As the leaves begin to fall and September rolls in, we at Greenlight Capital Canada are tracking key trends in the housing and mortgage markets that are shaping decisions for borrowers, homeowners, and investors alike. Below are the insights you need to know, and what they could mean for your financial positioning.

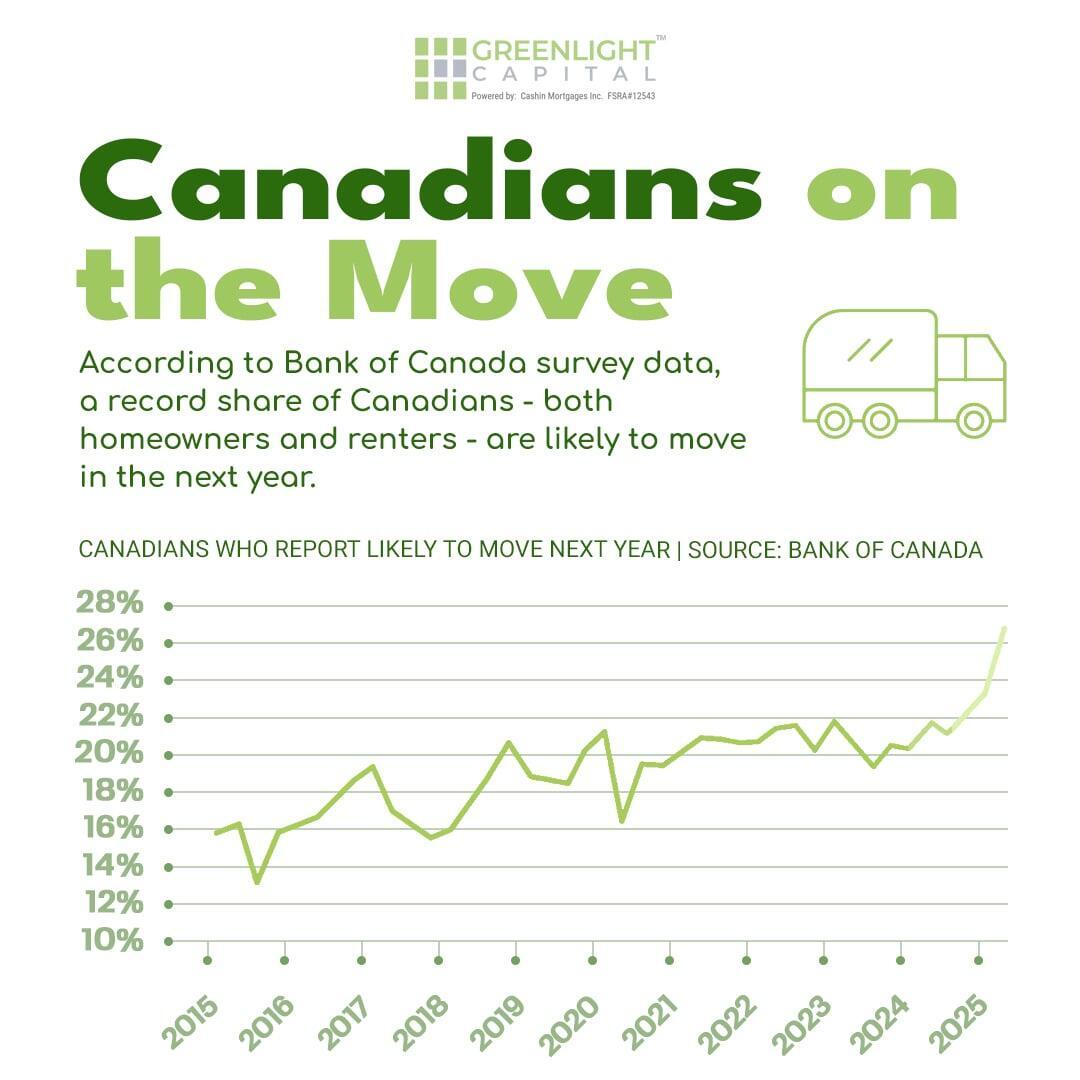

Canadians on the Move

A recent Bank of Canada survey reveals a record number of Canadians, both homeowners and renters are likely to relocate in the coming year. For Greenlight Capital clients, this suggests markets will be more competitive, especially in regions where supply is tight and demand is rising.

