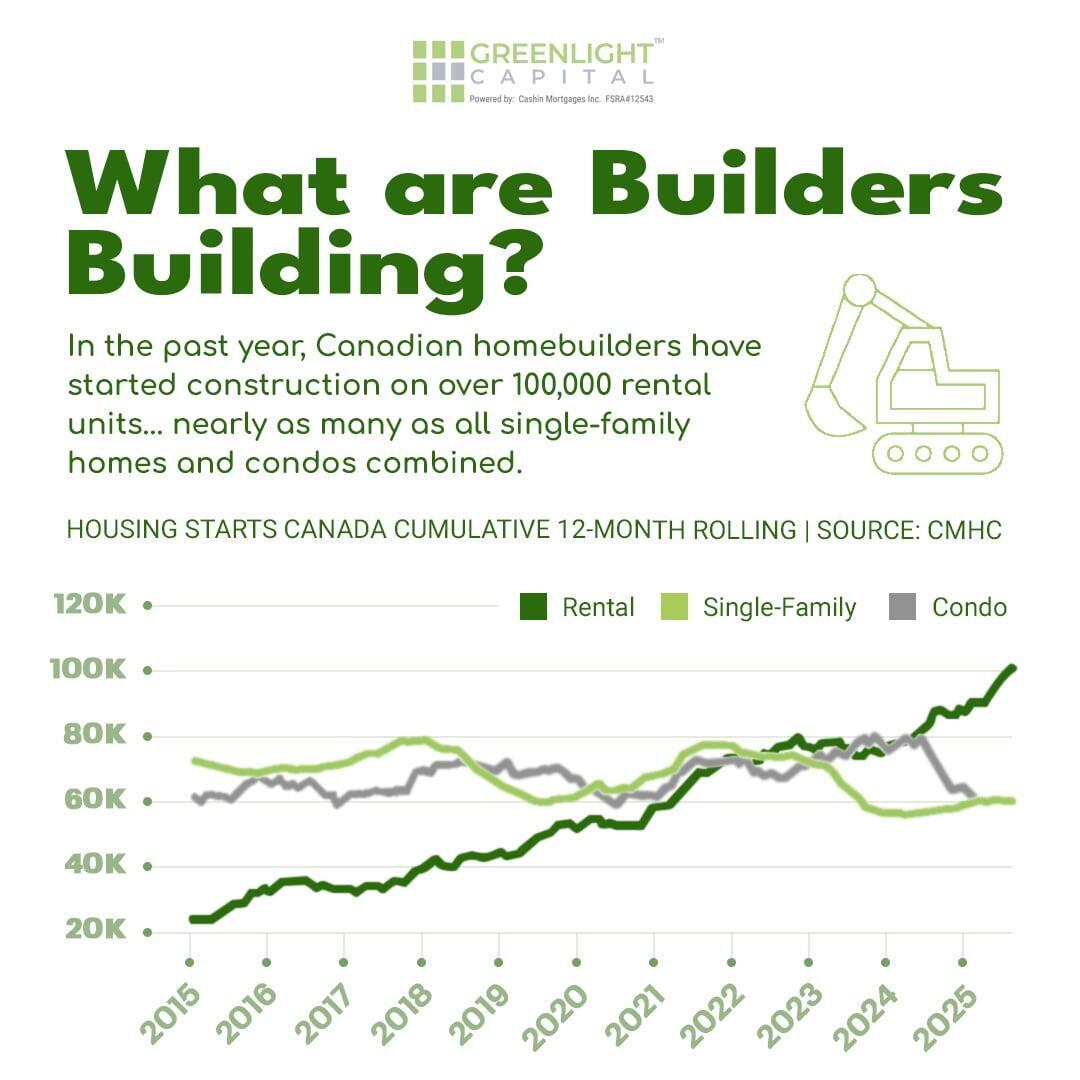

Renters will likely see more choice and flexibility in lease terms.

Buyers could experience slower price growth in some areas as rental supply eases pressure.

Investors may find opportunities in multi-unit housing developments.

Affordability Slowly Improving

Housing affordability remains a challenge, but it is gradually improving. Recent rate cuts have returned affordability to late-2021 levels, and September’s adjustment is expected to provide further relief. First-time buyers and those previously sidelined may now find opportunities to enter the market.