What this means for you:

If you’re considering buying, early mortgage pre-approval becomes even more important.

Moving could affect your financing options, because your equity, rates, and local housing conditions all play a role.

As we help clients navigate this, we’ll ensure your applications are well-prepared before you make offers.

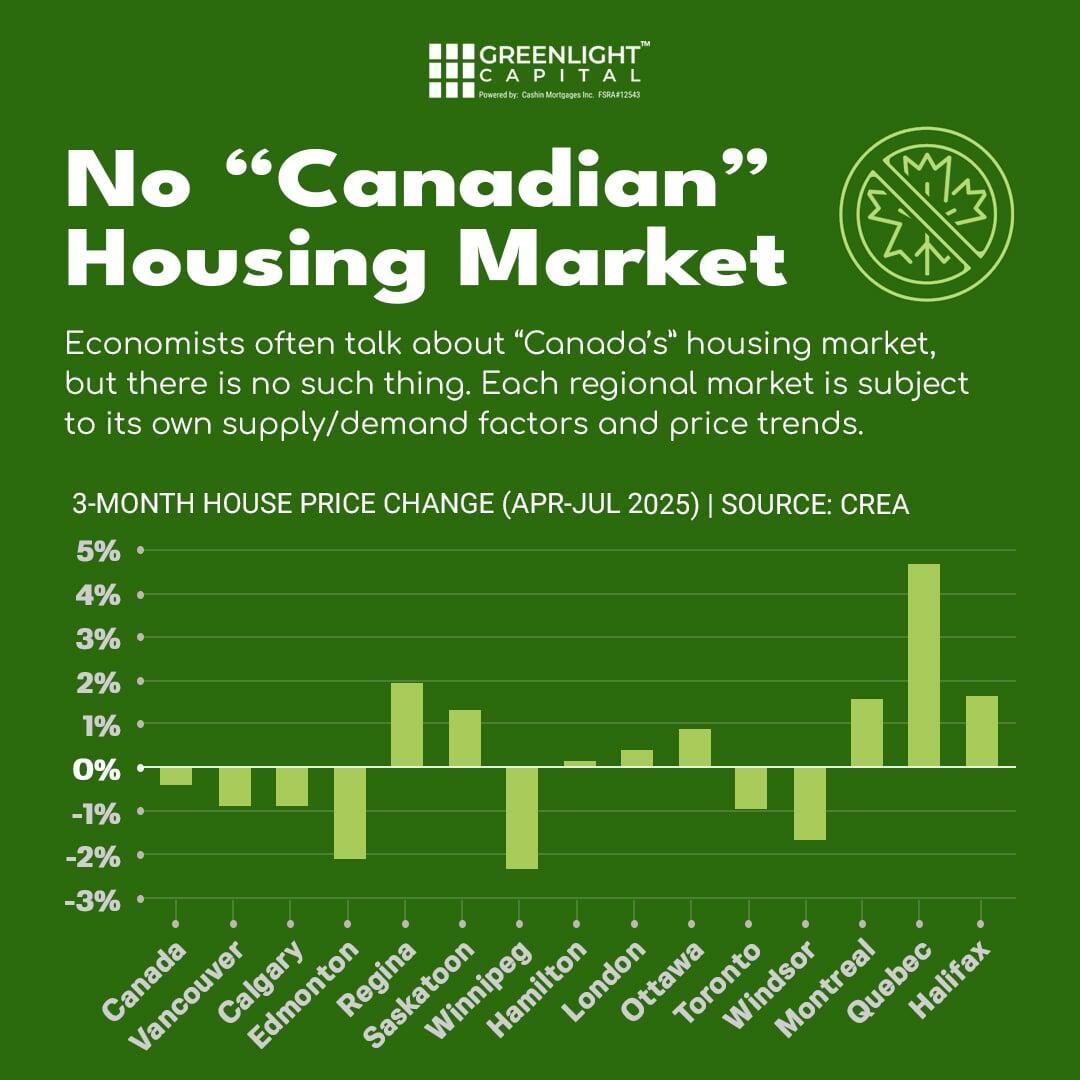

No Single “Canadian” Housing Market

What’s happening in Vancouver will look very different from Regina or Ottawa. Local supply, pricing, and demand are diverging strongly across provinces

What this means for our clients:

- Mortgage strategies must be tailored to your region’s unique conditions.

- What works in one city may not fit another, our team analyzes local data to help you position yourself correctly.

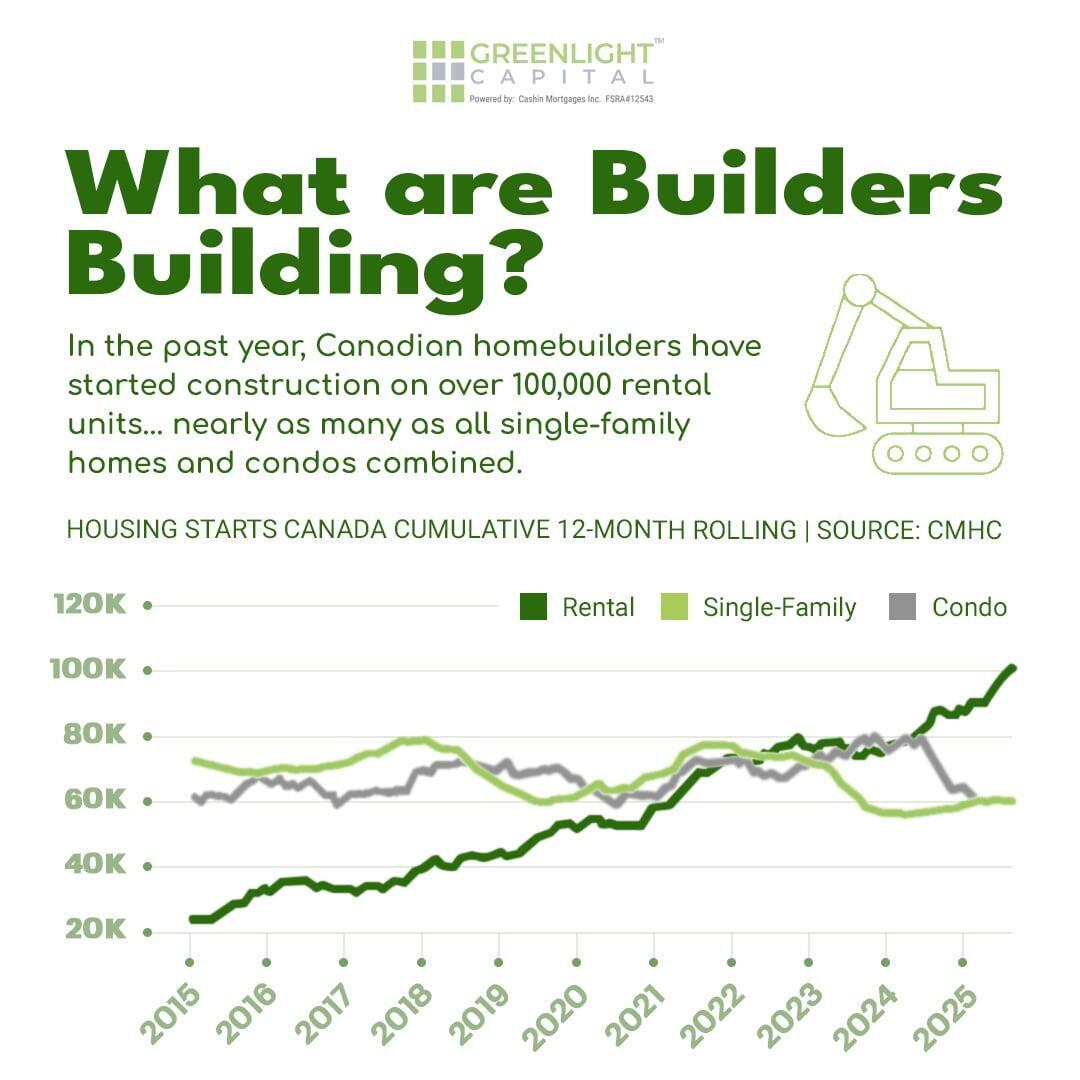

What Are Builders Building?

Builders launched over 100,000 rental units in the past year, nearly matching single-family homes and condos combined.

What this means for our clients:

Renters will likely see more choice and flexibility in lease terms.

Buyers could experience slower price growth in some areas as rental supply eases pressure.

Investors may find opportunities in multi-unit housing developments.