Household Net Worth Hits Record Levels

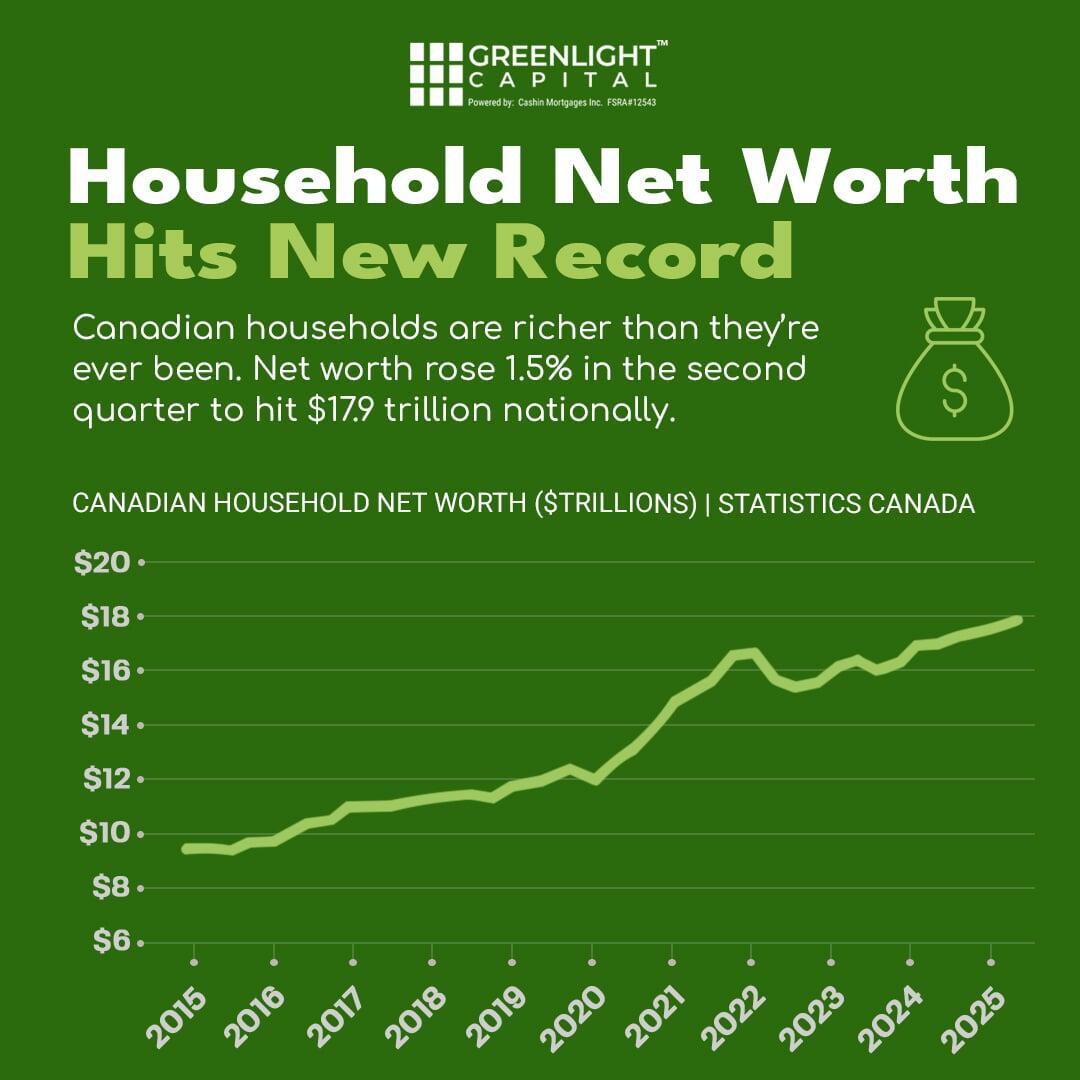

Canadian household net worth rose 1.5% in Q2, reaching $17.9 trillion nationally. Rising asset values and strong savings are boosting household financial resilience, creating more potential for refinancing, equity takeouts, or HELOCs to fund renovations, investments, or debt consolidation.

What This Means for Borrowers

Regional Awareness: Buyers should consider local market sentiment when planning purchases. Quebec and Atlantic Canada may offer stronger near-term growth.

Improving Conditions: Gradual affordability gains and potential future rate cuts may provide better opportunities for first-time buyers or those looking to refinance.

Leveraging Equity: Record household wealth can support borrowing strategies, giving borrowers more flexibility in financing their next move.

Final Thoughts

Whether you’re buying, selling, refinancing, or investing, Greenlight Capital Canada is here to provide the guidance and financing solutions that fit your needs and your clients.

Greenlight Capital Canada is here to support you with fast, flexible lending solutions and a deep understanding of where the market is headed.

📩 Have a deal or a client looking for financing?

Contact us today to see how we can help.