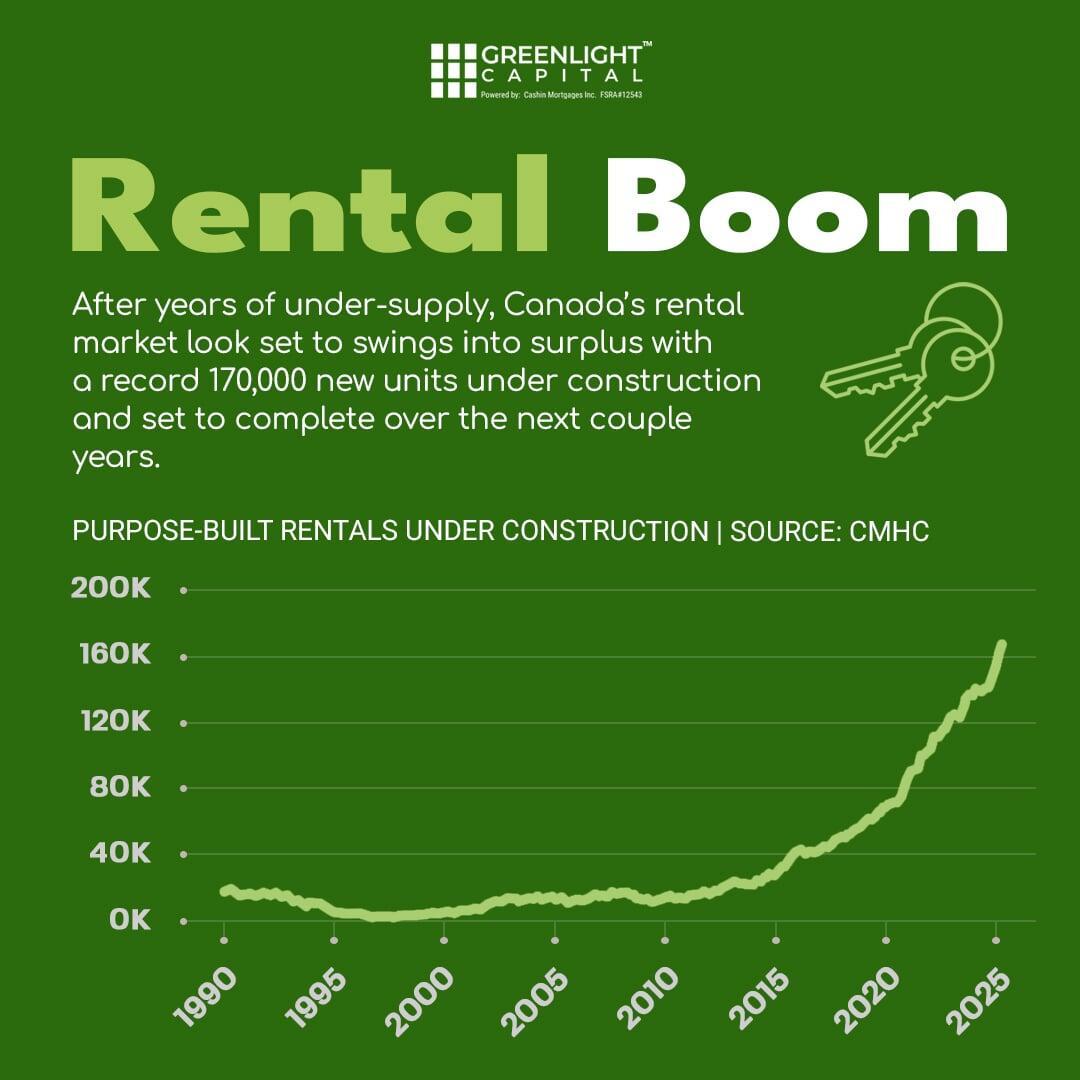

The Rental Boom

170,000 new rental units are under construction, potentially shifting the rental market from undersupply to surplus.

What this means for our clients:

Renters may gain negotiating power in pricing and terms.

Those saving for a down payment might benefit from delaying their purchase while conditions improve.

Investors should evaluate potential rental yields carefully before committing.

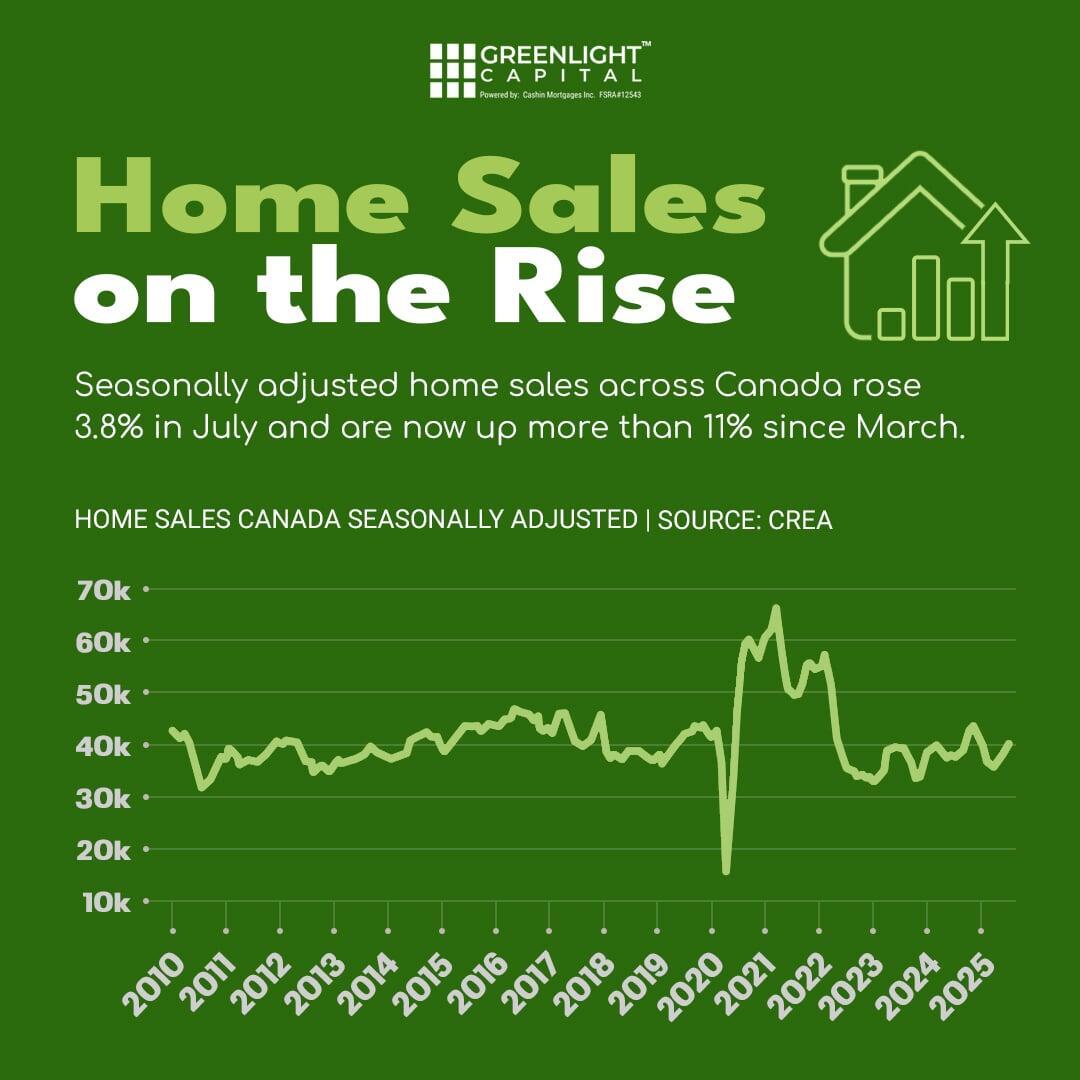

Home Sales on the Rise

Home sales jumped 3.8% in July and are up 11% since March, momentum is returning.

What this means for our clients:

Buyers face growing competition—acting now with financing in place is critical.

Sellers may benefit from stronger demand and multiple offers.

Refinancers should assess opportunities while activity is heating up.

Final Thoughts

Whether you’re buying, selling, refinancing, or investing, Greenlight Capital Canada is here to provide the guidance and financing solutions that fit your needs and your clients.

Greenlight Capital Canada is here to support you with fast, flexible lending solutions and a deep understanding of where the market is headed.

📩 Have a deal or a client looking for financing?

Contact us today to see how we can help.